Income-seeking investors have a variety of options when it comes to equity ETFs designed to generate high yields. Beyond popular names like the JPMorgan Equity Premium Income ETF (JEPI) and JPMorgan Nasdaq Equity Premium Income ETF (JEPQ), other funds cater to different risk tolerances and income strategies. This article explores the categories of income-focused equity ETFs, their benefits, and the potential risks investors should consider.

Categories of Income-Focused Equity ETFs

1. Covered Call ETFs

Covered call ETFs generate income by selling call options on their underlying assets. The most popular include:

JEPI and JEPQ: These ETFs use customized Equity-Linked Notes (ELNs) to implement out-of-the-money covered call strategies, combining income generation with reduced volatility. ELNs introduce counterparty risk because they are issued by banks, making the creditworthiness of the issuer a factor.

QYLD, RYLD, and XYLD (Global X Covered Call ETFs): These funds write at-the-money covered calls on the Nasdaq 100, Russell 2000, and S&P 500 indices, maximizing premium income but capping upside entirely. Unlike JEPI and JEPQ, these ETFs use exchange-traded options, which eliminate counterparty risk associated with ELNs.

Benefits:

High, consistent monthly income from options premiums.

Reduced volatility compared to direct equity ownership.

Risks:

Upside potential is limited, especially for at-the-money strategies like QYLD.

No significant downside protection beyond premium income.

JEPI and JEPQ carry additional counterparty risk due to their reliance on ELNs.

I do not personally recommend these ETFs as they retain your downside risk/beta while capping your upside return/beta.

2. Enhanced Dividend ETFs

Enhanced dividend ETFs focus on high-quality dividend stocks and may selectively use options to boost income. Examples include:

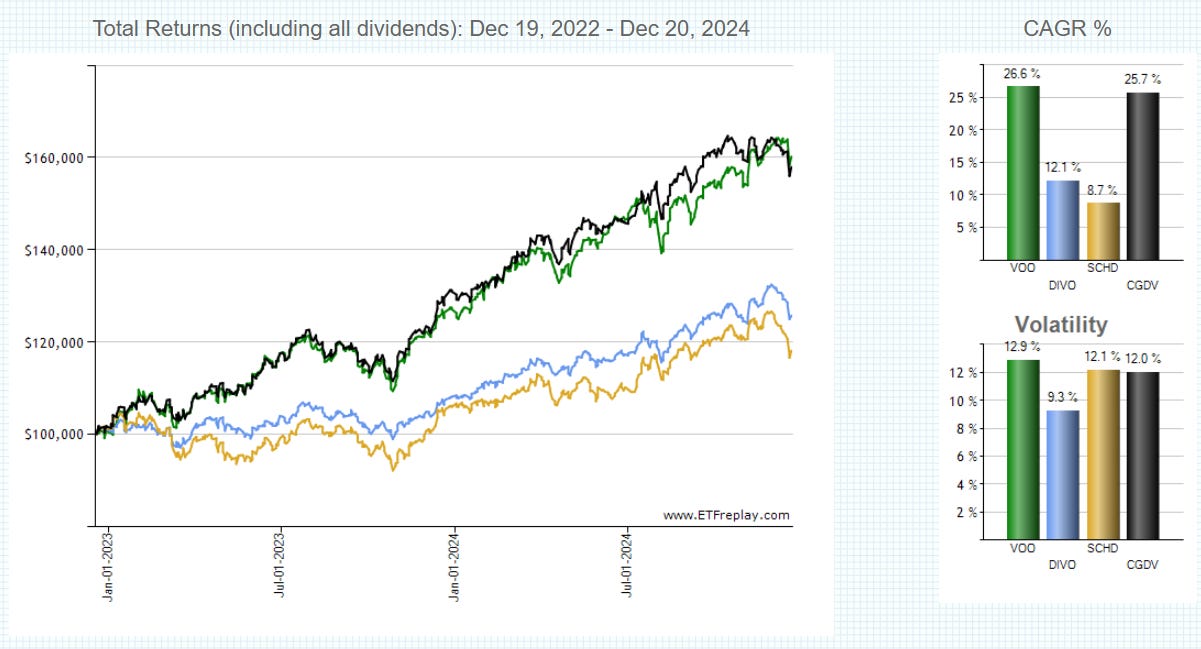

DIVO (Amplify CWP Enhanced Dividend Income ETF): Combines a portfolio of blue-chip dividend-paying stocks with a selective covered call strategy on individual holdings.

