Eastman Chemical (EMN)

Dividend Growth Stock Driving Sustainability Through Innovation and Resilience

Investment Highlights

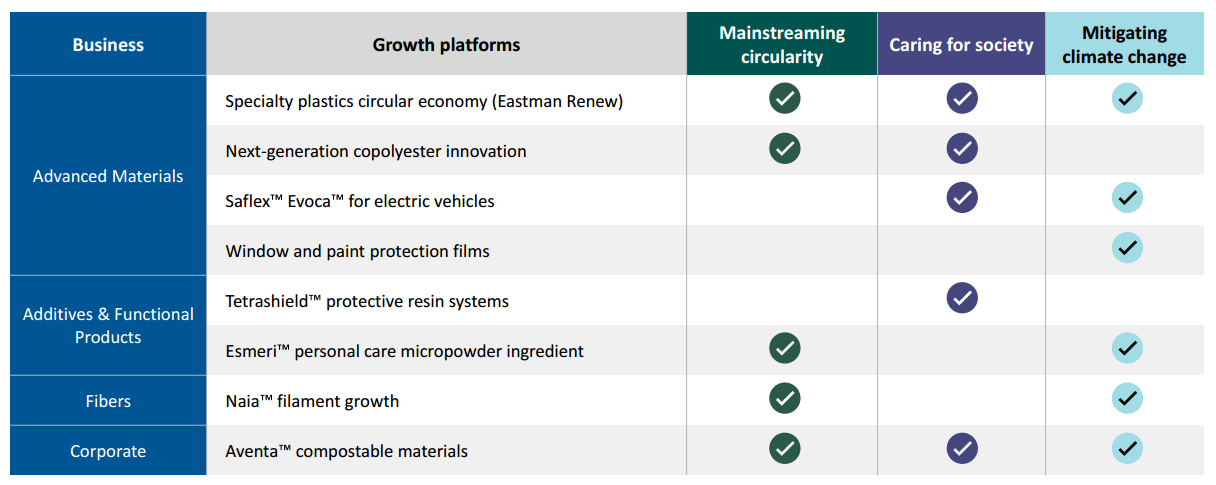

Circular Economy Leader: Eastman’s advanced recycling technologies, like CRT and PRT, position it as a sustainability pioneer in addressing plastic waste.

Strategic Growth Initiatives: New recycling plants in Tennessee, Texas, and France are expected to add over $500M in EBITDA by 2029 with strong ROIC.

Diverse Sustainable Portfolio: Products like Tritan™ Renew and Naia™ Renew target high-growth markets in consumer durables, textiles, and packaging.

Financial Recovery Underway: EBIT margins are improving, with EBITDA projected to grow 8.3% CAGR through 2029, driven by new projects and operating leverage.

Shareholder-Friendly Returns: A 15-year streak of dividend increases, and 2.5% annual share buybacks reflect Eastman’s focus on returning value to investors.

Pricing Power in Sustainable Plastics: CRT-derived PET commands a premium for its quality and eco-credentials, supporting margin resilience.

Company Snapshot

8.6% TTM Free Cash Flow Yield

11.4x NTM P/E

Dividend Yield: 3.28% with a 42% payout ratio

$11 billion market cap

9.2x LTM EV/EBITDA

Eastman’s Circular Economy Initiative

The urgent need for sustainable and recyclable materials has become a global crisis. With 360 million metric tons of plastic waste produced annually, and only 9% recycled, the environmental impact is staggering. More than 70% of plastic waste ends up in landfills or the natural environment. This alarming statistic underscores the urgent need for innovative solutions to reduce plastic pollution and promote a circular economy.

Mechanical recycling is inefficient due to:

Quality degradation with each cycle

Low yield back to food grade status

Requirement for very clean sources of feedstock (input)

Eastman Chemical Company is at the forefront of this movement, developing cutting-edge technologies to transform waste into valuable resources. By pioneering molecular recycling and circular economy initiatives, Eastman is not only reducing environmental impact but also driving sustainable growth and innovation for investors.

