Investment Highlights:

Industry Leader: Acuren is a top provider in the TIC industry with essential, recurring services across diverse sectors like oil & gas, chemicals, and aerospace.

Strong Financials: $1.15 billion in 2024 annualized revenue, ~17.5% EBITDA margin, and improving leverage profile (Net Debt-to-EBITDA ~3.2x).

Growth Drivers: Positioned for growth from aging infrastructure, stricter safety regulations, and industrial digitalization trends.

Attractive Valuation: Projected IPO valuation at ~$10/share, with EV/EBITDA of 9.1x and FCF yield of 6.0%, offering room for upside.

Technological Edge: Advanced robotics, phased-array ultrasonics, and data analytics set Acuren apart from competitors.

Proven Leadership: Backed by Sir Martin Franklin, with a track record of successful industrial investments and SPAC deals.

The upcoming public debut of Acuren Corporation, facilitated by Admiral Acquisition Ltd., represents another bold move by Sir Martin Franklin, a SPAC pioneer with a proven track record. This deal, valued at $1.88 billion, positions Acuren, a leader in Testing, Inspection, and Certification (TIC) services, for long-term growth in a critical industrial market. In this article, we break down the key aspects of the transaction, its financial implications, and how it compares to Franklin’s prior SPAC successes, such as the APi Group acquisition.

Overview of Acuren Corporation

Acuren is a market leader in providing asset integrity services to industrial sectors such as oil and gas, chemicals, power generation, and aerospace. The company differentiates itself with advanced non-destructive testing (NDT) methods, proprietary engineering solutions, and in-lab destructive testing capabilities. Its ability to offer compliance-driven and safety-critical services ensures strong customer retention.

Key highlights:

Revenue (2024): $1.1-1.2 billion (YTD annualized)

EBITDA (2024): ~$195-205 million (adjusted for IPO and acquisition; YTD annualized)

Company expects revenue growth of 5-7% CAGR for its industry

Transaction Details

Franklin’s SPAC (Admiral Acquisition Limited) acquired Acuren on July 30, 2024. After the acquisition, Admiral delisted its shares from the LSEG and now plans to IPO the new company Acuren on the NYSE in the first quarter of 2025 under the ticker TIC.

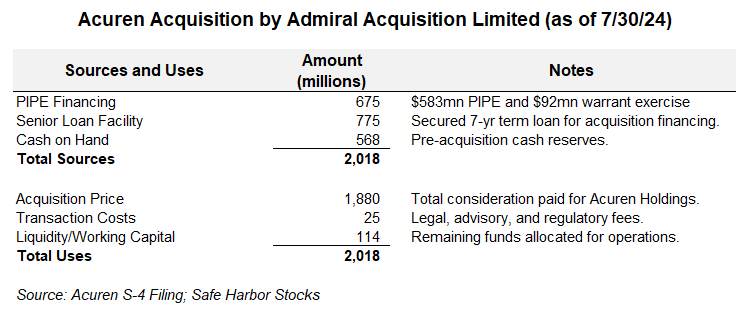

Below are the sources and uses on the date of the acquisition:

Sources of Funds:

PIPE Financing: $675 million includes institutional investments, representing a strong vote of confidence in Acuren’s growth potential.

Senior Loan Facility: $775 million floating secured debt with a 7-year term.

Cash on Hand: $568 million from pre-acquisition reserves.

Uses of Funds:

Acquisition Price: $1.88 billion for ASP Acuren Holdings.

Transaction Costs: ~$24.5 million.

Liquidity: Remaining funds (~$113.5 million) allocated to working capital.

Acuren’s will also transition from the British Virgin Islands to Delaware in order to facilitate a listing on the NYSE. As of 12/20/2024, the company announced it will trade on the OTC market imminently until its NYSE listing in early 2025. As of this writing I do not believe it has begun trading OTC yet (12/26/2024).

