Genuine Parts Company (GPC): A Resilient Dividend King

A Dividend King with Resilient Growth and Strategic Expansion

This write-up isn’t necessarily a stock trading below intrinsic value, but rather an excellent fairly valued company with a long track record of annual dividend increases and respectable capital allocation. This may be a stock that subscribers would consider for a dividend growth portfolio.

I collaborated on this article with

, a former investment banker and hedge fund analyst, who does an excellent job with charting FactSet data - and you will see his charts featured here. He also writes some fantastic articles of his own covering financial analysis and deep dives. I encourage you to check out his newsletter here: StreetSmarts.Introduction: A Dividend King with Staying Power

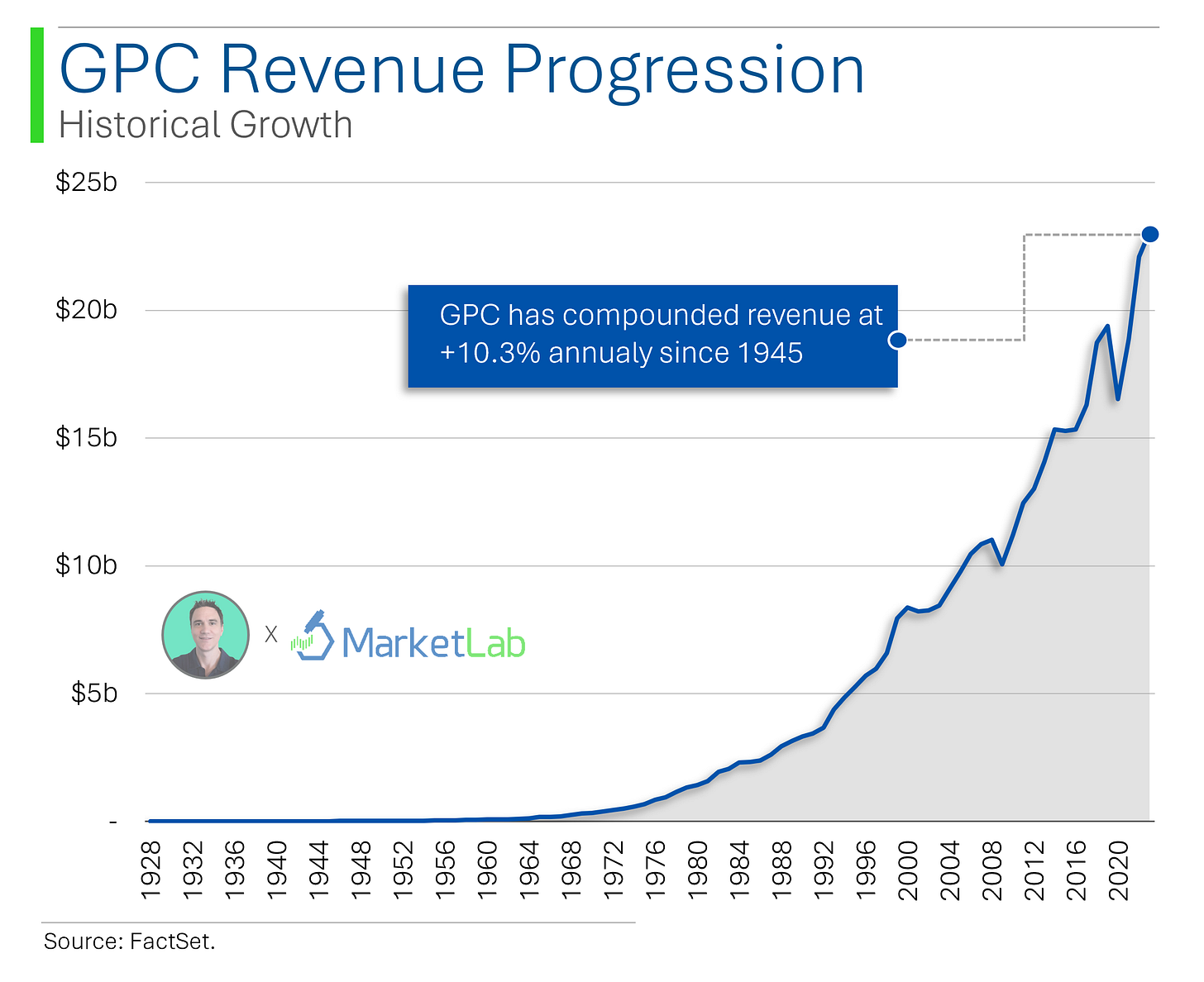

Founded in 1928, Genuine Parts Company (NYSE: GPC) has built a global distribution network spanning 17 countries, serving millions of customers in the automotive and industrial replacement parts markets.