Closing the Recycling Loop

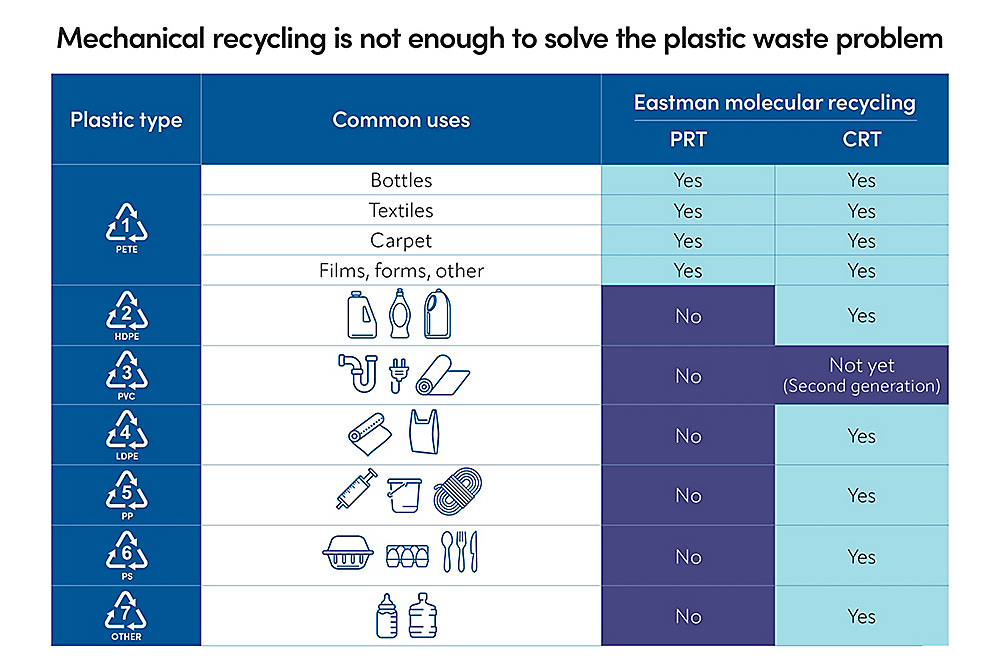

Mechanical recycling can only process Plastic Types #1 and #2 below. Eastman’s molecular recycling technology, especially the Carbon Renewal Technology (CRT), can process all of it.

With 70 years’ experience as a PET producer and 30 years in methanolysis (molecular recycling), Eastmain is uniquely suited to provide these solutions. As I explain later, this technology may become a large driver of its future growth.

Company History

Founded in 1920, Eastman is a global specialty materials company that produces a broad range of products found in items people use every day. With the purpose of enhancing the quality of life in a material way, Eastman works with customers to deliver innovative products and solutions while maintaining a commitment to safety and sustainability. The company’s innovation-driven growth model operates with leading positions in attractive end markets such as transportation, building and construction, and consumables.

Eastman has operated as a company for more than 100 years and now has raised its annual dividend consecutively for the last 15 years. It is well diversified and generates 59% of its revenue outside the United States. The company sports 15% operating margins, repurchases about 2.5% of its stock annually, and management is currently guiding to an LTM free cash flow yield of about 8.5% excluding growth capex.

Overview of Product Lines

The company offers its products under four different operating segments.

1. Advanced Materials

This segment focuses on specialty plastics, interlayers, and performance films used in a variety of high-end applications.

Tritan™ Renew: A specialty polyester made with molecularly recycled feedstock. It aligns with Eastman’s sustainability goals and serves markets like consumer goods, including products for Procter & Gamble, L’Oreal and NutriBullet®.

Saflex™ and XIR® Interlayers: Advanced materials for automotive and architectural applications. Saflex interlayers provide acoustic, solar, and safety properties for vehicles, while XIR enhances solar control in glazing.

SunTek® Reaction and LLumar® Valor: Paint protection films incorporating advanced resin systems for self-healing and protective qualities.

Tetrashield™: A resin technology enhancing durability, reducing potentially hazardous ingredients and eliminating energy-intensive manufacturing steps in the coatings of various products.

EastaPure™: Ultrapure chemicals designed for semiconductor manufacturing, critical for high-tech applications like AI.

2. Additives & Functional Products

This segment develops performance-enhancing additives and coatings for a variety of applications.

Core Digital Platform: A subscription-based service for the automotive film market, improving efficiency and profitability for installers and dealers.

Fluid Genius™: An AI-powered monitoring platform for heat transfer fluids, prioritizing safety and operational efficiency.

3. Chemical Intermediates

A core supplier of building-block chemicals that support downstream production, particularly for specialty chemicals.

Products like EastaPure™ originate here as precursors before their transformation into higher-value advanced materials.

4. Fibers

This division focuses on cellulosic materials, particularly for textiles and specialty applications.

Naia™ Renew and Naia™ Staple Fibers: Sustainable textiles made with recycled content, adopted by brands like Hugo Boss and Patagonia. These fibers are biodegradable and have certifications like marine biodegradability.

Aventa™ Renew: A compostable material ideal for food service packaging, replacing polystyrene foam trays with a fully circular solution.

Acetate Renew: A cellulose-based material for luxury eyewear and sunwear frames, combining biobased and molecularly recycled content for sustainability.

Cellulosic Materials for Cosmetics: Biodegradable esters designed to replace microplastics in beauty products.