EnerSys: A Deep Value Energy Transition Play

EnerSys is transforming into a higher-margin energy solutions provider. But can it navigate policy risks and market shifts?

Introduction: A Personal Connection to Battery Tech

While being a full-time investor for more than 15 years now, and investing in general since 1999, I have also acquired and operated a few small businesses in the vehicle services industry. You may have read briefly about this experience in my write-up on Genuine Parts (GPC) where I explain how I now passively own an automotive repair business. I also owned a golf car sales and service business for 7 years.

In 2016, I sold my regional golf cart and electric vehicle sales and service business, but I’ve remained involved as a consultant, staying close to the industry’s developments. During my years in the business, one thing was clear—lead-acid batteries were king. Whether it was golf carts, resort maintenance vehicles, or 18-passenger transport shuttles, everything ran on lead-acid. And that came with a major downside: battery replacements were one of the biggest maintenance costs, accounting for roughly 25-30% of total upkeep.

But over time, I started to see a shift. Lithium-ion, once an expensive and niche alternative, was creeping into the industry. First in high-performance applications, then in everyday fleet operations. Today, the transition to lithium-ion is well underway, not just in golf carts, but in EVs and broader commercial applications. This shift reminds me a lot of what’s happening at EnerSys ($ENS)—a company I encountered often in my days with that business. They’re making a similar transformation, moving from legacy lead-acid batteries to higher-margin, more strategic stored energy solutions. And that’s what makes them worth a closer look today.

Investment Thesis

EnerSys is shifting from lead-acid dominance to advanced lithium-ion and stored energy solutions, positioning itself for long-term success in energy storage, EVs, and commercial applications. But with shifting political winds and potential regulatory risks, the question is: Can it successfully execute this transition?

Business Overview: The Evolution of EnerSys

Ironically EnerSys began to establish the vision for its transformation in 2016, the year I sold my business. Having worked in the golf cart and commercial EV space, I saw firsthand how companies that failed to adapt to lithium-ion lost ground to competitors. Resort and community fleet managers started demanding longer-lasting, lower-maintenance batteries, and those who couldn't deliver lost business. EnerSys seems to understand this shift. Instead of clinging to the old lead-acid model, they’re proactively developing advanced energy solutions that reduce maintenance costs and improve performance—something I know end-users care deeply about.

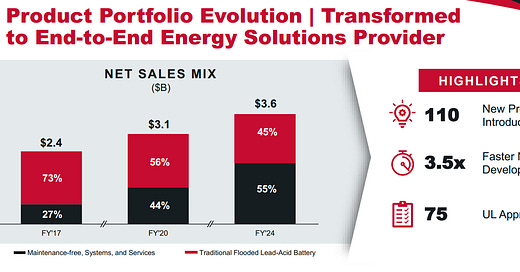

In 2016, EnerSys primarily sold traditional flooded lead-acid batteries with a narrow set of end markets. With some acquisitions, restructuring of its product offering, and improvement in development and production, the company today offers an integrated set of energy solutions tailored to a diverse set of strategic end markets.

As the slide above highlights, management has put the “Sys” in EnerSys. And the good news is that there is still additional opportunity for growth. The slide below shows the progress, and also potential, for its maintenance-free batteries and other systems and services.