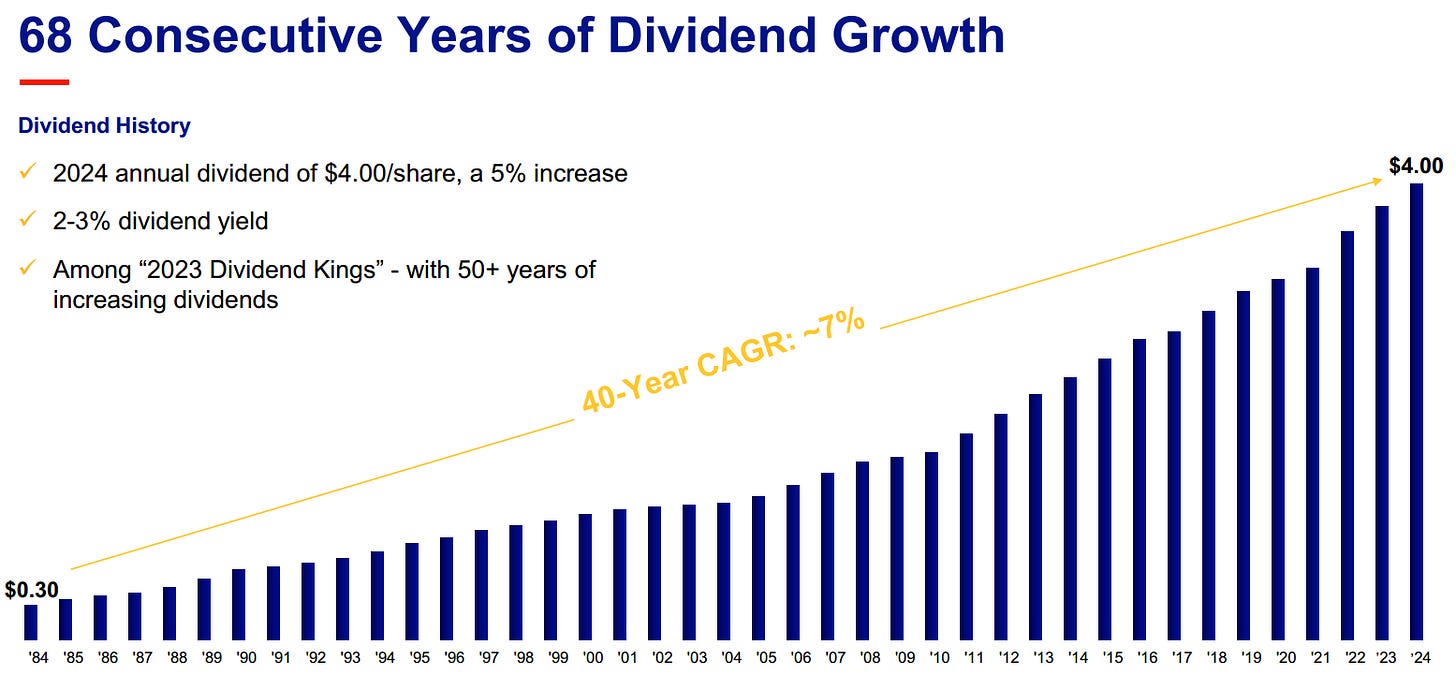

With 68 consecutive years of dividend increases, GPC has earned its place as a Dividend King, making it a staple for income-focused investors.

As a long-time owner—now passive—of an automotive parts distribution and service business, I have a particularly relevant vantage point on GPC’s business model and industry dynamics that gives me additional comfort in this company.

