Auna S.A. (AUNA): Unlocking Potential in Latin American Healthcare

Leading high-complexity care and oncology in Spanish-Speaking Latin America (SSLA)

This deep dive into Auna is more comprehensive than my usual posts, delving into the complexities of its markets, financial strategy, and growth trajectory. While the analysis is detailed, it’s tailored for advanced investors who seek to understand not just the numbers but the strategic underpinnings that make Auna a compelling investment. If you're up for exploring the nuances of this high-growth healthcare company, read on—you may find insights to fuel your portfolio.

Investment Highlights (TLDR)

Dominant Position in Growing Markets: Auna operates in Mexico, Peru, and Colombia, regions with significant healthcare gaps and a projected 8.4% CAGR in healthcare spending through 2028. The company’s vertically integrated model uniquely positions it to capture growth in these underpenetrated markets.

Strategic Expansion in Mexico: Poised to become Auna’s primary growth engine, Mexico offers significant upside. The 2025 launch of OncoMexico, targeting both B2B and B2C markets, coupled with low bed utilization (42%) and lower working capital intensity, positions the country as a high-margin growth opportunity.

Strong Operational Execution in Peru: Auna’s most mature market delivers consistent double-digit growth, with Q3 2024 Adjusted EBITDA up 49% and capacity utilization at 83%. Its success in Peru serves as a scalable blueprint for regional expansion.

Strategic Focus in Colombia: While managing regulatory hurdles, Auna prioritizes cash flow stability and high-complexity services in Colombia. Demand remains robust, with 89% facility utilization despite policy challenges.

Deleveraging and Free Cash Flow Inflection: Auna’s steady reduction of net leverage to 3.7x and its inflection in free cash flow position the company for debt amortization in 2025. This could boost EPS significantly, adding 20%+ upside from lower interest costs alone.

Attractive Valuation with Significant Upside: Trading at just 8.4x 2025 EPS and backed by insider ownership and institutional investors like Grupo VAZOL, the stock has an analyst price target of $14.67—more than double the current price. Even conservative growth assumptions imply a compelling risk-reward profile.

All figures are in USD unless otherwise specified.

Company Overview and Opportunity

Auna S.A. (NYSE: AUNA) is carving out a dominant position in Latin America’s healthcare sector, where rising demand for high-complexity care and modernization is reshaping the market. Operating across Mexico, Peru, and Colombia, Auna has built a vertically integrated healthcare platform that combines hospitals, outpatient facilities, and insurance plans into a seamless ecosystem. With its focus on underserved and fragmented markets, the company is well-positioned to capture a significant share of the region’s projected growth, as the Latin American healthcare market is expected to expand from $313 billion in 2023 to $469 billion by 2028 ( an 8.4% CAGR).

The Economist Intelligence Unit (EIU) expects the middle class of SSLA (Spanish-Speaking Latin America) to grow at a 7-13% CAGR rate through 2030 varying by country, defining middle-class as Latin Americans earning more than US $15,000 per year. Furthermore, hospital bed availability and private insurance penetration in the three target countries are each well below metrics in other Latin American countries such as Brazil.

Market Overview

Auna operates in Mexico, Peru, and Colombia, which together account for nearly half of healthcare spending and the population in Spanish-speaking Latin America (SSLA). These three countries represent over $140 billion in annual healthcare expenditure, supported by a combined GDP of $2 trillion and a population exceeding 213 million. Economic growth, rising per capita income, and a growing middle class in these regions are driving increased healthcare demand.

Despite this growth, SSLA’s healthcare systems face significant challenges:

Limited Access: Hospital bed availability per 1,000 inhabitants is well below the World Health Organization's recommended minimum of 3.0

Underfunded Public Systems: Infrastructure gaps and service quality issues persist due to inadequate funding.

High Costs in Private Healthcare: Many individuals cannot afford private healthcare due to limited insurance penetration.

Transparency Issues: Opaque pricing, high copayments, and unnecessary procedures erode patient trust.

Auna’s integrated model addresses these systemic challenges by combining hospitals, clinics, and healthcare plans to deliver affordable, transparent, and high-quality care. By focusing on underpenetrated markets and leveraging its scale, Auna is positioned to disrupt SSLA's fragmented healthcare landscape and capture value in these underserved areas.