Business Segments

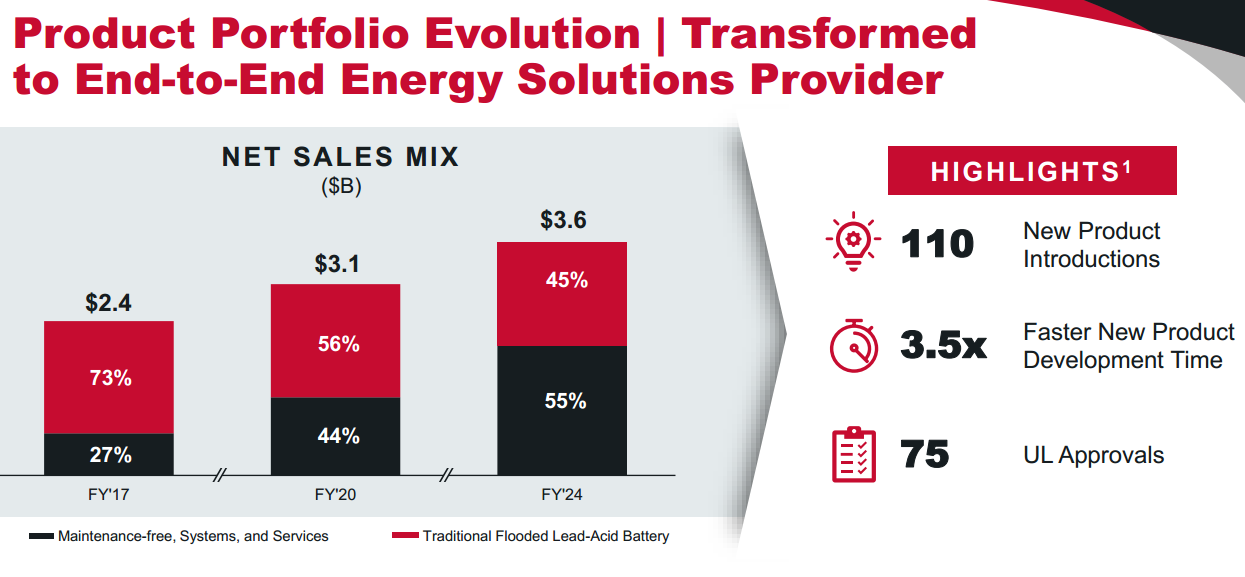

EnerSys identifies four different business segments through which it provides premium energy solutions and services to 7 different end markets.

1. Energy Systems

This segment comprises 44% of revenue counting multi-national blue-chips as customers. This segment has a global installed base of more than 1 million systems in operation. Diverse and important end markets include data centers, communications, and industrial power and utilities.

EnerSys has an estimated 8% share of its Serviceable Addressable Market (SAM).

2. Motive Power

Motive Power comprises another 42% of revenue and claims a 22% global market share. This segment offers solutions that utilize electric forklifts, mining and other commercial electric-powered vehicles. Its comprehensive service includes batteries, charging stations and software and services. Think logistics and warehousing here.

Some drivers for this segment include electrification (e.g., decarbonization) and automation such as maintenance-free solutions and even fully automated warehouses of the future. This segment has the highest operating margins at approximately 14%.

3. Specialty

The Specialty segment represents 15% of revenue primarily serving the transportation and aerospace/defense markets. The transportation market focuses on heavy-duty trucks. The aerospace and defense market focuses on battery solutions for the DoD as well as space and missile defense applications. EnerSys claims about a 30% market share here as a % of SAM.

Regarding the Defense market, EnerSys last year acquired Bren-Tronics for $208 million at an 8.7x EBITDA multiple with all cash in July 2024. This acquisition adds a strong relationship with the DoD and is a leading manufacturer of portable power solutions for military and defense.

4. New Ventures

This is an interesting segment that is accelerating innovation with energy storage and fast charge capabilities. The segment is new (internally developed) and provides systems to manage demand charge reduction, utility backup power and dynamic fast charging of vehicles.

There are many interesting potential end markets here including even commercial real estate and retail operations. In the earnings report from 2/5/2025, management mentioned that it recognized its first revenue from this segment from its Fast Charge & Storage (FC&S) system.

Modular Platform

The company provides its products and services through a set of three modular platforms to add value to customers and provide stickiness with tailored solutions. Think of these three modules as a total solution package applied to each business segment above. Essentially, EnerSys comes in to provide the customer with energy storage, the electronics and the software.

Energy Storage: Lithium-ion batteries, Thin Plate Pure Lead (TPPL) batteries and flooded batteries

Power Electronics: Power transfer and conversion, wireless power transfer for automated warehouses, fast chargers for EVs, high voltage power transfer (e.g., 5G)

Software: Edge computing, asset management software, data collection to the cloud, fleet management with automated service notification, smart batteries, etc.