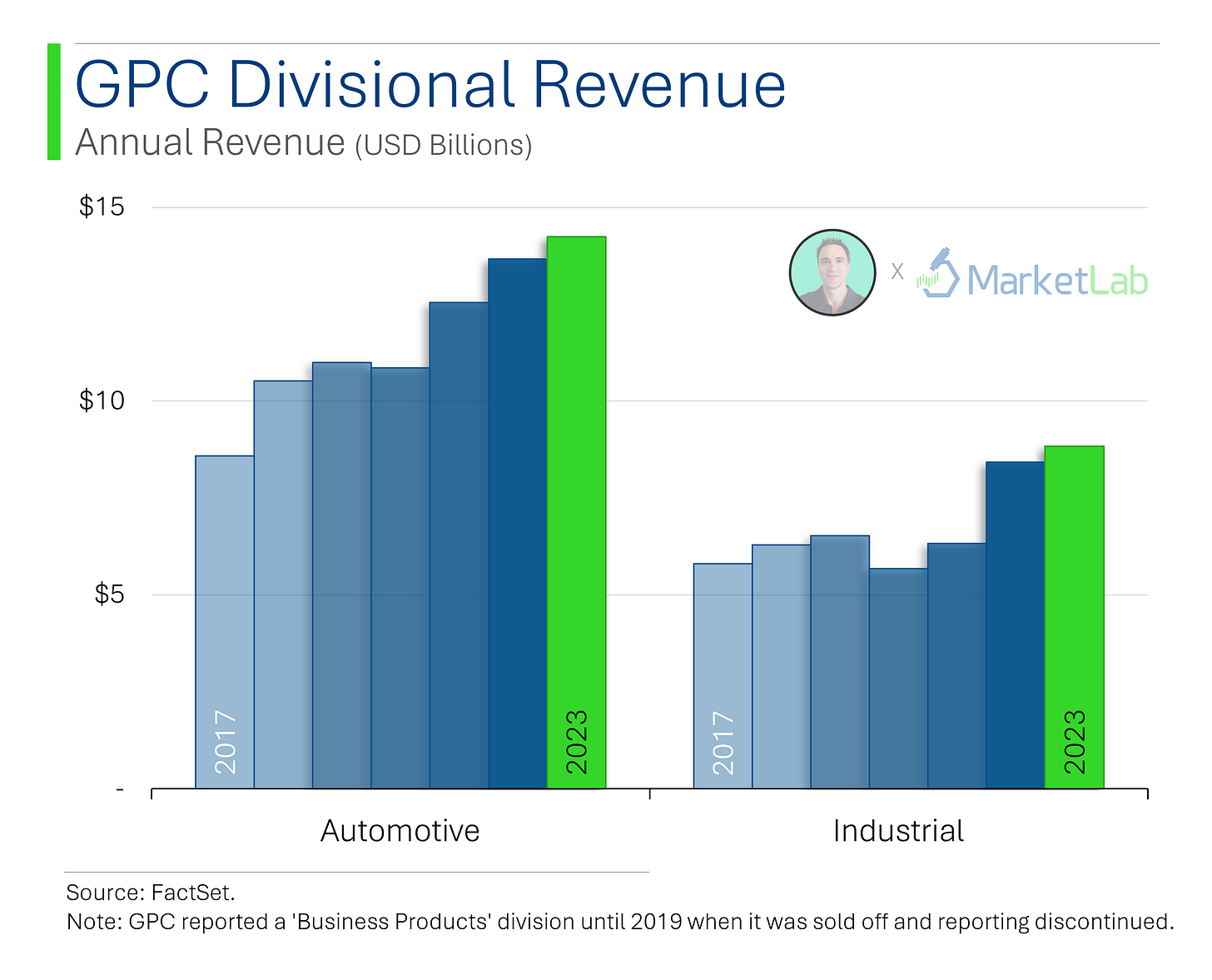

The company operates through two core segments:

Automotive Parts Group (62% of sales): Anchored by the NAPA brand, supplying repair shops and retailers.

Industrial Parts Group (38% of sales): Operating under the Motion brand, serving manufacturers, logistics, and critical industries.

GPC has maintained a disciplined capital allocation strategy, balancing strategic acquisitions, operational efficiencies, and shareholder returns.

While recent headwinds—including European demand softness and industrial market weakness—have pressured earnings, GPC’s long-term fundamentals remain strong, supported by a robust balance sheet, free cash flow, and steady demand for replacement parts.

Business Overview

Over the last 5 years GPC transformed its business to streamline its portfolio into two core segments as mentioned above. The company now operates a highly resilient, two-segment business model that supplies essential replacement parts across automotive and industrial markets. This diversified structure provides stability through economic cycles, as demand for replacement parts remains relatively steady regardless of macroeconomic conditions. The graph below reflects the two core segments excluding its divestitures under the transformation.

Automotive Parts Group (62% of Sales) - The Power of NAPA

GPC is a leading distributor of automotive replacement parts, primarily under the NAPA (National Automotive Parts Association) brand, one of the most recognizable names in the industry. The segment serves repair shops, dealerships, fleet operators, and retailers across North America, Europe, and Australasia.

Approximately 80% of its segment sales come from NAPA-branded products. Growth is driven by vehicle aging trends, increasing repair complexity and a fragmented market - where GPC continues to consolidate independent parts suppliers. It serves a large portion (also ~80%) of the Do-It-For-Me (DIFM) market, benefitting from growing repair complexity.

I literally experienced this consolidation dynamic in my parts business about 22 years ago. As a smaller regional player, I experienced firsthand (via ACDelco and Motorcraft parts) how the large parts companies encourage dealer consolidation and roll-up markets. They have it down to a science and are quite successful. Scale matters in this sub-industry.

GPC’s NAPA network includes company-owned and independent stores that provide broad geographic coverage and deep inventory availability. GPC is also investing into its omnichannel platform for B2B & B2C markets.

Industrial Parts Group (38% of Sales) - Strength in Motion

The Motion brand makes GPC a leading distributor of industrial replacement parts, serving manufacturing, mining, logistics, and energy sectors. These mission-critical components keep factories, warehouses, and infrastructure running smoothly.

Revenue drivers for this segment include:

Maintenance, Repair & Operations (MRO) services for industrial plants

Mission-critical components such as bearings and other smaller industrial supplies

Healthy end market diversification across industries such as aerospace, utilities, transportation, etc

GPC continues to expand its industrial offerings, including e-commerce channels, value-added solutions and network optimization.

Financial Strength and Dividend Profile

GPC has built a reputation for financial resilience, underpinned by strong cash flow generation, disciplined capital allocation, and a shareholder-friendly dividend policy. Its 10.3% CAGR in revenue since 1945 alone is rather impressive. Think of all the wars and recessions this company has endured.