Understanding Acuren’s Capital Structure

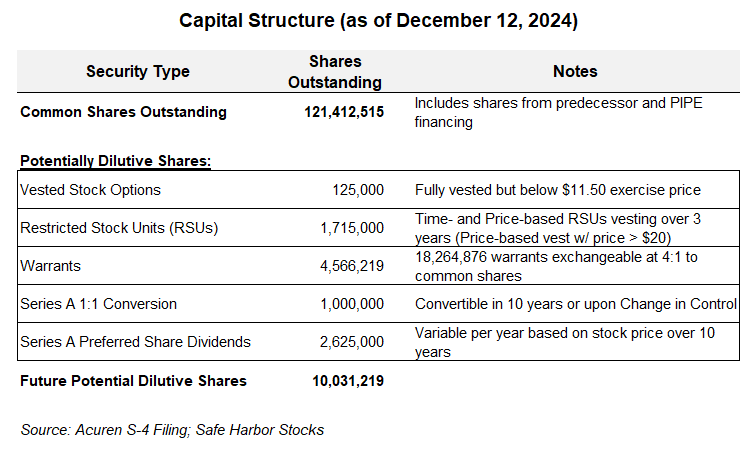

Acuren updated its Schedule S-4 with the SEC on December 12, 2024, and includes details we can use to formulate a projection of its value and capital structure - both today and upon its NYSE listing.

Equity Structure

Acuren possesses a complex capital structure, which is essential to understand in the context of valuation and potential investment. Below, we break down the key components and their implications:

Common Shares Outstanding

Acuren currently has approximately 121.4 million common shares outstanding, which includes the original equity, warrant conversions, and the PIPE offering. This figure should represent the approximate share count when the company lists on the NYSE. However, several sources of potential future dilution are worth considering below.

Vested Stock Options

Acuren has 125,000 options that are exercisable if the stock price exceeds $11.50. Given market conditions and the company's valuation, it is unlikely these options will vest at the time of IPO. This is also a relatively immaterial amount.

Restricted Stock Units (RSUs)

The company has 1,715,000 RSUs, of which 145,000 are already vested. The remaining RSUs are divided as follows:

Time-based RSUs: These vest equally over the next three years, representing 882,500 shares.

Price-based RSUs: These vest if the share price exceeds $20 over the next five years, adding a performance-based dilution component of 832,500 shares.

Warrants

Acuren has 18.26 million warrants outstanding, where every four warrants convert into one common share at an exercise price of $11.50. If exercised, these warrants represent an additional 4,566,219 shares. However, the exercise is unlikely unless the share price exceeds $11.50. I do reflect this scenario below in my valuation analysis.

Series A Preferred shares

The company issued 1 million Series A Preferred Shares, primarily held by Sir Martin Franklin or his entities. These shares carry some potential dilution effects:

Annual Share-Based Dividend:

The 10.5% annual dividend, based on the $25 liquidation preference, equates to $2.625 million annually. The dividend is payable in common shares, and the number of shares issued depends on the share price. For example:At $10/share, the dividend requires the issuance of 262,500 shares.

At $12/share, only 218,750 shares would be issued.

Change of Control Clause:

If Acuren experiences a Change of Control before the 10-year hold period, Franklin is entitled to receive the cumulative dividends upfront in common shares. For example:If redeemed after one year at $10/share, this would amount to approximately 1.05 million shares (10 years' worth of dividends).

In a worst-case scenario, this results in 0.86% dilution relative to the current share count of 121.4 million shares. While this is manageable, investors should carefully consider the timing and impact of this clause.

Conversion Upon Maturity or Change of Control:

Upon a Change of Control or 10 years post-issuance (2034), the Series A Preferred Shares convert to common stock at a 1:1 ratio.

For example, the 1 million shares convert directly into an additional 1 million common shares, regardless of stock price.

Overall, the dividend payments could dilute common shareholders further, especially if the stock price remains low at the time of payment. In a worst-case scenario involving a Change of Control immediately after listing, the cumulative 10-year dividend (approximately 1.05 million shares) and the 1:1 conversion ratio could result in a total dilution of 2.05 million shares. This represents a 1.6% dilution relative to the current share count of 121.4 million shares, which remains modest but should be factored into valuation models.

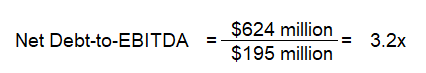

Debt Structure and Financial Ratios

As of the end of Q3 2024 (9/30/2024) Acuren has:

Gross Debt Outstanding: $756 million (including current portion).

Net Debt: $624 million (Gross debt less $132 million cash balance).