Political & Regulatory Landscape: Risks and Opportunities

Biden-Era Tailwinds

The Section 45X Advanced Manufacturing Credit (of the Inflation Reduction Act or IRA) is a key source of profitability for lithium-ion production, boosting EnerSys’ earnings by $135-175 million annually (~ 39% of EPS).

IRA tax credits are recorded as a reduction to COGS and not subject to taxation. Currently the company expects about $155 million annually in IRA tax credits through Section 45X, equaling about $3.93 a share of EPS. That is a significant amount. The company will continue to receive increasing amounts of tax credits, based on its volume, through December 31, 2032.

I disagree personally with the Inflation Reduction Act (IRA) yet I find the opportunities it presents for companies like EnerSys to be beneficial as an investor. Additionally, the Section 45X credits, and much else in the IRA, benefits republican-leaning states. So, I do not see a repeal as likely. Section 45X is rather insulated from Congressional scrutiny, as legislators across the country would feel the negative impacts of a repeal in their communities after all the new jobs and community investment. Outright repeal of Section 45X requires an act of Congress.

I do believe the market is undervaluing (through misunderstanding) EnerSys shares due to these 45X credits comprising a large portion of earnings, and this undervaluation allows the company to repurchase shares at lower multiples thereby making accretion to EPS stronger. There is also the potential for the shares to re-rate at some point once more clarity arises from Congressional discussions around the IRA sections. ENS shares sold off more than 10% after Trump’s election and now are back near the point of origin.

Trump Headwinds and Tesla

While government incentives can accelerate adoption, businesses and fleet operators don’t wait around for policy changes. When I was running my company, the shift to lithium wasn’t driven by government tax breaks—it was driven by end users who saw lower total cost of ownership and higher reliability. That’s a key factor that may help EnerSys weather political uncertainty. While policy shifts matter, the bigger question is whether private industry continues the transition to lithium-ion regardless of federal support.

Tesla and private companies continue to invest in EVs and charging networks. Some states (e.g., CA or NY) are maintaining strong EV incentives, keeping demand resilient.

It is important to note that EnerSys is not primarily a retail EV battery supplier. Instead, ENS is building energy systems of the future for applications across many different markets and industries. Thus, risks such as the termination of the $7,500 EV tax credit for consumers conceivably will not have a material impact on the company.

Opportunities Abound

As you read above, ENS serves 7 different key markets and none of them really compete directly with a Tesla or consumer EVs. There is potential risk of the $7,500 EV tax credit being affected by the new administration, though I am not even too confident about this.

As an example, EnerSys serves the commercial and defense markets where the value proposition and adoption are there. Of course, within 8 years EnerSys will need to plan and adapt if Section 45X type credits are not extended. And the company is already working to expand its margins through various strategies.

I have seen the transition to new energy storage technology firsthand in certain markets. Companies like EnerSys are providing tangible benefits financially and operationally to its customers. I will say that, personally again, I do not believe the use of lithium is the best alternative use of resources given factors such as waste pools.

Companies such as EnerSys will target the new technology that provides the most benefit for itself and its customers. Unfortunately, the lithium-ion technology has taken hold.

Department of Energy (DoE) Grant

Last month ENS announced the completion of its negotiation with the DoE award supporting the development of a lithium-ion gigafactory. This 500,000 square-foot factory, with expected completion in 2027-2028, will serve all EnerSys product and service lines including about 10% of capacity dedicated to a contract for Department of Defense (DoD) applications supporting the military’s equipment.

The DoE awarded $199 million to EnerSys to build the plant in Greenville, South Carolina (a republican-leaning state, by the way). The $665 million price tag also includes funding from:

Local and state incentives totaling $200 million

$120-160 million of annual IRC 45X tax credits to support development costs

Management projects the IRR on this project to be greater than 20% with a payback less than 3 years after plant completion. This plant secures the company’s own product sourcing and allows it to continue execution of its transformation through conversion of its customers to higher-margin energy solutions.

