Marex Group PLC (MRX)

Unpacking Marex Group: Growth Opportunities and Key Risks

Investment Highlights

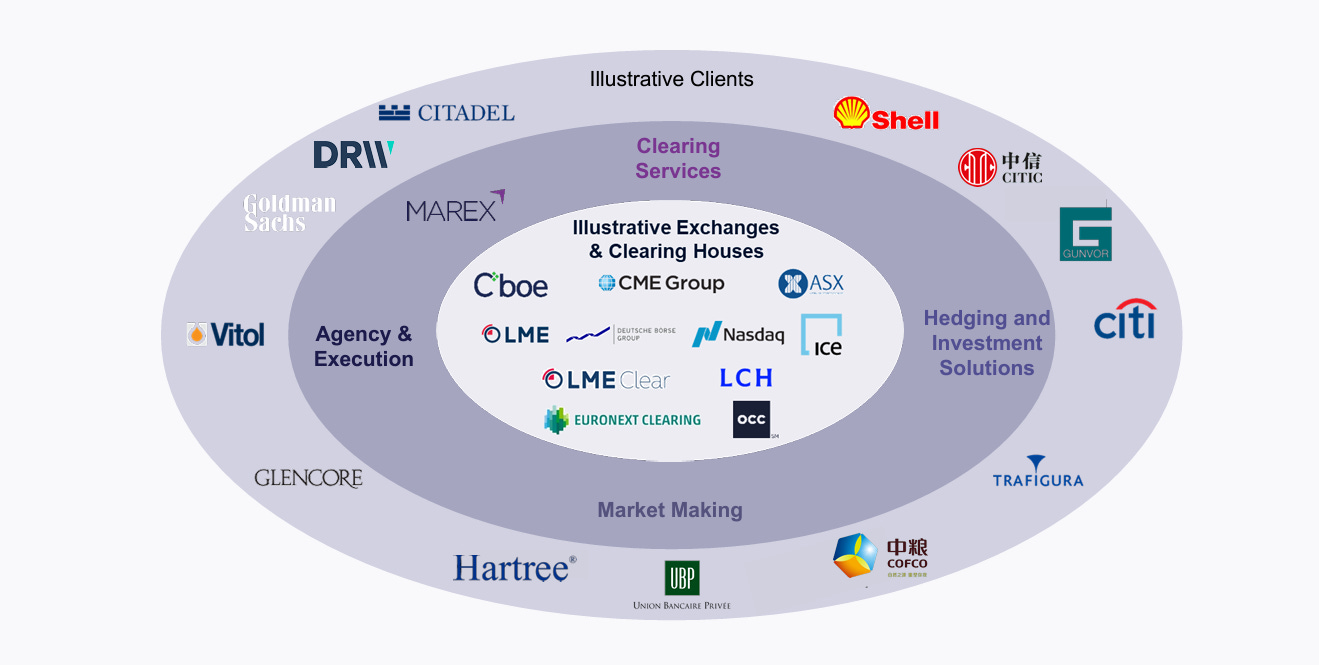

Diversified Financial Services Platform: Marex Group (NASDAQ: MRX) provides global financial market access to over 4,000 institutional clients, with a focus on commodities and financial derivatives.

Successful M&A Strategy: Marex has achieved strong growth through disciplined acquisitions, including ED&F Man and TD Cowen, with a consistent payback period of under three years and operating margins exceeding 20%.

Proprietary Technology: The in-house Neon platform enhances operational efficiency, supporting organic growth with a 16x increase in users since 2019.

Strong Financial Performance: MRX grows revenue at ~20% annually, delivers >10% FCF yield, and reinvests in organic growth, M&A, and shareholder returns.

Valuation Opportunity: Despite its recent run-up, MRX trades at an attractive ~10x NTM earnings for a company with a scalable, high-margin business model.