Net Debt-to-EBITDA Ratio (July 2024): Reported by company at 3.7x, reflecting initial conditions at the time of acquisition.

Net Debt-to-EBITDA Ratio (December 2024): Using the annualized EBITDA estimate of ~$195-205 million, the updated leverage ratio is 3.2x:

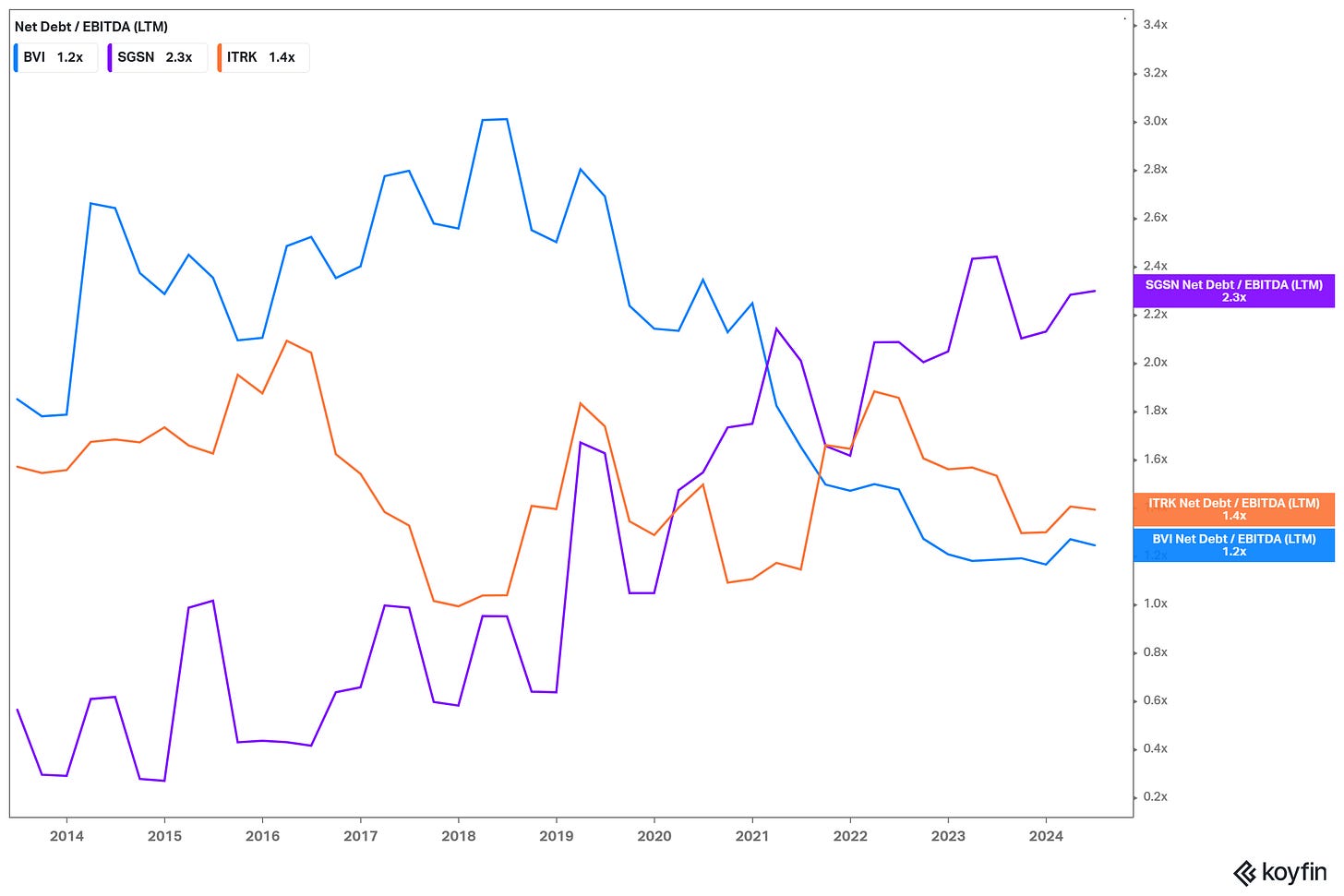

This reduction in net leverage since July reflects improved cash flow, higher EBITDA, and effective debt management during the two months post-acquisition. This level of leverage is within the norm for the TIC industry, which typically range between 2.5x and 3.5x.