Free Cash Flow

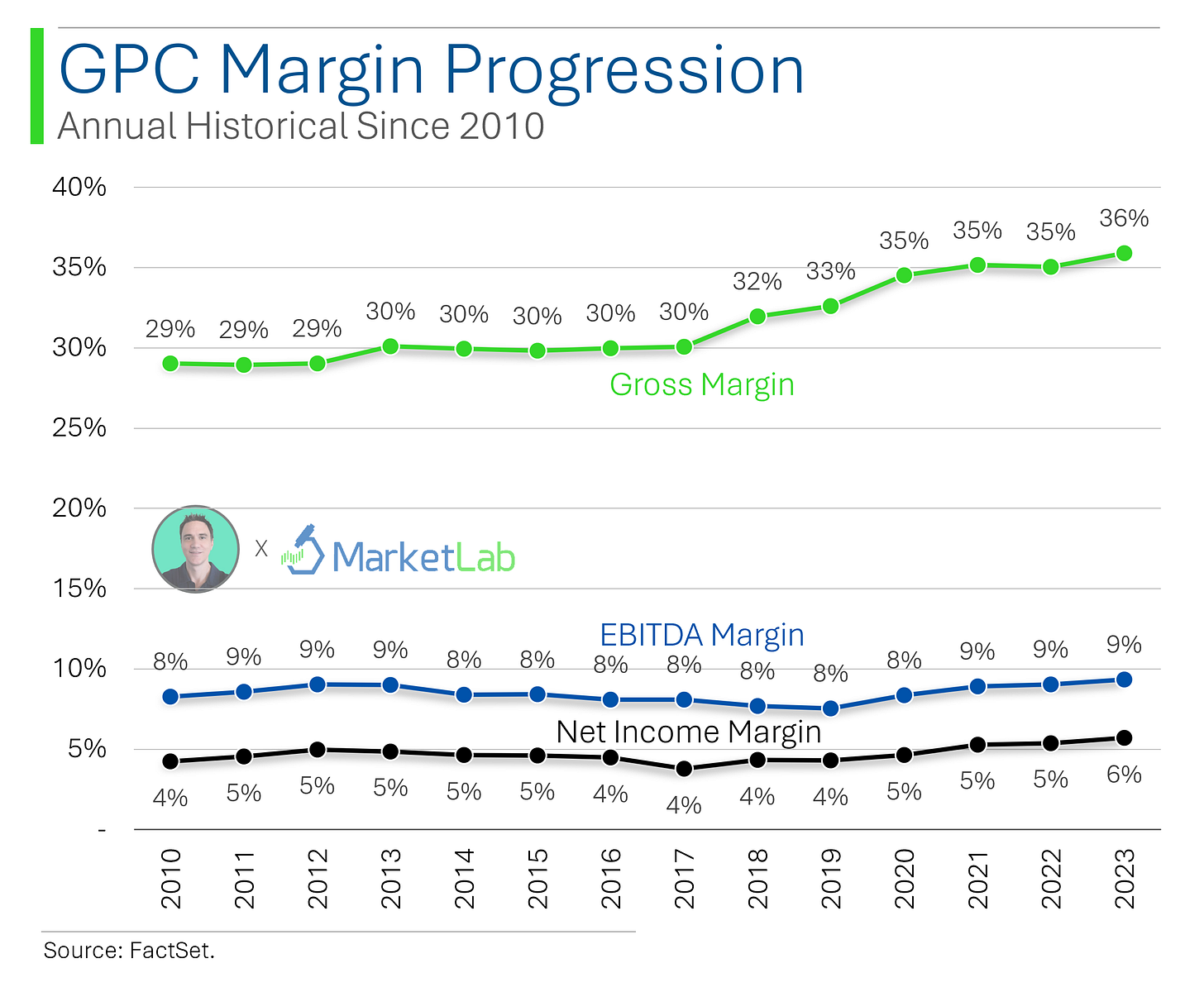

GPC's ability to generate stable free cash flow (FCF) allows it to fund acquisitions, reinvest in operations, and return capital to shareholders without compromising its balance sheet strength. The company has healthy debt levels and ample liquidity.

Net debt-to-EBITDA is 3.2x, which is slightly higher than I prefer. I accept this net leverage ratio because:

GPC carries a low WACD of 3.49%

Remains withing its own target at gross debt-to-EBITA of 2.2x.

Holds $2.6 billion of liquidity including $1.1 billion of cash and an additional revolver about equal to its market cap

Exhibits very disciplined net working capital management at 7% of sales and an average CCC of 27 days

Read more about the Cash Conversion Cycle (CCC) and NWC Intensity here:

GPC, however, is not necessarily undervalued. The TTM and FY 2024 company guidance for its free cash flow (FCF) is $900 million, which yields a current FCF yield of 5.6% on the current market cap. This figure already excludes capex for growth such as acquisitions.

A Dividend King

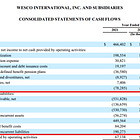

GPC’s 68-year streak of annual dividend increases places it among the elite Dividend Kings, a distinction achieved by only a handful of companies. And GPC’s more recent dividend growth is maintaining its reputation.

The company has grown dividends at a 6.7% CAGR over the last 14 years and currently sports its highest dividend yield in the same time period at about 3.5%. Furthermore, it is important to note that the company still only has a payout ratio of 22% in 2024 and 31% over the last 5 years.

Recent Performance and Challenges

Despite short-term earnings pressures from industrial market softness and European demand challenges, GPC’s overall fundamentals provide a strong foundation for continued dividend growth and long-term value creation for shareholders. However, I would be remiss if I didn’t share the more prominent risks facing the company.