EnerSys' True Market Positioning

The true market positioning of EnerSys focuses on trends and drivers unrelated to retail EVs - or even predominantly any EVs you see on the streets. The consumer EV tax credit is a retail-focused incentive benefitting companies like Tesla, Ford and GM. EnerSys serves the commercial, industrial and defense markets.

Defense & Aerospace: ENS supplies mission-critical battery and energy storage solutions to the US military and defense contractors.

Industrial and Commercial Battery Demand:

Large-scale backup power systems for data centers, telecom and critical infrastructure

Fleet electrification of buses, logistics, maintenance and utility vehicles

Grid-scale energy storage supporting renewable power generation

EnerSys is no longer a battery company, in which I would have no particular interest. Today it’s a company in the midst of a higher-margin transformation to an energy solutions provider and a long-term infrastructure enabler.

Financial Analysis

I need to preface this section with a note on how the IRA / 45X tax credits influence earnings. As mentioned previously, the IRA credits comprise a notable portion of the company’s earnings and it breaks out results with and without the credits.

Latest Earnings (from February 5, 2025)

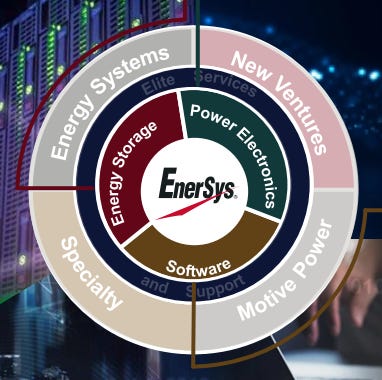

A look at the latest earnings below helps to illustrate the distinction between “base” earnings and “IRA” credit benefits. Lighter shade colors below denote the IRA benefit while the darker shares represent the base earnings.

Per the image above, this implies a base operating margin of about 8.5% (total 17.1% w/ IRA) and a total net income margin of about 5% (total 13.5% w/ IRA). At first glance the reliance on these credits may seem tenuous for the company’s future performance. However, if you understand the regulations and the industry one can see the longer pathway to growth and margin expansion.

Ex- IRA benefits, ENS reported 13% YoY growth in operating earnings.

Order rates in the Americas for communications and data centers increased 40% and 25% respectively, partly attributable to AI-driven data demand