According to Koyfin data displayed below, the ratio is higher than some of its public peers, but Acuren does have a plan to reduce this. Part of this is forced due to the terms of the senior credit facility, which requires Acuren pay down its debt each quarter by 0.25% of the original principal balance beginning next week on 12/31/2024.

Insider Ownership

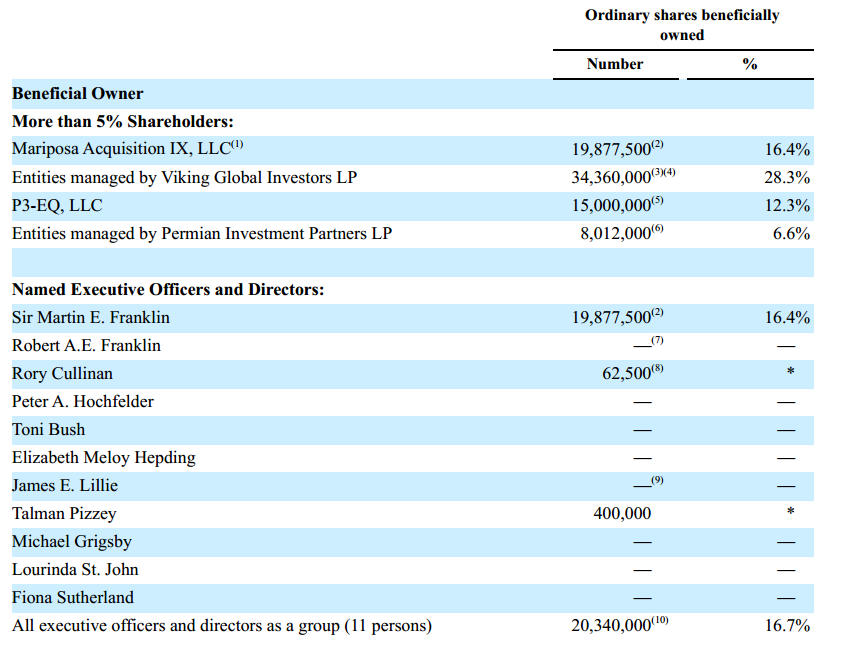

Currently insiders own 16.7% of common shares with Martin Franklin owning the majority of this. In addition, some other private investment firms hold material amounts of shares, as seen below, but they are not insiders. They include Viking, Progeny and Permian Investment Partners - as part of the PIPE financing.

Lockup Restrictions

The preferred shares held by Franklin are subject to a 5-year lockup but his common share interest apparently has no lockup. The three investment firms have a 3-month lockup then require written notice.

Strategic Implications

Acuren operates in the Testing, Inspection, and Certification (TIC) industry, which is experiencing steady growth driven by aging infrastructure, stricter safety regulations, and a shift toward digital solutions. These trends, combined with Acuren’s strong market position and growth strategy, provide a compelling investment case.

Key Industry Drivers

Aging Infrastructure:

Companies increasingly aim to extend the lifespan of their assets rather than replace them. Acuren’s services play a critical role in ensuring safety and compliance.

Safety Regulations:

Stricter pipeline safety laws, such as the U.S. "Mega Rule," are driving demand for integrated inspection and data management solutions.

Digital Transformation:

Industrial facilities are transitioning from paper-based methods to digitized integrity management. Acuren’s data analytics tools enhance operational efficiency and cost control.

Outsourcing Trends:

The complexity of technical services and the shortage of skilled professionals are leading companies to outsource asset integrity management to specialized providers like Acuren.

Competitive Advantages

Comprehensive Service Offering:

Acuren provides an end-to-end solution, combining advanced non-destructive testing (NDT), rope access techniques (RAT), and lab testing. This reduces client downtime and enhances satisfaction.

Technological Leadership:

Investments in robotics, phased-array ultrasonics, and advanced material testing meet evolving industry demands, particularly in aerospace and renewables.

Skilled Workforce:

Acuren’s large pool of highly trained technicians enables rapid scaling for large-scale projects such as plant turnarounds.