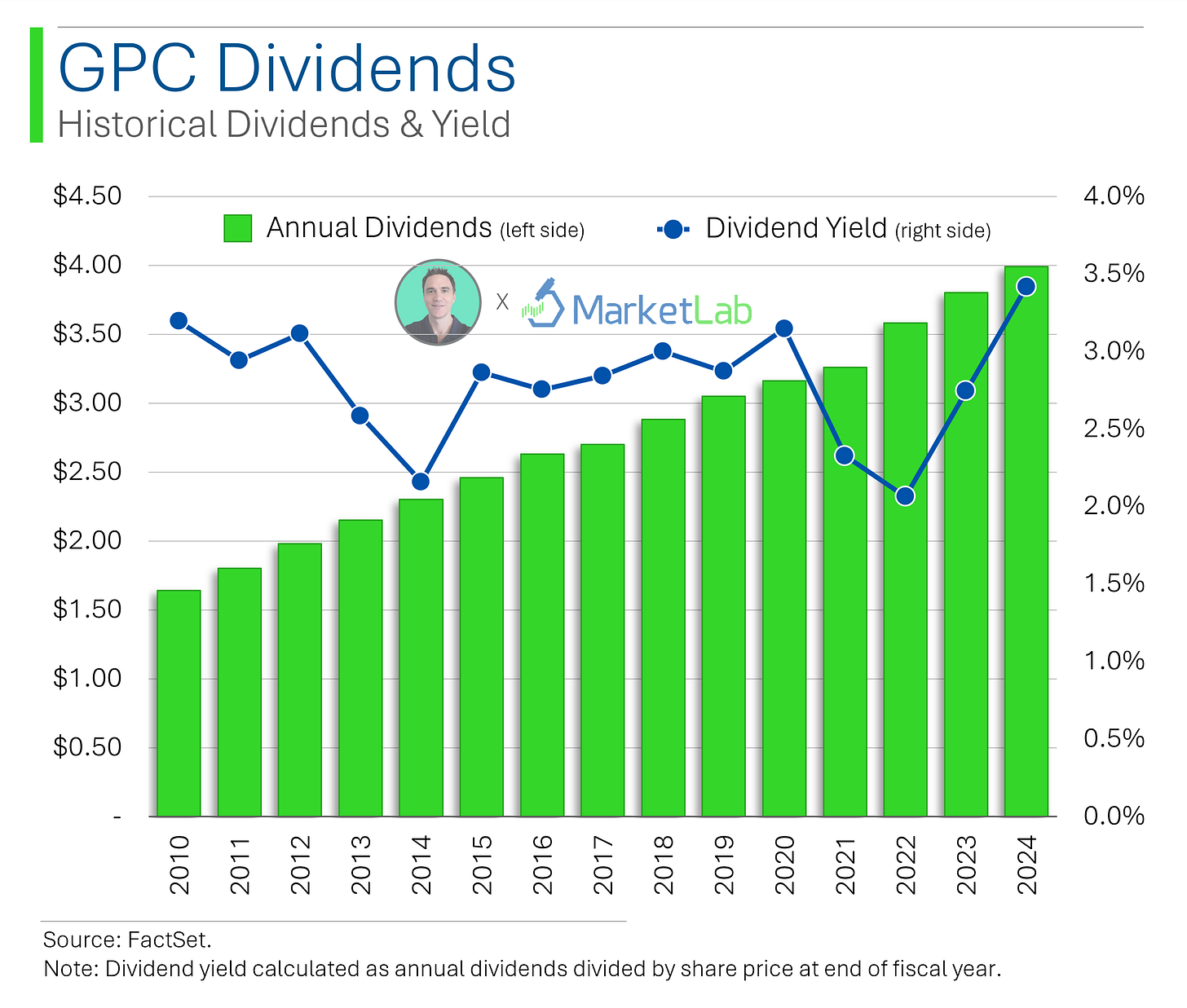

In its last earnings release on October 22, 2024, management reduced its FY 2024 guidance to $8.10 from $9.40, a 14% drop. That’s material and the share price reacted accordingly. The Q3 numbers below illustrate the story below.