Auna History

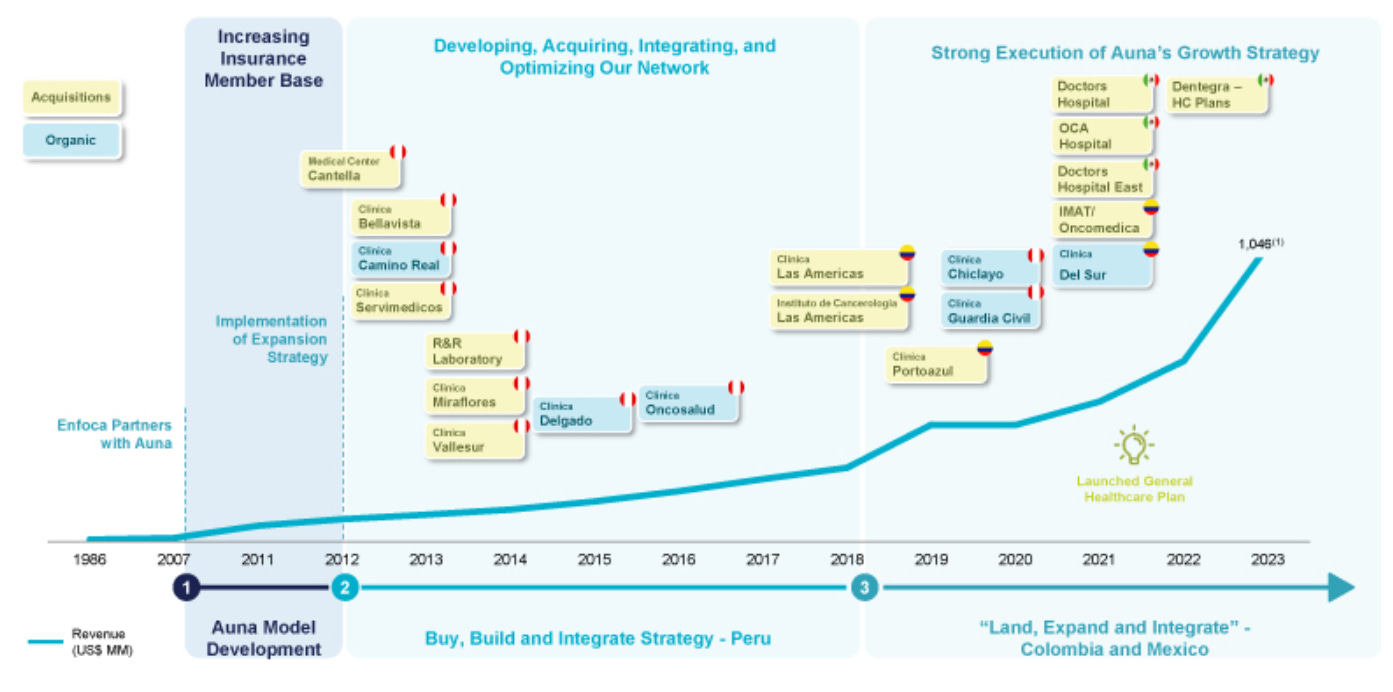

The predecessor to the Auna brand was founded in Peru in 1989 as Oncosalud, with the aim of addressing the unmet need for accessible, high-quality cancer treatment. During Peru’s economic crisis of the late 1980s, cancer patients often lacked access to specialized care, as insurance companies did not cover cancer treatment. Oncosalud offered prepaid oncology coverage plans for as low as $1 per month, providing unlimited access to treatments and surgeries by specialists.

In 1997, Oncosalud expanded by establishing its own network of facilities to integrate cancer treatment and, in 2011, Enfoca Group partnered with Oncosalud to launch Grupo Salud del Perú. This led to the creation of the Auna brand and the transformation of the company into a comprehensive healthcare provider. Auna expanded its footprint through strategic acquisitions and organic development, growing into one of the largest private healthcare networks in Spanish-speaking Latin America (SSLA).

Auna’s recent milestones include:

Expanding into Colombia in 2018 with the acquisition of Grupo Las Américas, a leading healthcare network.

Acquiring additional facilities in Montería, Medellín, and Barranquilla to enhance its oncology and general healthcare offerings.

Expanding into Mexico in 2022 by acquiring Grupo OCA, a private healthcare group located in Monterrey, Mexico operating three high-complexity hospitals.

Entering the insurance market in Mexico by acquiring Dentegra in 2023, aiming to leverage its insurance platform for launching mono-risk oncology plans.