Diverse Client Base:

Serving oil and gas, chemicals, aerospace, and power generation industries reduces dependence on any single sector, providing resilience during economic fluctuations.

Growth Strategy

Deepening Customer Relationships:

Acuren plans to increase wallet share by expanding its range of services for existing customers.

Acquiring New Customers:

The company is targeting new clients at a rate exceeding market growth to expand its footprint.

Service Line Expansion:

Expanding RAT solutions and advanced NDT capabilities into industries that traditionally rely on older methods like scaffolding.

Mergers and Acquisitions:

Building on successful past acquisitions, Acuren aims to grow through strategic M&A, focusing on complementary service offerings and geographic expansion.

Key Challenges

Leverage Management:

With a Net Debt-to-EBITDA ratio of ~3.2x, effective cash flow management and cost optimization are crucial to maintaining financial flexibility.

Integration Risks:

Successfully integrating acquisitions while maintaining service quality and profitability remains a critical focus.

Potential Equity Dilution:

The company could dilute equity value to fund future M&A if it cannot generate sufficient cash flow from operations and debt reduction. This is something to monitor.

In summary, Acuren’s strategic positioning and growth initiatives align well with industry trends, providing a solid foundation for long-term success. However, careful attention to leverage, M&A, and shareholder dilution risks will be key to delivering sustainable value.

Comparison to APi Group

APi Group was a previous company acquired by Sir Martin Franklin and taken public in 2019. It proved to be a successful deal. Below are some highlights for comparative purposes.

Similarities:

Industrial Focus: Both deals target essential services with recurring revenue streams.

Market Leadership: Acquired companies dominate niche industrial markets.

Value Creation Framework: Franklin’s SPACs emphasize operational improvements and bolt-on acquisitions.

Differences:

Deal Size: Acuren ($1.88 billion) is smaller than APi Group ($2.9 billion).

Leverage: Acuren’s initial 3.7x Net Debt/EBITDA (July 2024) reduced to ~3.1x by year-end 2024, reflecting active debt management.

Geography: APi has broader global reach, while Acuren is primarily North American.

Valuation

IPOs (including spin-offs) often lack analyst coverage, company guidance, and clear financial disclosures, creating opportunities for investors to uncover value before the broader market. This may be the case with Acuren.

Rather than relying on detailed DCF analysis, which is highly sensitive and subjective, I approach valuation more practically. Below, I outline Acuren’s financial performance and my projections.

Comparative Valuation to TIC Peers

The SPAC paid a total of $1.88 billion (EV Equivalent) for Acuren. This valuation translates into an LTM EBITDA multiple of 9.6x based on projected adjusted EBITDA for FY 2024:

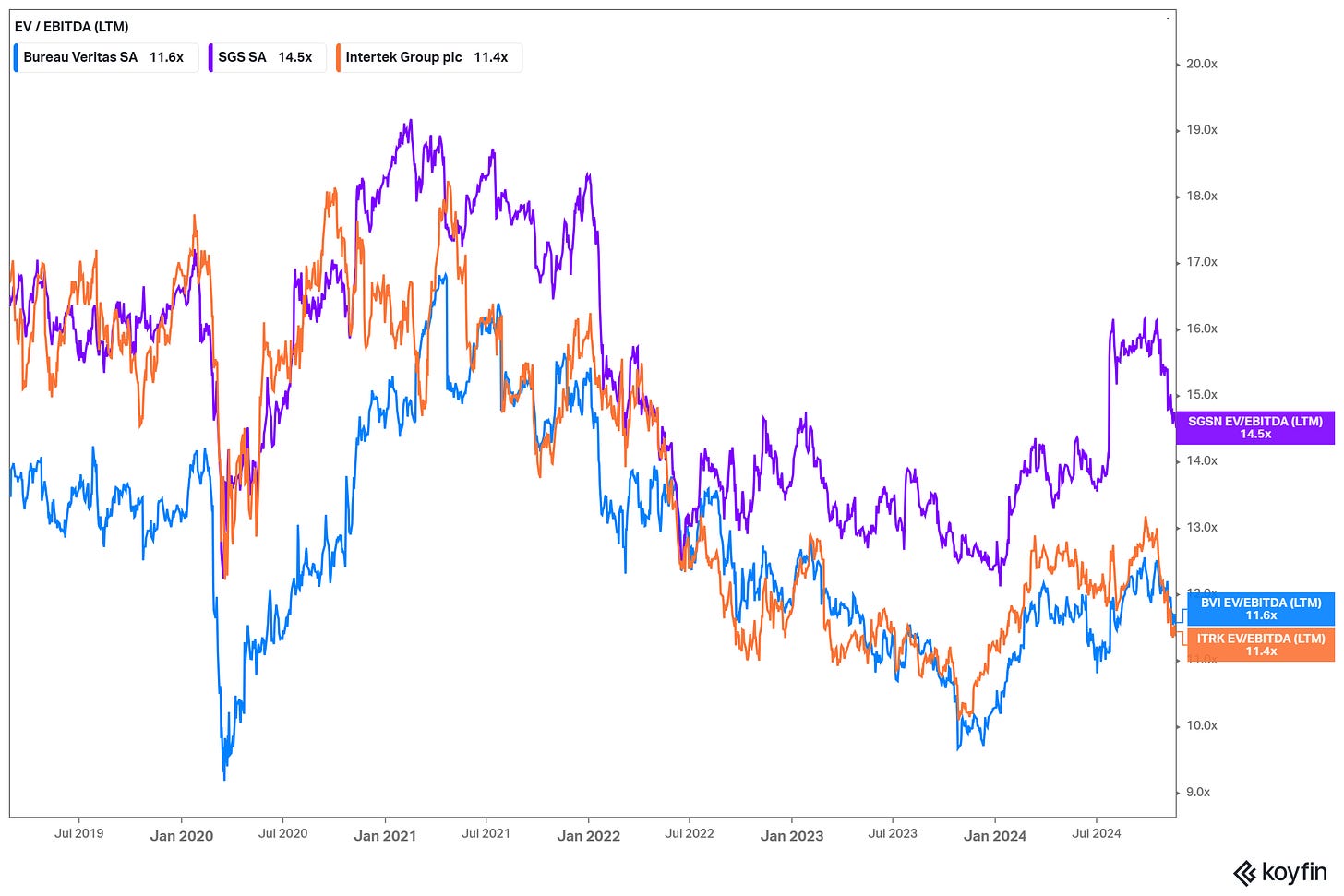

Acuren earned adjusted EBITDA of $145.9 million for the nine months ended 9/30/2024. Annualizing this through the upcoming Q4 2024 yields $194.6 million. This is lower than the LTM multiples of its three main competitors which currently range from 11.4-14.5x.