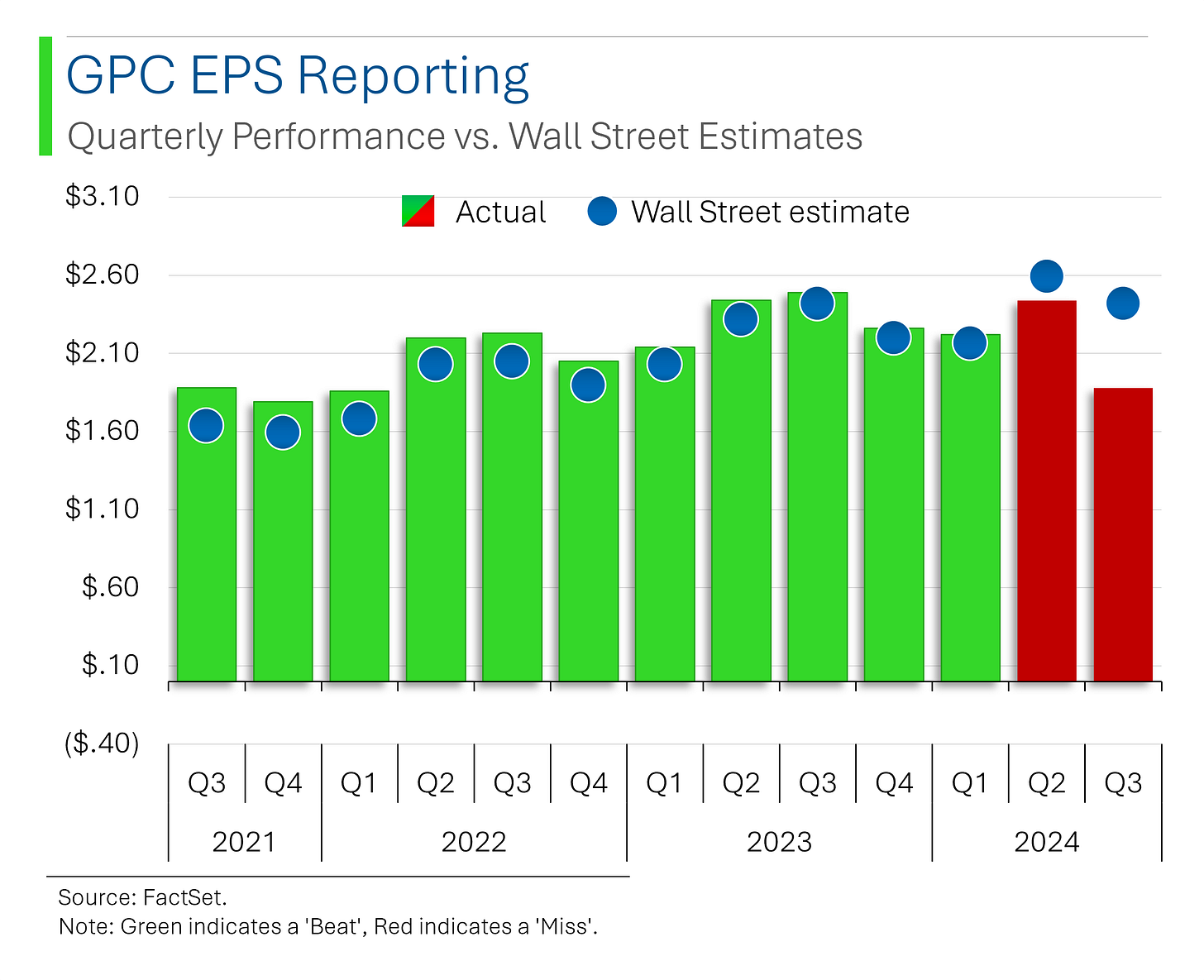

However, there are silver linings if you peek beneath the surface. GPC has steadily increased its gross margins since 2017 due to the strategic transformation from 2019 and its continued focus on optimizing NWC management exemplified in the chart below. Even its latest gross margin in Q3 2024 increased another 60bps to just under 37%.

In its last earnings call management acknowledged the weaker demand environment along with ongoing cost pressures. The company stated that it is remaining focused on extending its competitive advantages and maintaining its disciplined strategy. Despite gross margins increasing, GPC has suffered from SG&A cost inflation and sales deleveraging.

Regarding sales deleveraging, the weakness manifested in the industrial segment with global comparable sales down 2.4%. Consequently, the segment margin decreased 100bps to 11.9% from 12.9%. Management noted we’ve seen the largest contraction of PMI in 33 years. However, management reiterated that it is prepared to capitalize on the eventual improvement in the manufacturing economy.

Nearshoring, automation and infrastructure investment provide tailwinds for the industrial segment

Global EV market growth presents a long-term revenue growth driver for the automotive segment

