North American Construction Group: Building Value, One Ton at a Time

How North American Construction Group is building its future on strong fundamentals.

Investment Highlights

Strong Financial Growth: Revenue has grown at a 15.5% CAGR from 2019-2023, with guidance of $1.5 billion in 2025.

Strategic Diversification: The acquisition of MacKellar Group expanded NOA’s geographic footprint to Australia, diversified revenue across over 30 resource types, and improved year-round fleet utilization.

Compelling Valuation: NOA trades at a 7.2x NTM P/E, below peers, with potential for 32% upside from multiple expansion alone to a 9.5x P/E.

Operational Excellence: Consistent ROIC growth (12.5% in 2023) and in-house equipment maintenance save 30-50% on costs, enhancing margins and competitiveness.

Shareholder Alignment: Insider ownership of 11.4%, a disciplined capital allocation strategy, and minimal share dilution despite significant acquisitions.

Robust Backlog: $3.6 billion backlog provides ~2.4x annual revenue coverage, offering strong visibility into future earnings.

Introduction

North American Construction Group Ltd. (NOA) stands out as a leading provider of heavy equipment and mining services. With roots dating back to 1953, the company has developed a robust operational footprint across Canada, Australia, and the U.S., while leveraging expertise in heavy earthworks, mining services, and civil construction. This article evaluates NOA's competitive positioning, growth opportunities, risks, and financial outlook to assess its suitability for investment.

1. Company Overview

NOA specializes in providing equipment and services for resource development projects, particularly in the oil sands and mining industries. The company’s services range from equipment rental and earthworks to project management and civil construction. NOA’s operations are geographically diversified, with strongholds in Canada and growing market share in Australia due to the transformational acquisition of MacKellar Group.

NOTE: All figures below are CAD unless noted otherwise.

2. Industry and Competition

The mining and civil construction industry is defined by substantial capital intensity, exposure to cyclical demand, and stringent safety requirements, creating both opportunities and challenges for market participants.

Capital Intensity:

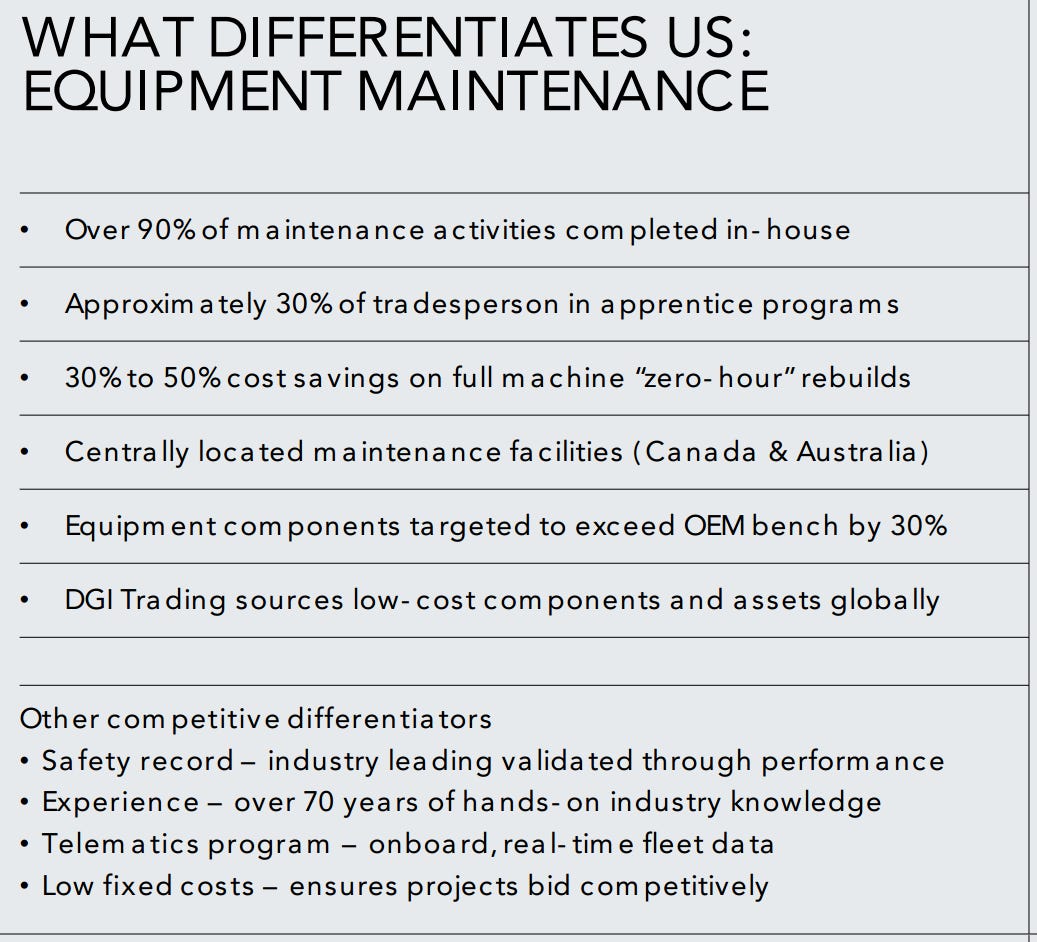

Fleet acquisition and maintenance represent significant barriers to entry. NOA’s fleet replacement cost of $3.5 billion underscores the capital required to compete effectively.

NOA’s in-house maintenance operations, handling 90% of repairs internally, provide a cost advantage, saving 30-50% compared to OEMs. This efficiency supports competitive bidding and long-term profitability.

Cyclicality:

Commodity price volatility and macroeconomic conditions heavily influence project demand. During downturns, delayed projects and reduced production volumes can compress revenues. Conversely, growth periods provide opportunities for well-capitalized operators like NOA to scale operations and secure contracts.

Geographic and commodity diversification, such as NOA’s entry into Australia, mitigate some of the cyclicality risks.

Safety Requirements:

Mining and construction operations involve harsh environmental conditions that demand rigorous safety protocols. NOA’s safety-first culture is validated by its strong performance record, making it a trusted contractor for blue-chip clients.

Compliance with stringent regulations, particularly in environmentally sensitive areas, differentiates well-established players like NOA from smaller, less-experienced competitors.

Core Competitors

NOA faces competition from Canadian, Australian and international players.

Notable competitors in Canada include:

Aecon Group Inc. (TSX: ARE): A leading construction and infrastructure company with a diversified portfolio spanning mining and energy projects.

Bird Construction Inc. (TSX: BDT): Focuses on civil construction and large-scale infrastructure, directly competing in mining-related projects.

CES Energy Solutions Corp. (TSX: CEU): Provides oilfield and energy solutions, overlapping with NOA’s energy-related services.

Wajax Corporation (TSX: WJX): Specializes in industrial equipment distribution and construction solutions across Canada. Also, a supplier to NOA.

Notable competitors in Australia include:

BUMA Australia (Delta Dunia Indonesia): A significant provider of mining services, particularly in Queensland and Western Australia. Competes directly with MacKellar in large-scale mining contracts.

Mader Group (ASX: MAD): Specializes in contract labor and maintenance services for heavy equipment, directly competing with MacKellar in equipment maintenance and support.

Alfabs (ASX: ALL): Diversified into equipment hire, engineering services, and manufacturing, serving similar industries as MacKellar. Its broad service portfolio overlaps with MacKellar’s operations.

Western Plant Hire: Previously acquired by MacKellar, this entity has a regional presence that complements MacKellar’s core business while also competing on specific scopes.

Global Positioning

NOA’s acquisition of MacKellar Group has expanded its competitive footprint into Australia, a resource-rich and mining-friendly region. This move diversifies its geographic exposure and reduces reliance on the Canadian oil sands. Key strategic advantages include:

Geographic Reach: Operations now span Alberta, Queensland, and Western Australia, providing access to high-value mining projects in stable jurisdictions.