A major customer raised its outlook by 20% for a telecom power project

Digital lift truck shipment growth in 2025 is forecast to be more than 10%

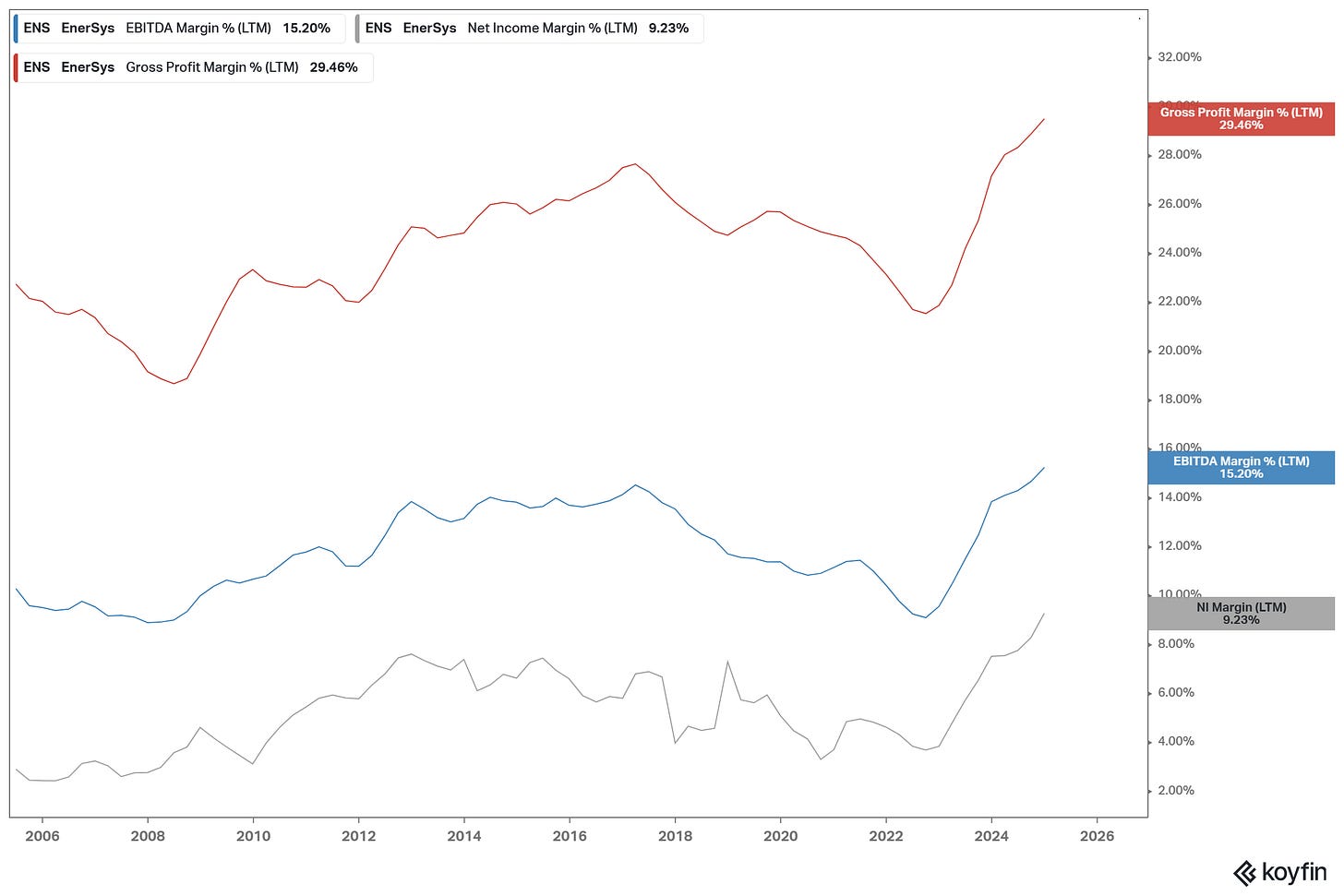

Margin Expansion

A large driver of price appreciation for an investor can come from margin inflection and expansion stories, especially if caught early on. Margin expansion for ENS is well underway with more progress to come in my opinion.

As its transformation proceeds from lead-acid to maintenance-free systems and value-added energy solutions, the company has seen margins expand materially. The company’s EOS program, aftermarket opportunities, and maximization of its fixed asset base, are all contributors as well.

In the chart below, we see the trend in margins for EnerSys over the past 20 years. The company faced inflationary pressures and supply chain disruptions which impacted margins temporarily. However, the company focused on strategic pricing actions and operational improvements and saw dramatic improvement within only 3 quarters.

The company’s performance above suggests a strong resilience and adaptability to navigating economic challenges. This gives me confidence that management will sustain the current, recent trend of increasing margins depicted in the chart above.

FY 2025 Guidance

Management has guided for the following FY performance through the last quarter of fiscal 2025:

Net Sales: $3.60-3.64 billion (+1.7% YoY)

Adjusted EPS: $9.97-10.07 (+19%, and increased due to additional IRA credits)

IRA Benefits: $135-175 million (~ 39% of earnings)

Capital Allocation

I assess that management has a very good capital allocation policy and history. The company targets a 2x long-term net leverage ratio and currently it stands at 1.5x EBITDA.

Share purchases typically average about 3.5% of market cap the last couple of years, and ENS pays a low (my preference) dividend yielding 0.96% - with three years of consecutive increases now. The remainder of its FCF is put into organic growth capex (e.g., Fast Charge & Store) and strategic M&A (e.g., Bren-Tronics acquisition).

I calculate FCF for EnerSys during the LTM to be $322 million, or an 8.2% yield on market cap, excluding effects from changes in balances of net operating assets.