Enfoca and the NYSE IPO

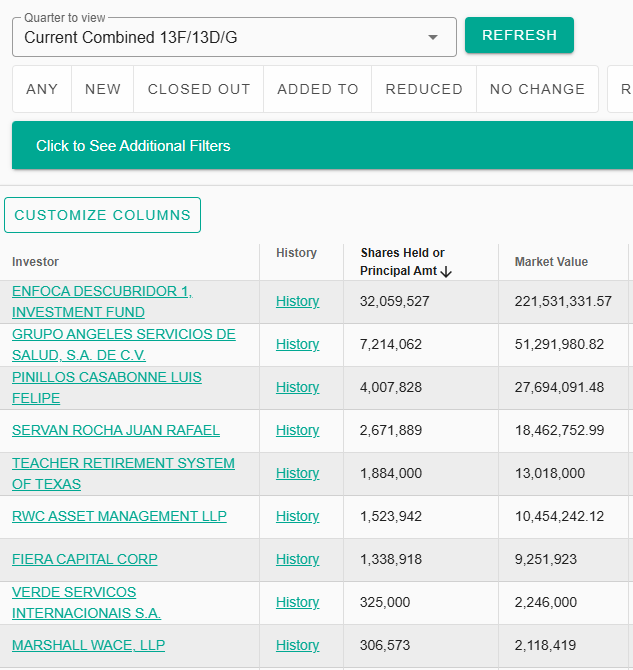

Auna today still counts its early and founding physicians as shareholders with material inside ownership. Luis Pinillos and Juan Servan alone own at least 9% of company shares. The largest shareholder, at ~43% interest, is Enfoca Group, one of Latin America’s top investment firms and holds majority voting power of the company. Enfoca formed its partnership with OncoSalud in 2008, and the firm counts large institutional firms - such as Farallon Capital and Canada Pension Plan Investments (CPP) - as investors.

There are some other interesting outside investors in the top shareholder count displayed directly above, and I explain them below next.

Grupo VAZOL

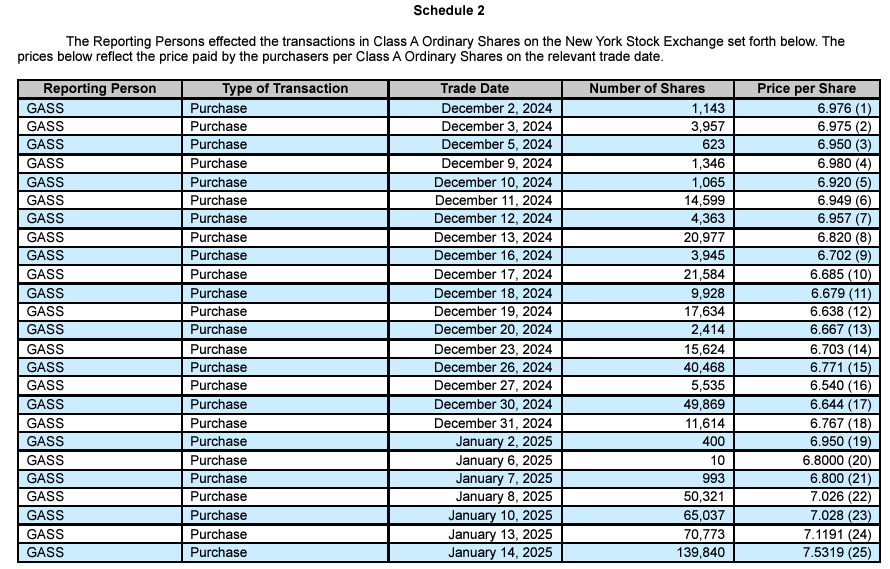

Grupo Angeles, which recently became Grupo VAZOL last year, operates a 27-hospital network in Mexico (among other ventures) and is building a Mexican conglomerate. VAZOL also has partnered with reputable hospital networks in the US such as Cleveland Clinic. I learned this week that VAZOL has quietly been purchasing shares in AUNA and as of 1/14/2025 it holds just under 10% of the stock.

Other Investors and Share Liquidity

RWC Asset Management (Redwheel) and Teacher Retirement System of Texas also own 2.0% and 2.5% of the shares, respectively. So, despite this being a less liquid stock on some days, there is definitely quality institutional interest here.

Average daily volume over the last 10 days has been 66,000 shares - or about $462,000. This is not much volume for institutional investors to accumulate significant positions. Nonetheless, they are doing so patiently in smaller blocks each day over the last couple of months. VAZOL, however, appears to have become a bit less patient this week, buying 2x the average daily volume on January 14th alone.

I didn’t know it at the time, but I was buying stock alongside Angeles/VAZOL in December and the first half of January.

The IPO

In March 2024, Auna S.A. (NYSE: AUNA) completed its initial public offering (IPO), raising $360 million to support its ambitious growth strategy across Latin America. The offering marked a significant milestone for the company. Unfortunately for investors, the IPO priced at $12 a share and has traded lower ever since, today at $7.36 a share. IPO proceeds were strategically allocated to enhance Auna's financial flexibility, including the repayment of sponsor financing and the expansion of its healthcare footprint.

Recent Financial Performance

The IPO prospectus offers vast details through 12/31/2023, however this includes acquisitions closed through January 2023, making for a lumpy analysis. The most recent YTD financials for Q3 2024 provide a clean organic comparison year-over-year. Metrics such as total bed capacity have been steady since Q1 2023.