Commodity Diversification: Exposure to metallurgical coal, thermal coal, gold, and iron ore complements the company’s core oil sands operations, balancing its revenue streams.

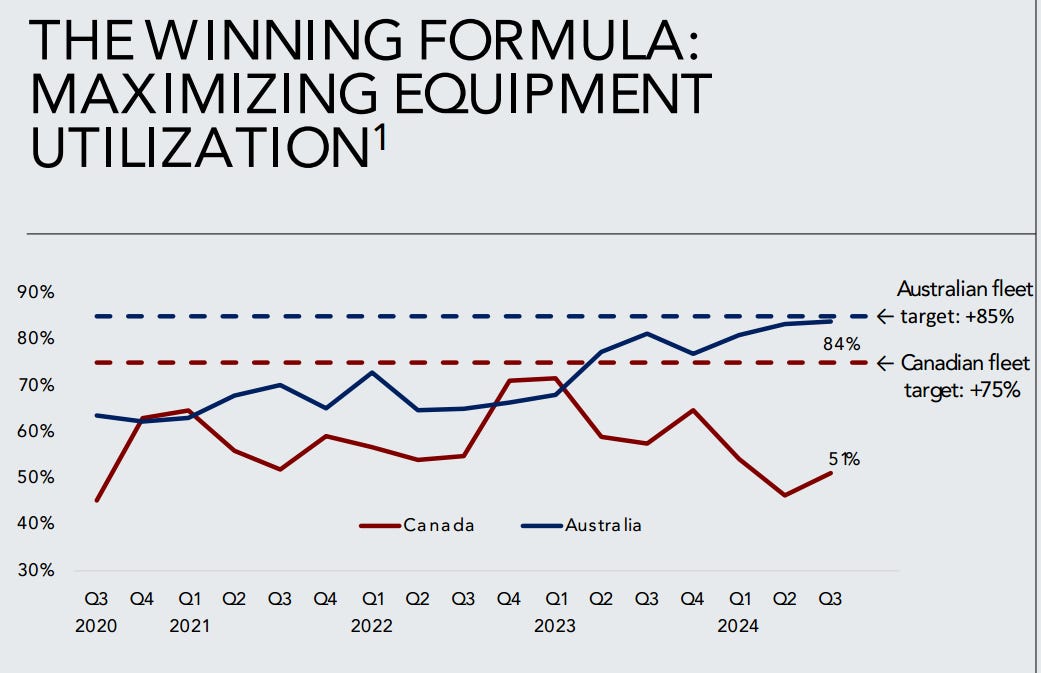

Year-Round Operations: MacKellar’s steady activity throughout the year enhances fleet utilization, with Australian operations targeting an 85% utilization rate compared to 75% in Canada.

NOA's Canadian equipment utilization has fallen below the 75% target, primarily due to project completions, seasonal delays, shifting work scopes, and growing haul distances, with mitigation efforts focused on telematics, diversification, and strategic maintenance.

3. Competitive Advantages

Indigenous Partnerships:

NOA’s long-standing relationships with Indigenous partners in Canada enable it to secure contracts that mandate such collaborations. These partnerships also contribute to local employment and economic development. Mikisew and Nuna are the two most significant partnerships for the company, and the company owns a 49% interest in each of those JVs.

In-House Equipment Maintenance:

Over 90% of maintenance is completed in-house, delivering 30-50% cost savings compared to Original Equipment Manufacturer (OEM) rebuilds.

The company leverages telematics for real-time monitoring of over 375 units, improving uptime and lowering repair costs.

Barriers to Entry:

Fleet Acquisition: NOA’s fleet replacement cost exceeds $3.5 billion, deterring smaller competitors from scaling up.

Significant number of trucks larger than 240 tons in capacity providing a distinct advantage relating to a specialized skill base and equipment availability.

Operational Expertise: Decades of experience in harsh environments (e.g., Canadian oil sands) reinforce its reputation as a reliable contractor.

4. Management Profile

Insider Ownership:

NOA’s management demonstrates alignment with shareholders through significant insider ownership (11.4% of shares).