Marex Group (NASDAQ: MRX), based in London, operates as a global financial services platform connecting institutional clients to over 60 exchanges. It caters to key players in the commodity and financial markets, such as Shell and Glencore, while maintaining a strong foothold in the growing outsourced trading and prime brokerage markets.

I’ve owned strong stocks like Interactive Brokers (IBKR), CBOE, CME Group, and Intercontinental (ICE) in this industry. Marex stands out for its vital role in linking commodity and financial exchanges with institutional clients.

M&A Strategy

Marex’s disciplined M&A strategy has driven about half of its growth. The two more recent and larger acquisitions are:

TD Cowen Prime Brokerage (December 2023): Provides outsourced trading services, an industry projected to reach up to 33% of buy-side trading volumes according to Coalition Greenwich.

ED&F Man (Late 2022): Acquired at a discount to NAV, this Middle East-focused business generated a 25% ROI within the first year (prior to synergies), contributing $284 million in revenue at a 21% margin.

Management targets acquisitions with 20%+ margins upon stabilization and payback periods under three years. Average EBIT multiples remain attractive at <8x.

Acquisition Performance

Marex's M&A strategy has driven growth, increasing revenue per client and employee, though some efficiency dips reflect acquisition integration. Management targets a 20% adjusted operating profit margin and a 3-year payback period for acquisitions, often purchased near or below NAV. Recent acquisitions averaged a 13% first-year margin, ramping to 20%+, with an attractive average EBIT multiple under 8x. M&A will remain a key driver of future growth, contingent on disciplined execution.

Diversified Revenue Streams and Technology Integration

Marex operates four core service lines, including market making, hedging solutions, agency execution, and clearing services. Notably:

Resilient Revenue Model: ~45% of revenue comes from commodity-focused clients with little sensitivity to market price changes.

Market volumes depend on demand from institutional clients who largely must trade regardless of market conditions.

Neon Platform: Marex’s proprietary Neon system boosts efficiency and scales at low cost. It now supports 16,000 clients globally, up from 1,000 in 2019.

Double-Digit Growth: All business lines have delivered double-digit revenue growth, with commodities outpacing financial products.

All four business lines pictured above yield greater than 20% adjusted operating profit combined. The agency and execution service line has the lowest operating margin at 13%. However, it is also the lowest risk offering with limited capital requirements.