Financial Risks

IRA Benefits: There is a fat left tail risk of the government appealing the IRA though I find this extremely improbable. Nonetheless, it is a risk you must consider for yourself.

Raw Material Costs: The company uses lead and other raw materials as a major input cost and these commodity prices can be volatile. However, management enters into fixed-price contracts and commodity hedging to neutralize this risk.

The above paragraph is a great segue to read my write-up on Marex Group (MRX), which helps producers hedge their commodity price risk:

Defined Benefit Pension Plan: EnerSys sponsors a defined benefit pension plan both US and internationally, and the company does have a deficit in its funded status of $21.4 million, recorded on its balance sheet. Management de-risked its US plan by moving from 60% equity exposure to an all-cash and fixed-income portfolio last year, and the UK plan is fully insured through an annuity contract. The international plan still has a large exposure to equities.

ENS has planned benefit payments of $43 million over the next decade.

Note the gains/losses show up in AOCI not the reported EPS.

The recent losses have only been in a range of 0-2% of earnings but it’s important for you to be aware of this factor

ENS is gradually de-risking and moving away from these DB plans, so I expect this to be less of a factor in the future

Supply Chain Competition: We all know about Tesla and its gigafactories. EnerSys is purely building new lithium-ion factories to supply its own customer orders rather than compete with Tesla or other suppliers. While competition is fierce in the lithium-ion battery market, ENS is proactively investing in its own production infrastructure to secure its supply chain and meet customer demands effectively. In part, the supply chain disruption from COVID has driven this response.

Conclusion: Is EnerSys a Buy?

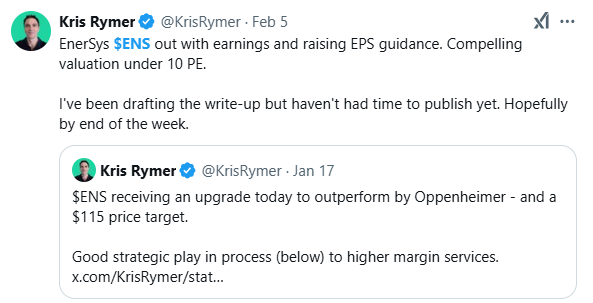

I put out some tweets (below) mentioning ENS since mid-December as I built up my position in the low 90s. I didn’t receive any real response. I believe the stock sold off in November/December 2024 due to the Trump election and concerns over the IRA credits. However, reading and researching this, as you have seen, there is quite a low probability of any repeal of these credits for ENS’s business.

