Amentum: Decoding the Backlog Decline and IDIQ Opportunities

Why Amentum's backlog decline may be less concerning than it seems.

Nearly a month ago I introduced Amentum ($AMTM) as an investment. You can find the two Amentum articles from last month linked below:

Today I will discuss one of the concerns investors may have since the company’s last earnings release in December, and how we as investors can think about it.

Introduction

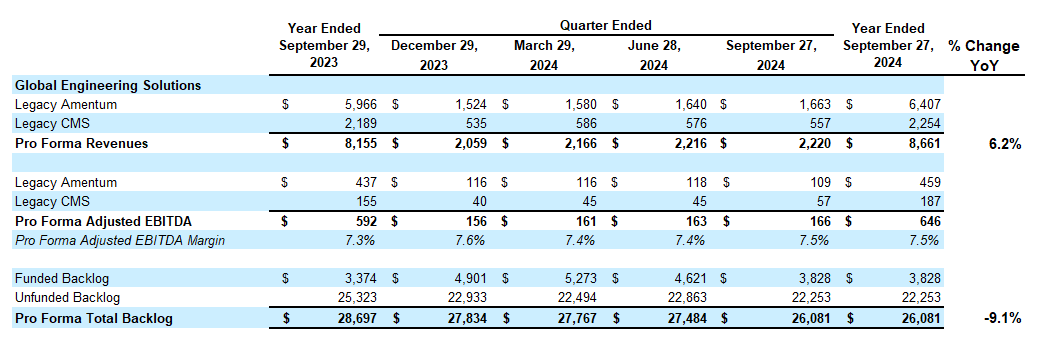

Amentum Holdings (NYSE: AMTM), a leading provider of advanced engineering and technology solutions, recently reported fiscal year 2024 results (on 12/16/24) that initially sparked investor concerns. The company reported a backlog decline of 9.1% YoY in its Global Engineering Solutions segment, despite achieving 6.2% revenue growth. I marked the YoY percentage change in the far-right column below.

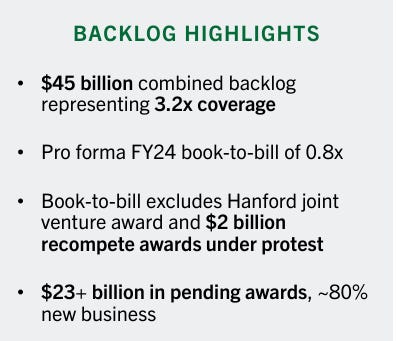

This divergence between revenue and backlog created a book-to-bill ratio below 1.0x and raised questions about Amentum’s ability to replenish its revenue pipeline. However, a closer look reveals that the story may be more about timing and opportunity rather than structural weakness.

Stock Price Reaction

First, take a look at the stock price reaction beginning December 17th, when the share price dropped more than 20% over two trading sessions from the $23.78 close on December 16th.

I took the opportunity to buy more shares and now hold about 5% of my portfolio in AMTM at an average cost basis of $21.07 a share - and I see a lot of room for price appreciation.

The stock, in my opinion, was hit by a perfect storm of events at the time:

Reported book-to-bill ratio of 0.86x in the conference call (due to decreased backlog)

Holiday trading with low liquidity

DOGE in the news cycle negotiating a new CR and Musk tweeting about $2 trillion of budget cuts

Unreasonably low analyst estimates ($1.41/share) entering the earnings release, despite previous guidance for much higher (see my tweet)

Rebalancing due to AMTM moving from the S&P 500 Index to the S&P SmallCap 600

Erroneous reporting through Zacks of a huge revenue miss (from not using the combined revenue from the merger)

Arguably the event that most influenced the drop that week was the net bookings comment, and the budget negotiations didn’t help either.