CGDV (Capital Group Dividend Value ETF): Focuses on high-quality dividend-paying stocks, with a selective approach to value and growth, balancing income and capital appreciation potential.

Benefits:

Balanced income and growth potential.

Focus on quality companies enhances stability.

Risks:

Lower yields compared to pure covered call ETFs.

Fully exposed to equity market volatility.

DIVO actually beat the popular SCHD over the last 1-3 years and is a good consideration for more conservative exposure. CGDV and CGDG do not use options to boost income. I would recommend these to retain your equity upside.

3. Risk-Managed Income ETFs

Risk-managed income ETFs incorporate downside protection strategies to reduce losses during market selloffs. However, these funds cannot seem to escape the unfavorable asymmetric return of option overlays. A prominent example is:

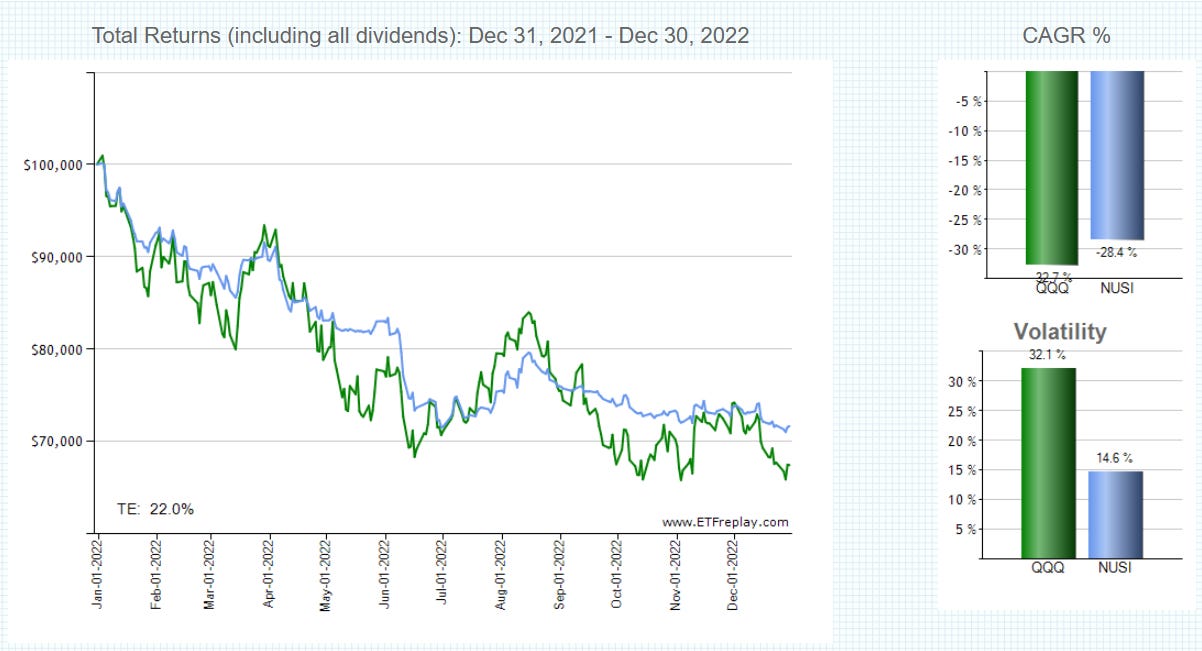

NUSI (Nationwide Risk-Managed Income ETF): Implements a collar strategy by selling call options and using part of the premium to buy protective puts on the Nasdaq 100. NUSI is a smaller ETF, with approximately $326 million in assets under management (AUM).