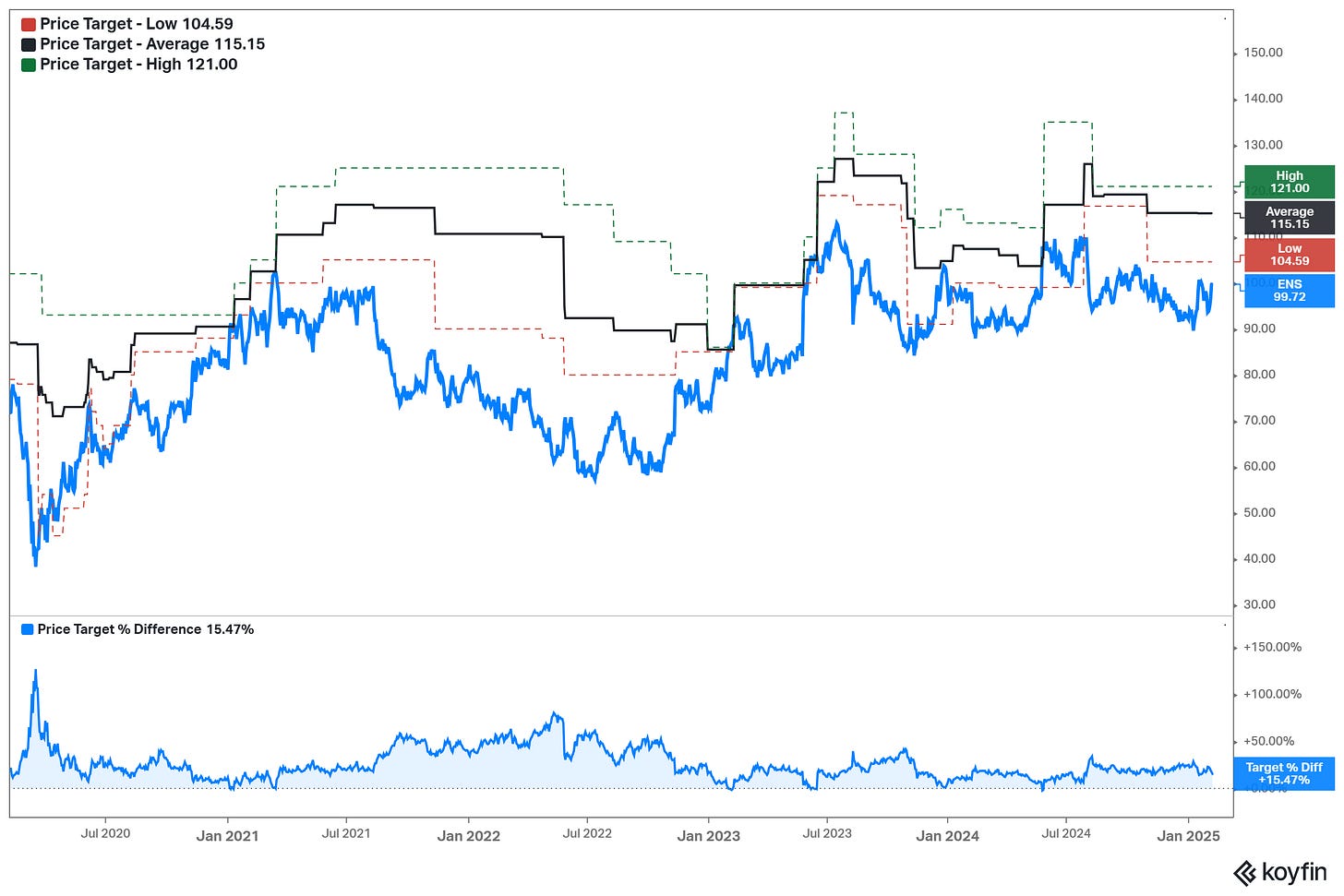

Despite the 9% increase in share price since tweeting about this company, there is still an additional 15% of upside potential based on the consensus of 6 analyst price targets, averaging out at $115 a share.

