Finding Alpha in PE-Backed IPOs: A Strategy for Patient Investors

Why Private Equity IPOs Can Be Hidden Gems for Patient Investors

Private equity (PE)-backed initial public offerings (IPOs) offer a unique opportunity for investors who understand the nuances of the market. Like spin-offs, these IPOs often enter the public markets with structural inefficiencies—low analyst coverage, investor uncertainty, and overhang from private equity owners gradually exiting their stakes. However, patient investors can take advantage of these dynamics, waiting for the stock to re-rate as earnings visibility improves.

This approach has been a significant source of alpha in my portfolio, with examples like Marex Group (MRX) and Academy Sports & Outdoors (ASO) delivering strong returns after their initial public listings. In this article, I’ll discuss why PE-backed IPOs can outperform, how they resemble spin-offs, and what to look for in a winning investment.

Why PE-Backed IPOs Can Outperform

While the long-term performance of an IPO depends on the underlying business fundamentals, the pricing of a newly listed stock is influenced by capital market conditions, investor sentiment, and the private equity exit cycle. PE firms typically hold assets for five to seven years, and when exit windows narrow—due to weak IPO markets or a slow M&A environment—sponsors can be forced to sell at more attractive valuations when conditions improve.

We’ve seen this play out in recent years. In the wake of higher interest rates and a weaker IPO market in 2022–2023, PE sponsors faced increasing limited partner (LP) pressure to return capital. As a result, some IPOs were priced conservatively, offering investors a chance to buy into high-quality companies at favorable valuations.

Moreover, PE-backed companies often enter the public markets with disciplined capital structures and strong operational playbooks, a result of years of hands-on private ownership. Sponsors optimize their portfolio companies before going public, leading to:

Cost efficiencies and margin expansion

Deleveraging at IPO to create financial flexibility

An incentive structure that aligns management with long-term shareholders

These factors can drive long-term outperformance, provided the company’s fundamentals remain strong and management executes well.

Marex Group and Academy Sports: Learning from Past Successes

PE-backed IPOs can often resemble spin-offs, as they debut with little analyst coverage, high uncertainty, and discounted valuations. Investors willing to do the work and understand the business before the market catches on can generate significant upside.

Two of my most successful PE-backed IPO investments—Marex Group (MRX) and Academy Sports & Outdoors (ASO)—followed this exact pattern.

Marex Group (MRX): A Classic PE Overhang Play

Marex, a global commodities broker, came public in April 2024 in a PE-backed IPO. The stock was priced conservatively due to a lack of analyst coverage, investor unfamiliarity, and a supply/demand imbalance created by PE owners gradually selling down their stakes.

As I wrote in my Safe Harbor Stocks analysis, Marex had:

A strong, growing business with deep customer relationships

A capital-light, high-return model that generated robust free cash flow

A valuation that reflected uncertainty rather than fundamentals

Early investors benefited as the stock re-rated once earnings visibility improved and more institutions had initiated coverage.

Academy Sports (ASO): A Post-IPO Growth Story

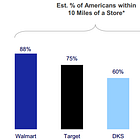

Academy Sports, which went public in 2020 after being owned by KKR, was another mispriced IPO that later delivered outstanding returns. In its first year, ASO traded at a low valuation due to:

Lingering private ownership overhang

Low investor awareness compared to larger sporting goods retailers like Dick’s Sporting Goods (DKS)

Skepticism about its business model despite strong execution

However, as Academy demonstrated consistent earnings growth and shareholder-friendly capital allocation, the market rewarded it with multiple expansion and strong stock performance.

The key lesson from MRX and ASO? Mispricing often occurs due to market inefficiencies rather than business fundamentals.

Identifying Winning PE-Backed IPOs

Not all PE-backed IPOs are created equal. Some firms manage their exits better than others, and some IPOs come with excessive debt, low reinvestment opportunities, or sponsor-driven short-term decision-making.

Here’s what I look for:

1. Quality of the PE Sponsor (But Not Necessarily the Biggest Names)

While large firms like KKR, Blackstone, and Apollo have strong track records, some of the best IPOs come from lesser-known but highly disciplined sponsors.

For example, Marex was backed by BXR Group and Trilantic Europe, not one of the mega-funds, but their strategic guidance and exit approach helped create an attractive opportunity for public market investors.

2. Managing the Private Equity Overhang

Look for PE firms that stagger their exits, rather than flooding the market with shares immediately.

Lockup expirations and follow-on sales can create temporary selling pressure—investors who understand these dynamics can take advantage of price weakness.

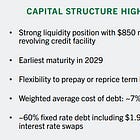

3. Right-Sizing Debt at IPO

A healthy balance sheet post-IPO is critical.

Companies that use IPO proceeds to reduce leverage often perform better in the long run.

4. Capital Allocation Post-IPO

Share buybacks and dividends can signal management’s confidence in the business.