Benefits:

Some downside protection from put options.

High and stable income potential with reduced risk.

NUSI’s use of NDX index options provides Section 1256 tax treatment.

Risks:

Protective puts reduce income during low-volatility periods.

Upside is capped by the call options.

Look at what NUSI has done during 2021 and 2022, separately, one bullish and one bearish year, versus QQQ. It severely underperformed (-17%) in 2021 and very modestly outperformed (+5%) in 2022.

4. High-Risk, High-Yield ETFs

These ETFs offer extremely high yields but come with significant risks due to their concentrated or speculative strategies. Examples include:

YieldMax ETFs (e.g., TSLY, APLY, OARK): Take aggressive covered call positions on individual volatile stocks like Tesla, Apple, or ARK Innovation ETF.

Benefits:

Exceptional income potential, often exceeding 30% annually.

Risks:

Highly speculative and exposed to sharp drawdowns in volatile markets.

Minimal downside protection beyond options premiums.

STAY AWAY!

Key Benefits of Income-Focused ETFs

High Monthly Income:

Most income-focused ETFs deliver yields far exceeding traditional dividend stocks or bonds, appealing to retirees and income-focused investors.

Diversified Strategies:

Investors can choose from low-volatility funds, risk-managed strategies, or aggressive high-yield options depending on their goals.

Equity Exposure with Reduced Volatility:

Covered call strategies provide market exposure while moderating volatility, making these ETFs attractive during uncertain market conditions. I would caution that these ETFs provide very little downside protection due to retention of downside risk (beta).

Key Risks of Income-Focused ETFs

Capped Upside Potential:

Covered call and collar strategies limit participation in sharp market rallies, reducing long-term growth potential.

Downside Retention:

Most funds, except risk-managed ETFs like NUSI, remain exposed to significant market declines.

Complexity and Costs:

Strategies involving options or ELNs add layers of complexity. JEPI and JEPQ introduce counterparty risk because ELNs depend on the creditworthiness of the issuer.

Tax Considerations:

Depending on how distributions are classified, income from these ETFs may have different tax implications. Investors should consult a tax advisor.

Choosing the Right Income ETF

When evaluating income-focused ETFs, consider:

Risk Tolerance: High-yield options like YieldMax ETFs are speculative, while JEPI and DIVO offer more conservative approaches.

Income Needs: Covered call ETFs like QYLD and JEPI are ideal for maximizing income, whereas dividend-focused ETFs like CGDV prioritize stability.

Market Outlook: In volatile markets, risk-managed ETFs like NUSI provide only modest downside protection, while covered call ETFs excel in flat or slightly rising markets.

I recommend quality dividend growth ETFs that generate 1-3% of dividend yield. If you are wanting more yield I consider quality BDCs such as MSDL or KBDC, which I have written up at Accredited Investor Insights. These are not equity ETFs but they offer about 10% yield and hold a higher position in the capital stack.

Conclusion

Income-focused equity ETFs offer diverse strategies to meet varying investor needs. From high-yield covered call funds to risk-managed options with potential downside protection, these ETFs provide compelling solutions for generating income while maintaining equity exposure. However, it’s crucial to understand the trade-offs between yield, growth potential, and risk before investing.

For more insights into how income-focused ETFs can enhance your portfolio, subscribe to Safe Harbor Stocks, where we break down strategies for equity investors seeking stability and growth.

Thanks for being part of the Safe Harbor community! Follow me for more insights: LinkedIn | X (formerly Twitter)

Disclosure: This information is provided for informational purposes only and should not be considered a solicitation or recommendation to buy or sell any securities. The author or entity providing this information may hold positions in the securities discussed. This is not investment advice.