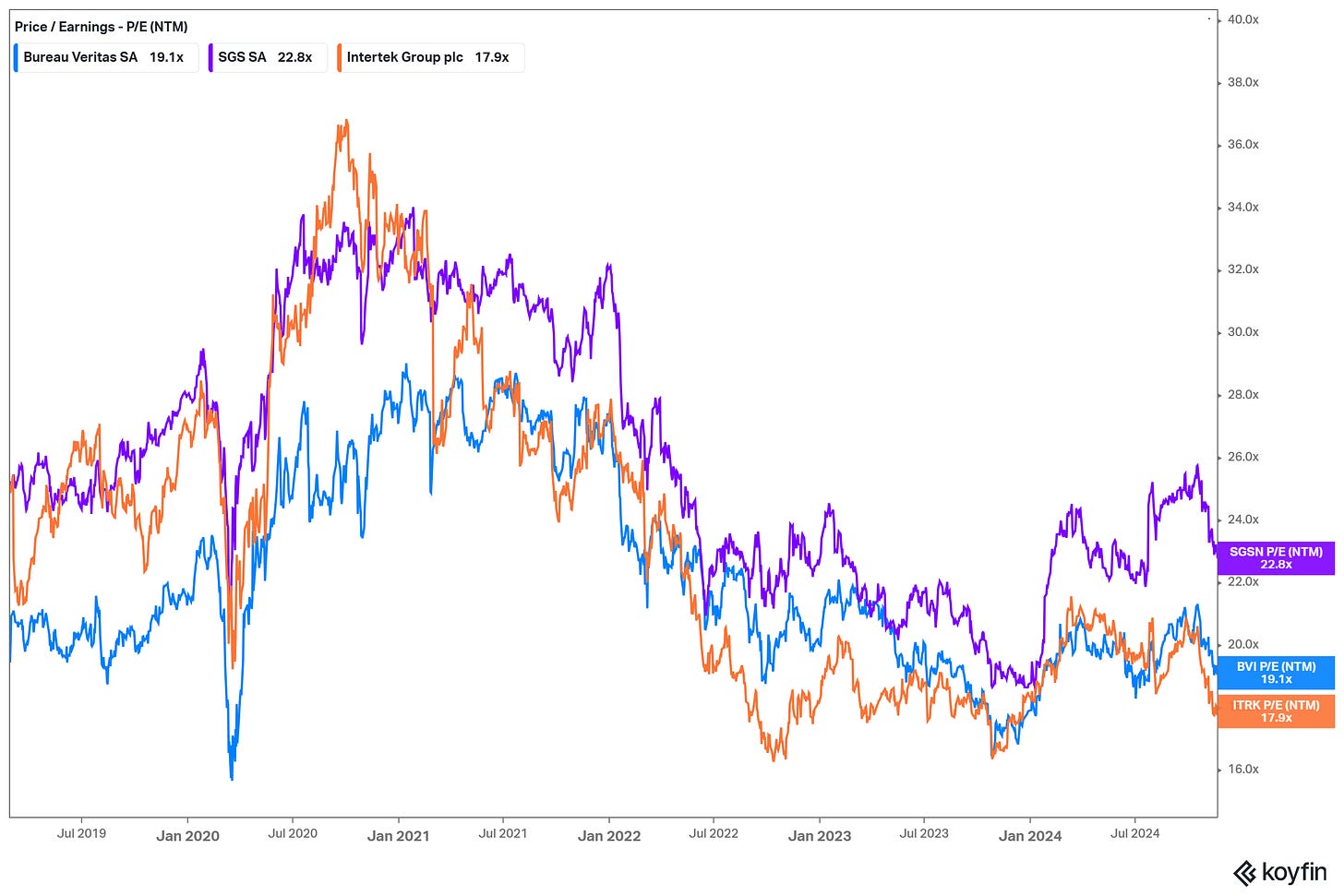

Publicly traded TIC companies such as SGS S.A., Intertek Group plc, and Bureau Veritas offer a useful benchmark:

TIC industry EV/EBITDA multiples typically range between 10-17x in recent years, higher than Acuren’s 9.6x acquisition.

NTM P/E ratios in the TIC space for these three competitors currently range between 17.9-22.8x.

This analysis underscores that Acuren’s valuation at purchase aligns well with industry norms, with the potential for upside driven by organic growth and operational efficiency improvements post-listing.

2025 Projection and Thoughts on IPO

With Acuren’s NYSE listing set for Q1 2025 and no formal guidance for FY 2024 or 2025, we must rely on assumptions to estimate financial performance and IPO valuation. Below is a breakdown of projections and valuation considerations.

Revenue Growth: Acuren achieved 7.1% YoY revenue growth YTD 2024, but the impact of prior acquisitions complicates organic comparisons. Assuming no additional M&A, I project 4% revenue growth from annualized 2024 revenue.

Gross Margin and EBITDA: Gross margin and adjusted EBITDA improved YoY. For simplicity we’re going to use the adjusted 2024 adjusted EBITDA margin of 17.5% to drive our 2025 estimate.

Depreciation and Amortization: Based on the S-4 filing, I project D&A at $34 million, derived from $192 million of PP&E with a weighted-average useful life of 5.68 years.

Interest Expense. Current gross debt of $756 million at a floating 9.2% rate results in approximately $70 million of interest expense, adjusted slightly for the 1% mandatory annual principal paydown.

Tax Expense: Assuming a 24% tax rate, normalized to historical averages, we calculate tax impacts based on adjusted earnings and free cash flow.

Free Cash Flow: I assume adjusted net income converts 100% into free cash flow (excluding growth capex). The 1% debt paydown is mandatory so I break out the FCF with and without this item below.