Strategic Growth Through M&A

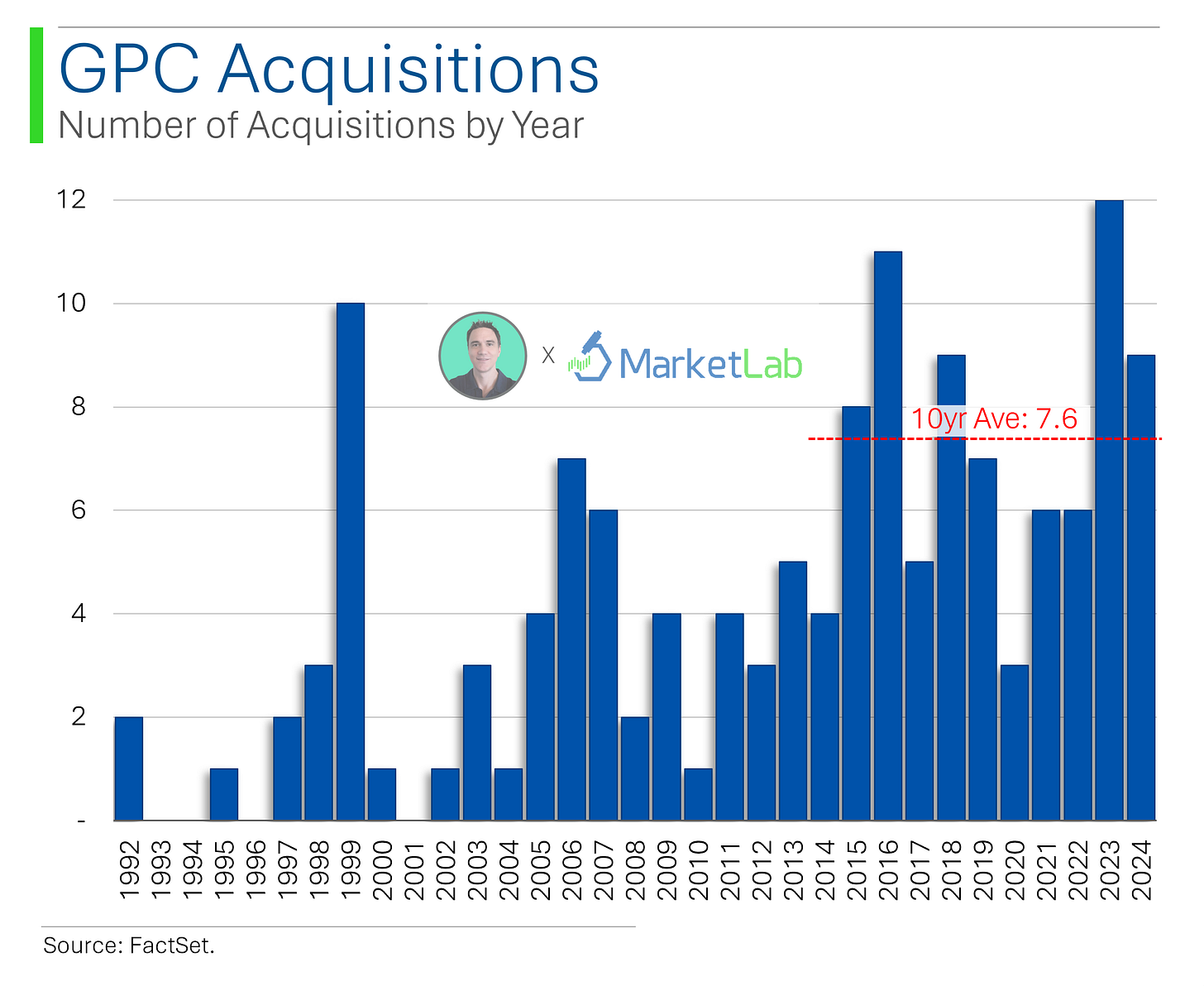

GPC has a long history of using acquisitions to build its franchise. The last five years the company has allocated 40-50% of FCF to acquisitions. It has already acquired $954 million through Q3 YTD with more in the pipeline ready to close in Q4.

The company has a very disciplined approach to acquisitions:

Accretive to EPS within first year

ROIC > GPC cost of capital

Post-purchase price multiple below GPC’s multiple

Keen eye to strategic operational filters such as market expansions and operating synergies

One final point is the vast opportunity facing GPC in its very fragmented markets. The company has an 8% and 6% market share, respectively, in the automotive and industrial segments, which together represent a global TAM of $350 billion.