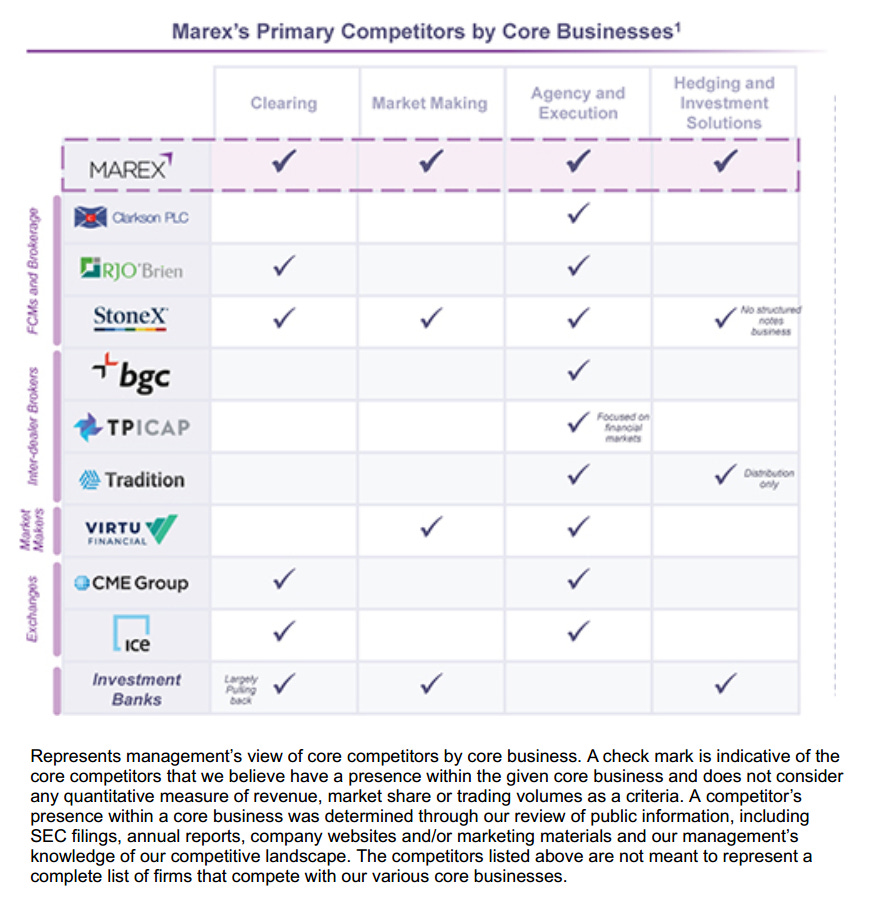

Competition

Marex holds just a 2% share of its large, fragmented addressable market, offering significant growth potential despite competition. It competes with brokers and banks for talent and with major platforms for clients.

Key competitors include:

Clearing: RJ O’Brien, ADM, and large investment banks such as Citigroup, JPM and Societe Generale.

Agency and Execution: Citadel, Koch, JPM, StoneX, Virtu.

Market Making: Citadel, Koch, StoneX, Societe Generale, Virtu

Hedging and Investment Solutions: StoneX, Macquarie, Cargill (in-house commodity producer)

These markets feature high barriers to entry, supporting Marex's growth prospects. Despite competition, Marex has maintained strong organic growth above 20%, recently easing to 17.5%.

Risk Management

Risk management is critical for Marex. While it faces credit and liquidity risks, the client-driven business avoids directional market exposure. Marex has a strong profitability record, with 87% positive days, 96% positive weeks, and 100% positive months. Its daily Value-at-Risk (VaR) averages just $2.3 million, modest for its size.

Marex History

Marex was acquired in 2009 by JRJ Group, founded by Jeremy Isaacs, formerly of Lehman Brothers Europe. Despite his Lehman connection, Isaacs left shortly before its collapse and was credited with building its profitable European arm. JRJ partnered with BXR Group and Trilantic Capital Partners, and the three private equity groups still hold a significant stake.

Insider Ownership

As of June 30, 2024, insiders (executives and directors) owned 7.4% of outstanding shares including 3.6% owned by the CEO. Ian Lowitt has served as CEO since January 2016 and on the Board of Directors since 2012, when he joined as CFO. Lowitt was at Barclays Bank and Lehman prior to this, since 1994.

As of June 30, 2024, insiders owned 7.4% of Marex shares, with CEO Ian Lowitt holding 3.6%. Lowitt, CEO since 2016 and a director since 2012, previously worked at Barclays and Lehman. Following the IPO in April 2024, private equity shareholders collectively owned 62.1%, which declined to 46.9% by September 30 after a secondary offering that did not dilute existing shareholders.

JRJ also features Marex prominently on its website so it may plan to hold a material interest for a longer period of time. Remember these are not insiders except to the extent that some of the PE individuals hold Board seats.

Share Lock-Ups and Secondary Offering

The private equity groups' lock-up expired on October 22, 2024. A secondary offering at $24 per share was announced simultaneously, causing a brief dip in the stock price but was positive overall as it was non-dilutive. These shareholders are likely to sell gradually to maintain market stability.

Executive lock-ups remain in place:

3.6% (2.53M shares) are restricted until April 2025.

CEO Ian Lowitt's 3.5% (2.51M shares) is restricted until April 2026.

I expect management to retain shares beyond these lock-ups, with future executive incentives worth monitoring.

