Portfolio-Level Metrics

Understand The Portfolio of Businesses You Own

Investors often discuss stock metrics like P/E ratios and EV/EBITDA, but rarely do we evaluate the metrics of our entire portfolio. Today, I’ll share insights into my own portfolio metrics, why they matter, and how I target specific levels.

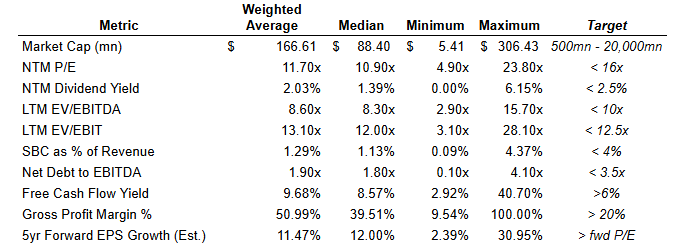

Whether you own individual stocks or ETFs, your portfolio represents an amalgamation of businesses. Understanding what you own—beyond industry exposure or stock concentration—is critical. Below is a table of key portfolio metrics I track, along with flexible targets:

Key Considerations

1. Accurate Data

Data is abundant, but accuracy isn’t guaranteed. My last article (linked below) highlights nuances from data providers like Koyfin, where metrics like free cash flow yield can be misreported. Always verify underlying numbers.

2. Qualitative Factors Complement Metrics

Numbers simplify analysis but don’t capture risks like competition, management quality, or regulatory threats. Always pair metrics with a qualitative assessment of a company’s strengths and vulnerabilities.

3. Weighted Average vs Median

I compare weighted averages with medians to avoid skewed results from large-cap allocations. For example, while my portfolio’s weighted average market cap is $166B, the median is $88B. This reveals a balance between large and mid-cap stocks.

The median reflects the very middle value of the businesses you own. I have some larger allocation to a few larger cap stocks, but half of my portfolio is invested in stocks with a market cap less than $88 billion. And the lowest is only $306 million.

Portfolio Metrics: Breakdown

Now let’s get into the meat of the discussion. These are in no particular order.

Market Cap

I focus on companies with market caps between $500M and $20B, large enough to offer both competitive advantages and small enough for great compounding growth. This has been my sweet spot over the years.

P/E Ratio (NTM)

I prefer forward P/E ratios under 16x but occasionally accept higher multiples for growth scenarios. Forward estimates come with bias, so I blend analyst consensus with management guidance to build a more accurate forecast.

Dividend Yield (NTM)

For growth-oriented stocks, I target dividend yields below 2.5%, ensuring enough retained earnings for reinvestment. Share buybacks are preferable when the stock isn’t overvalued.

This metric can vary by investor due to personal objectives and the stage of life you’re in. At 45, I prefer lower or no dividends but an older retired investor seeking current income may prefer a higher yield.

EV/EBITDA and EV/EBIT (LTM)

I aim for EV/EBITDA multiples below 9-10x, balancing value and risk. An exceptionally low multiple often signals underlying risks requiring deeper analysis - or simply inaccurate underlying data.

The EBITDA multiple is the one most often used as depreciation can vary by industry and stock using EBIT. EBITDA is the multiple at which you invest before accounting for any debt-financing costs.

Stock-Based Compensation (% of Revenue)

SBC is strictly a claim on equity, and not an income statement expense or deduction from cash flows. It is important to evaluate it in the denominator (share count) rather than the numerator (re: EPS or FCF per share). You can read the article below for a deeper understanding.

The highest SBC in my portfolio is 4.4% of revenue, with companies like WIZEY, PYPL, and SSNC falling in the 3.3%-4.4% range. I avoid higher levels, as excessive share dilution makes modeling growth and risk more challenging.

While some high-SBC companies have succeeded—like Meta and Tesla, which now have manageable levels—it was significantly higher in their earlier years. For every success story, many high-SBC companies have eroded shareholder value over time, particularly among smaller, fast-growing firms.

Below you can see the SBC for a few of the Mega Cap stocks over the last 20 years.

Net Debt to EBITDA

I target net debt/EBITDA below 3.0x to ensure sufficient margin of safety. Higher multiples are acceptable for turnaround plays with clear deleveraging plans and margin expansion.

Free Cash Flow Yield

Free cash flow yield is one of the most critical metrics, and I also consider FCF per share growth as part of this analysis. It reflects:

Margin of safety

Reinvestment potential

Shareholder return potential through buybacks and dividends

I target a levered FCF yield of at least 6-7% (on market cap). FCF can often be misreported or misinterpreted due to its nuanced nature, but the median and weighted average values in my table provide a reasonable estimate.

Understanding the distinction between growth capex and maintenance capex is essential for accurately evaluating free cash flow.

Gross Profit Margin %

I favor companies with at least a 20% gross margin, indicating pricing power and competitive advantages. Exceptions exist (e.g., CostCo), but low-margin businesses require careful scrutiny.

JD and Amentum (AMTM, recent spinoff) are the only sub 20% values currently in my portfolio.

5-Year Forward EPS Growth

While long-term EPS growth estimates are inherently imprecise, I look for expected growth to exceed the forward P/E ratio, effectively creating a PEG ratio. However, I approach broadly disseminated PEG ratios with caution, as they often lack context without a deeper understanding of the underlying numbers.

Analyst projections can be useful for gauging sentiment, but I place more weight on companies' 3- to 5-year strategic plans, particularly when backed by strong management with a track record of execution.

Currently, about one-third of my portfolio lacks reported 5-year growth estimates, based on Koyfin data sourced from S&P Capital IQ.

Fundamental Data Resources

For fundamental-focused investors, I recommend two data providers. While I’ve used others, these two stand out for their practicality. Note that they may not be ideal for technical investors or traders.

Koyfin: This is a referral link that gives you a 10% discount and provides me with a $20 credit. Koyfin offers accurate, well-organized fundamental data, including easy access to filings and transcripts. It also excels in portfolio tracking and macro-level insights, such as global yield curves and factor analysis.

FinChat: I use a free FinChat account, which offers a solid selection of data, including filings, news, transcripts, and advanced charting. While it excels in accessibility and visualization, it lacks some of the deeper portfolio tracking and macro-level features that Koyfin provides, such as global yield curves and factor analysis.

If you’re using Koyfin, I’d be happy to share how I track my portfolio metrics. I’m also curious to hear about other tools you might use. Koyfin integrates with Schwab brokerage accounts, but I haven’t tested this feature yet. Alternatively, you can use the portfolio targets I’ve included in this article as a guide.

Thanks for being part of the Safe Harbor Stocks community! Follow me for more insights: LinkedIn | X (formerly Twitter)

Disclosure: This information is provided for informational purposes only and should not be considered a solicitation or recommendation to buy or sell any securities. The author or entity providing this information may hold positions in the securities discussed. This is not investment advice.