Valuation and Investment Case

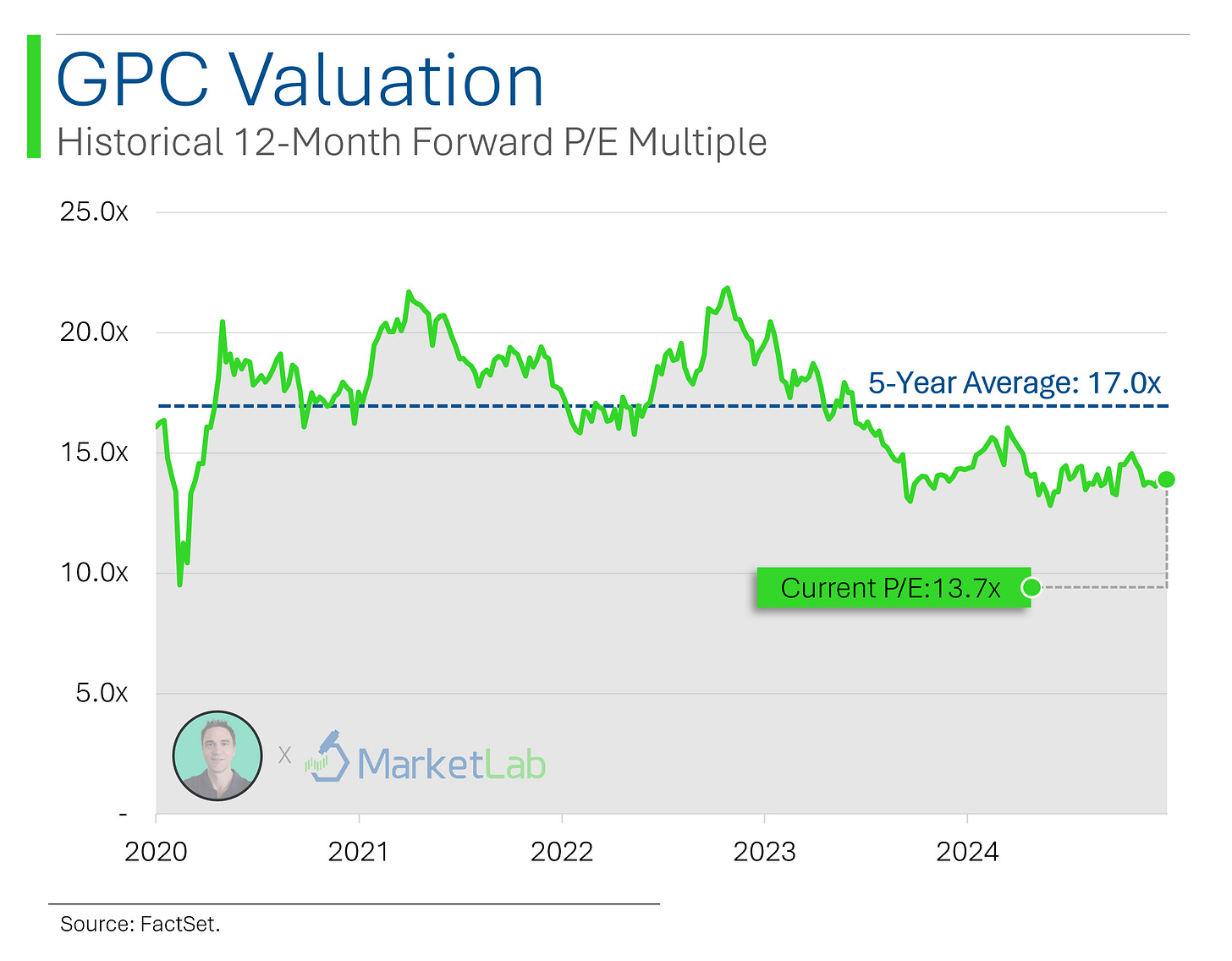

GPC currently trades at a 13.7x P/E for 2025 analyst estimates of $8.52 per share. And this P/E is based on dramatically lowered 2025 estimates since the October 2024 earnings guidance revision downward. On a historical basis, GPC also trades at a 20% discount to its average 5-year forward P/E of 17x.

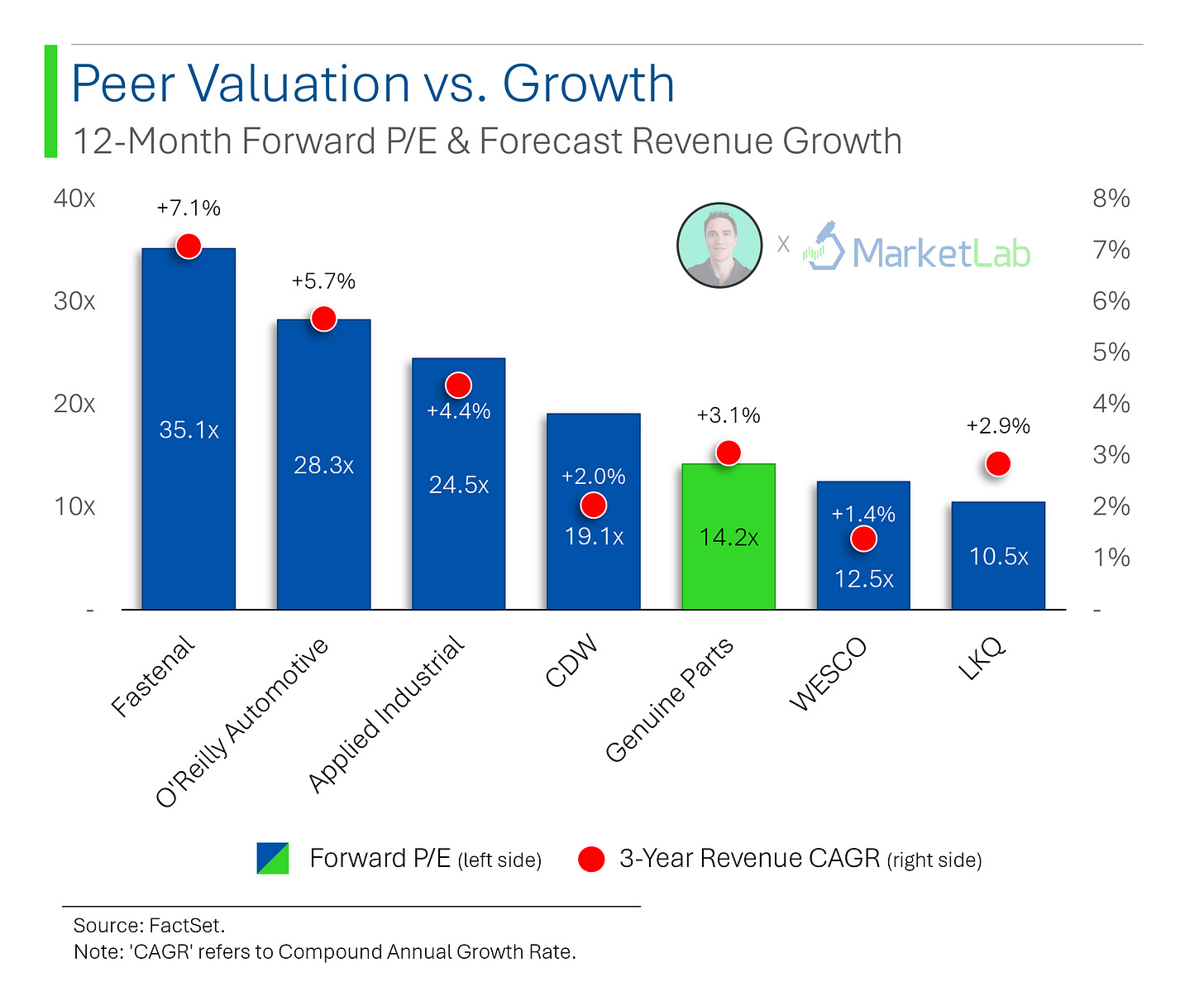

To support the case for relative undervaluation, GPC trades at a significantly lower P/E multiple than its closest peers, such as O'Reilly Automotive (ORLY), despite only a modest difference in expected revenue growth. Analysts project 3.1% annual revenue growth for GPC over the next three years, compared to 5.7% for ORLY, yet GPC trades at roughly half ORLY’s valuation on a P/E basis.