Avoid companies where PE firms extract too much cash through dividends or aggressive secondary offerings.

Notable 2025 PE-Backed IPO Candidates

The 2025 IPO pipeline includes several well-known PE-backed firms, some of which have already filed S-1 forms and are preparing to go public. These companies span industries ranging from enterprise software to customer experience AI and automotive data analytics, and each has a unique private equity ownership story.

Here are five IPO candidates worth watching:

1. Panera Bread (BDT & Company, JAB Holding Company)

Panera Bread, now owned by BDT & Company and JAB Holding, is a dominant force in fast-casual dining, known for its bakery-café model emphasizing fresh, healthy ingredients.

Beyond Panera, the company owns Einstein Bros. Bagels and Caribou Coffee, creating a diversified portfolio in the premium café space.

Panera previously went public in 1991, then was taken private in 2017 by JAB Holding, a PE firm specializing in consumer brands (also behind Krispy Kreme and Peet’s Coffee).

If Panera successfully prices its IPO in 2025, it could be a compelling consumer brand play—with strong unit economics and an established customer base.

2. UST Global (Temasek Holdings, Blumberg Capital)

UST Global is a digital transformation and IT services firm headquartered in California, backed by Temasek Holdings, Singapore’s sovereign wealth fund.

It specializes in AI, cloud computing, and cybersecurity solutions for Fortune 500 companies.

The firm was founded in 1999 and has grown into a 30,000-employee operation providing mission-critical services across multiple industries.

Temasek's involvement signals strong institutional backing, and if pricing is reasonable, UST Global could be a solid play on enterprise IT spending and digital transformation.

3. BMC Software (KKR, Acadia Capital, Access Industries)

BMC Software is a legacy IT infrastructure and operations software vendor, with a focus on AI-driven automation and mainframe modernization.

The company was public for decades before going private in 2013 under Bain Capital, then later acquired by KKR in 2018.

BMC’s offerings remain essential in data center management, cloud migration, and IT automation, positioning it well in an era of hybrid cloud adoption.

This IPO will be interesting because BMC operates in a slow-growing but highly profitable niche, making it an attractive steady cash flow business.

4. Genesys (Hellman & Friedman, Permira, BlackRock, Salesforce Ventures, ServiceNow Ventures, Zoom Video Communications, D1 Capital)

Genesys is an AI-powered customer experience (CX) platform, leveraging artificial intelligence and automation to optimize enterprise call centers and digital customer interactions.

Originally a spinoff from Alcatel-Lucent, the company was taken private in 2012 by Hellman & Friedman and Permira, then later attracted investments from Salesforce Ventures, ServiceNow Ventures, and Zoom Video Communications.

Genesys has leaned heavily into AI-driven customer service automation, competing with the likes of Five9 and NICE.

Given the explosive growth in AI-driven enterprise solutions, this IPO has the potential to garner significant investor interest.

5. Solera (CPPIB, Vista Equity Partners)

Solera is an automotive technology and data analytics company, specializing in vehicle lifecycle management, claims automation, and fleet management solutions.

Originally founded in 2005, Solera was a publicly traded company until 2016, when it was taken private by Vista Equity Partners for $6.5 billion.

It later attracted investment from Canada Pension Plan Investment Board (CPPIB) and has been actively expanding through acquisitions.

Why this IPO stands out:

Deep industry moat in insurance claims processing, auto repairs, and digital vehicle history tracking.

Recurring revenue model with strong pricing power.

Potential AI-driven automation tailwinds, as insurers and fleet operators increasingly adopt predictive analytics.

Given my particular interest in automotive-related businesses, Solera is one I’ll be watching closely. If it enters public markets at a reasonable valuation, it could offer a compelling tech-enabled auto industry investment.

My write-up on Genuine Parts (GPC) describes my experience and interest in the automotive space:

Final Thoughts: A Strategy for Patient Investors

PE-backed IPOs offer investors a chance to buy high-quality businesses at attractive valuations—but only if they are willing to understand the nuances of the exit process.

Much like spin-offs, these stocks often debut undervalued due to uncertainty, limited coverage, and private equity selling pressure. However, for investors willing to take a long-term view, the upside can be significant as the market re-rates the business to reflect its true value.

By focusing on market conditions, sponsor quality, and post-IPO capital allocation, investors can position themselves for success in what remains an underappreciated corner of the market.

Below are two spin-offs I recently covered, and own:

If you are interested in deeper coverage of private equity or credit investing, check out

and ! It’s an excellent source of insights on private placement investing.

Thanks for being part of the Safe Harbor community! Follow me for more insights: LinkedIn | X (formerly Twitter) | Instagram | YouTube

Disclosure: This information is provided for informational purposes only and should not be considered a solicitation or recommendation to buy or sell any securities. The author or entity providing this information may hold positions in the securities discussed. This is not investment advice.