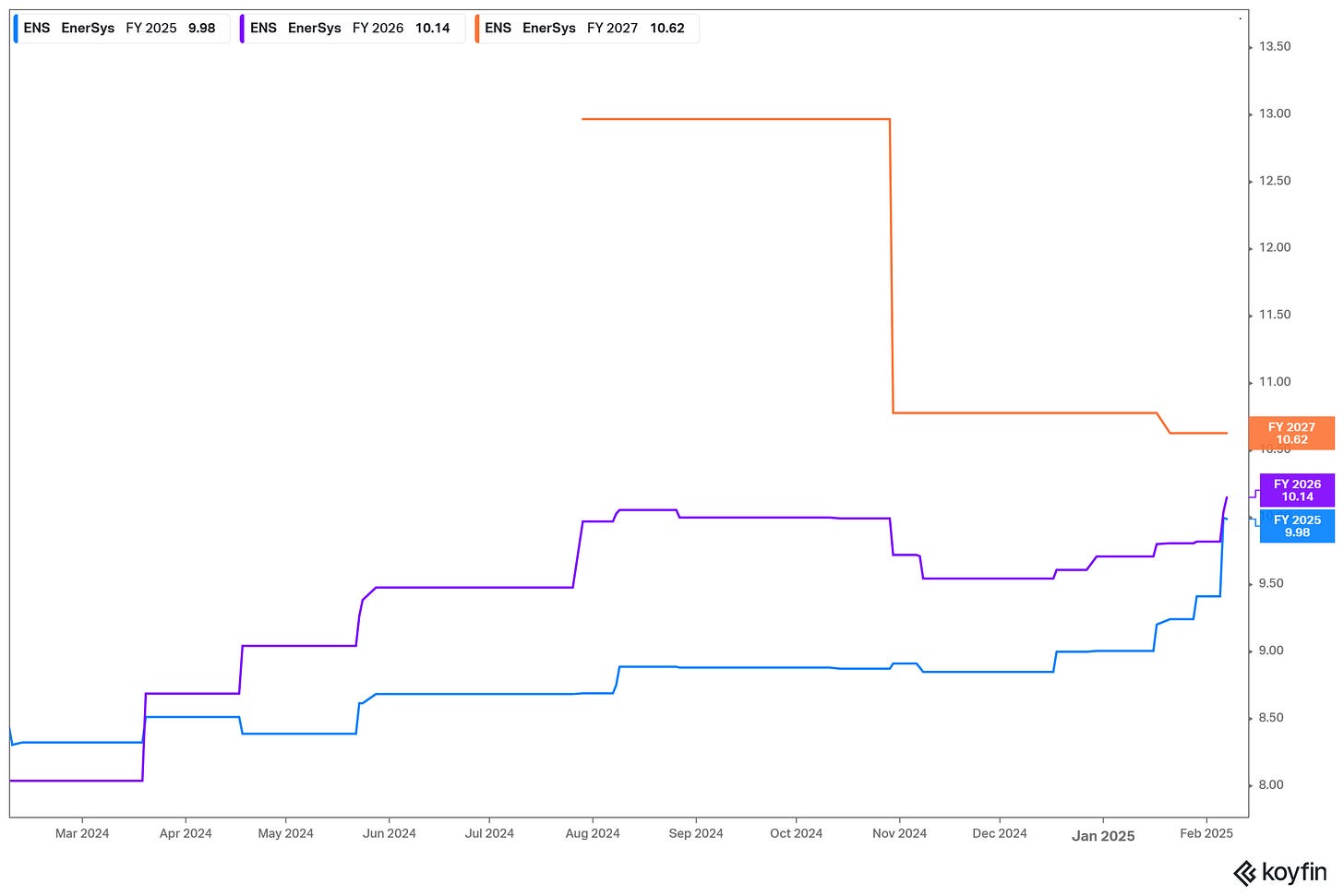

And now we are beginning to see the stronger upward EPS revisions after the latest earnings and guidance increase to $10 a share, giving this stock a current NTM P/E ratio of 9.8x. It’s also possible the FY 2026 and 2027 estimates are still too conservative. Next quarter management will likely release its 2026 guidance but based on management commentary I am optimistic.

Organic revenue has slightly contracted yet we may in fact be troughing and I like the longer-term fundamentals and valuation here. Remember we have a few engines of growth (borrowing from

’s article):Earnings Growth: organic troughing, accretive acquisitions and margin expansion

Share Repurchases: About 3.5% of buybacks per year as a percentage of market cap

Potential Multiple Expansion: Re-rating higher from a single-digit P/E from clarity of IRA benefits and recognition of margin expansion and the transformation

EnerSys comprises about a 2.5% allocation in my portfolio at a P/E of 9.3x on a forward basis. I would continue to add shares below $100 at this stage, but the lower the better, being patient with additions.

If the overall trend in demand persists across several of the company’s key markets, we could easily see a guide for FY 2026 much higher than the $10.14 per share currently marked by the analyst consensus.

Thanks for being part of the Safe Harbor community! Follow me for more insights: LinkedIn | X (formerly Twitter) | Instagram | YouTube

Disclosure: This information is provided for informational purposes only and should not be considered a solicitation or recommendation to buy or sell any securities. The author or entity providing this information may hold positions in the securities discussed. This is not investment advice.

Great analysis, Kris! Super interesting how you blended empirical industry knowledge with qualitative analysis. Well done!