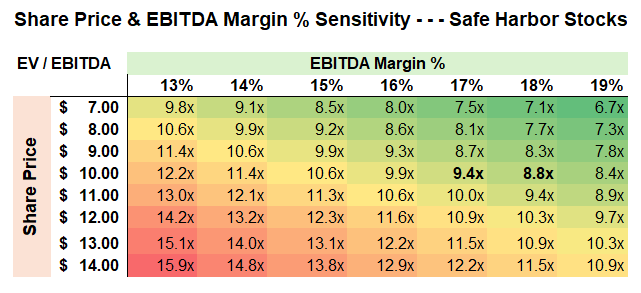

IPO Price: Assuming an IPO price of $10/share—typical for SPACs—Acuren’s valuation metrics are as follows:

Analyzing the table above, if Acuren opens with a $10 share price, it will trade at approximately a:

17.9x LTM P/E and a 16.7x NTM P/E ratio

9.4x EV / EBITDA and 9.1x EV / EBITDA multiple

These are fair valuations. Acuren would trade slightly lower than all three referenced competitors on both EBITDA and EPS.

Note that I don’t include historical expenses for 2022/2023 because: (1) the information for proper adjustments is unavailable and (2) the predecessor company’s capital structure is incomparable to the successor.

Free Cash Flow Yield

At a $10 share price, Acuren would trade at a 6.0% FCF yield excluding growth capex. If we also subtract the mandatory debt paydown, then the yield is 5.4%. Remember debt paydown is considered part of shareholder yield so this is good for shareholders yet provides less cash flow for M&A or other investments.

Exploring other IPO Prices

What if the stock trades higher or lower than $10?

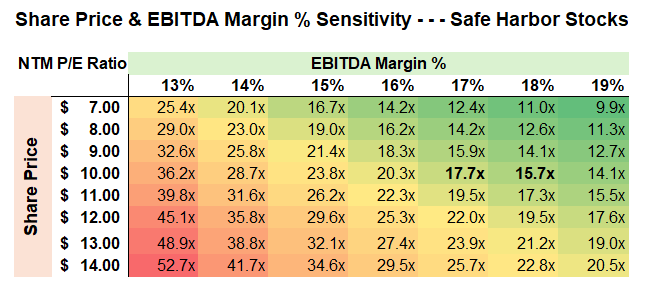

To account for variable outcomes, I constructed sensitivity tables illustrating:

NTM EV/EBITDA across changes in share price and EBITDA margin.

NTM P/E under similar variables, highlighting equity leverage effects potential share dilution on valuations.

These tables serve as benchmarks to evaluate Acuren’s market price at IPO. Until management provides clear guidance, $10/share appears to reflect fair value. Sub-$10 levels may warrant starter positions, with greater conviction under $9.

Note: Remember the data underpinning the above tables rely on estimates using historical company data. Inputs such as the EBITDA margin will change going forward.

Risks

Leverage: Requires disciplined cash flow management with $756 million in gross debt at 9.2% interest.

Dilution Risk: Series A preferred stock and warrant exercises (above $11.50/share) could dilute equity value.

Integration Challenges: Successful M&A integration is critical for maintaining margins and service quality.

Market Sensitivity: Dependent on economic cycles and demand for industrial services.

Labor Reliance: Skilled labor shortages or turnover could disrupt operations.

IPO Uncertainty: Lack of formal guidance and potential pricing volatility post-IPO introduce valuation risks.

Conclusion

Acuren’s market leadership, essential industrial services, and favorable industry dynamics position it as a compelling investment opportunity. The company’s path to public markets presents a balance of opportunity and risk, with success hinging on disciplined leverage management, seamless integration of acquisitions, and effective execution of its growth strategy.

At a projected IPO price of $10, Acuren offers fair valuation metrics compared to its peers, with potential upside as the company provides greater clarity on capital allocation and future growth plans. While challenges remain, Acuren’s operational strengths and industry positioning provide a solid foundation for long-term value creation.

Thanks for being part of the Safe Harbor community! Follow me for more insights: LinkedIn | X (formerly Twitter)

Disclosure: This information is provided for informational purposes only and should not be considered a solicitation or recommendation to buy or sell any securities. The author or entity providing this information may hold positions in the securities discussed. This is not investment advice.

If I am reading this correctly the warrants (ADMWF) trade at $.08 so you buy what in essence is over a 4 year option on a stock that is already in the money. Seems the risk/reward is much better than the common stock, though it is a relatively cheap stock based on your analysis