Capital Structure

Marex's capital structure is more complex than non-financial firms, particularly in its Hedging and Investment Solutions segment, where it acts as a counterparty. Traditional debt is minimal and includes some unsecured notes.

The company also has $100 million in Additional Tier 1 (AT1) notes with a 13.25% yield, redeemable in 2028. In Q3, Marex raised $600 million through a 5-year senior unsecured note offering to fund growth, choosing to avoid equity dilution.

Capital Allocation

Marex converts over 100% of net income into free cash flow, enabling reinvestment and shareholder returns. Its key profit metric, Adjusted Operating Profit After Tax Attributable to Common Equity (AOPAT), accounts for AT1 dividends and non-recurring expenses.

Recent performance suggests a 10.7% annualized yield on the current market cap. The company allocates profits to:

Dividends: $0.14 per share quarterly (1.87% yield).

Strategic M&A: Acquiring 3–4 firms annually.

Internal reinvestment for organic growth.

Valuation and Investment Considerations

Until September, Marex traded at about an 8x NTM P/E ratio since its April IPO. This was the best time to acquire shares. However, I believe the stock is still somewhat undervalued at $30 if you consider it for a long-term hold. It traded at $29 as I began to write this article last week.

With 2025 EPS estimates by analysts at $3.01/share, Marex trades at ~10x 2025 AOPAT, a very reasonable valuation for a business growing its topline ~20% annually before M&A.

I believe Marex can surpass those estimates. Lowitt stated on the latest conference call he is very confident in their guidance of $300-305 million AOP, which translates into about $3.02 per diluted share. There is some profit sensitivity to interest rates, but Lowitt believes, at worst case, the accretive M&A will offset this in 2025.

You get a business growing its top line around 20% per year BEFORE acquisitions. This revenue growth also translates into a higher operating margin over time due to synergies from cross-selling and shared services.

I would like to acquire additional shares on a dip below $28, but I also don’t consider $30 overvalued either for the long-term.

Risks

Rate Sensitivity: MRX benefits in part from increases in rates on the spread of its customer balances. Per the last filing, a 100bps decrease in rates will reduce operating profit by about $20 million before any management actions. The firm sees some rate cuts ahead and models/plans for that sensitivity.

Investor Discipline: The stock (like many lately) has run up 50% in the last couple of months albeit from quite a low multiple. If you invest, be sure to understand the potential price volatility in today’s markets. Holding a stock long-term requires strong emotional discipline and conviction in the company/management.

Client and Counterparty Risks: Although Marex has limited price risk exposure, it faces credit and liquidity risks due to its reliance on client relationships and counterparties. Economic downturns or disruptions in its client base could negatively impact its financial health.

Integration and Execution Risks with M&A: Marex's growth strategy relies heavily on acquisitions. While it has executed well in integrating acquisitions so far, there is always the risk that future acquisitions may not meet performance expectations or disrupt the business in the short term.

Execution Risk in Expanding Shareholder Base: While private equity shareholders, including JRJ Group, have been mindful of maintaining a stable share price, there remains a risk that large shareholder sales or dilutive secondary offerings could lead to stock price volatility. Although the recent lock-up expiration hasn't caused significant issues, further disposals by insiders could impact stock performance.

Regulatory and Operational Risks: As a financial services firm, Marex is subject to regulatory changes across its various markets. Changes in regulations, particularly in its key markets for clearing, hedging, and market making, could pose operational challenges or increase compliance costs.

Thanks for being part of the Safe Harbor community! Follow me for more insights: LinkedIn | X (formerly Twitter)

Disclosure: This information is provided for informational purposes only and should not be considered a solicitation or recommendation to buy or sell any securities. The author or entity providing this information may hold positions in the securities discussed. This is not investment advice.

Interesting idea. What’s a fair PE multiple in this industry? Are there any good publicly traded competitors to compare margins / multiples too?

Seems like a high-quality, well-entrenched company with good growth prospects. Which to me begs the question, why did they IPO it for roughly 10x earnings?