The Trade That Went Wrong: What No One Wants to Admit

Skeletons in the Closet: Enter at Your Own Risk

Few investors talk about their losing trades. But losses are a part of the game, and today, I’m sharing one of mine—an investment that seemed undervalued but kept falling. Here’s what happened, what I’ve learned, and what comes next.

I knew I would need to eventually write this article, but I didn’t know the name of the company at the time. Bear with me below as I set the stage, disclose the company, share my experience, and offer my insights.

Value Over Hindsight

Before I begin, let me briefly tell you some responses you may hear to an article such as this. I share these conceived quotes with to remind you to seek actual value rather than dismiss the loss as glaringly obvious - it never is.

“I always thought the company was uninvestable or overvalued.”

“This is exactly why I never touch medtech stocks—too much regulatory risk and margin pressure.”

“Catching falling knives rarely works out. Just look at how this has played out.”

“Hospitals are getting squeezed, and medical device companies are feeling the pain. Not surprised this one has struggled.”

“Another classic example of a value trap—cheap for a reason.”

“At what point do you admit it’s just a bad investment and move on?”

The fact is that hindsight is 20/20 and everyone experiences losing trades. I enjoy going out on a limb here because this type of article is rarely written. I encourage you to process this post thoughtfully and practically for yourself. I’m here to share my investment journey with you - the good and the bad.

Anyone can ascribe a specific reason to said loss after-the-fact, which is not my purpose. We’re here to learn together and apply lessons to our future investing.

Investor Profiles: Which One Are You?

There are three common reactions to a losing trade. Which mindset are you bringing to the table?

1. The Emotional Investor

“I refuse to admit I was wrong.”

Some refuse to reassess, doubling down blindly (“It’s not a loss unless I sell”), while others sell and become bitter (“Glad I got out.”).

Then there’s the Momentum Chaser, who dismisses the stock outright:

“Why bother with this when you could buy [hot stock]?”

These reactions aren’t analysis—they’re just emotion in disguise.

2. The Hindsight Expert

“This was obviously a mistake—should’ve seen it coming.”

They always saw the risks—but only after the stock dropped. Their wisdom comes in broad, empty hindsight:

“Medtech is dead.”

“This stock was always a value trap.”

“This is why I just buy the S&P 500.”

But narratives shift with stock prices. At $180, it was "undervalued." Now at $136, it’s "uninvestable." Which one was true?

3. The Thoughtful Contrarian

“I see the risks, but I also see the opportunity.”

The rare but valuable investor who looks past the price drop and asks:

Was this bad timing or a fundamental mistake?

Has the thesis changed, or is the market overreacting?

They separate ego from analysis, recognizing that losses can teach us just as much as wins.

Which Investor Are You?

Every investor falls into one of these categories at times. The key is recognizing when emotion clouds judgment (thanks to

for this post). As we dive into the challenges of our specific company below, ask yourself—which mindset are you bringing to the table?I’ve tried to dissuade you from influence of the Hindsight Expert. It’s important to acknowledge the very fine line between being an Emotional Investor and a Thoughtful Contrarian. I won’t sugar coat this: sometimes you just never know.

I write the above to preempt any reactions you may encounter elsewhere that would conflate the purpose of this article, which is to provide value to you on the losing side of investing without any excuse or defense. I hope you look at this without the effect of someone explaining it away as obvious and irrelevant. No losing trade is ever obvious, especially because human action (e.g., emotion) drives markets.

Skeleton in the Closet

Thanks for your patience - if you read this far. Without further ado, I want to introduce you to Teleflex (TFX), a company that provides single-use medical devices in critical care and surgical applications worldwide.

This is not a dive into TFX. The company has been on my list for a write-up, but I had not gotten around to formalizing my research yet for an article. This article will only discuss the company to the extent it’s useful as a case study for readers.

The Biases of Investing Newsletters

Most newsletters avoid sharing losing trades. Some buffer bad investments with positive spin, while others simply omit them altogether.

The easiest “loss” to share? Selling too early. The hardest? A real capital loss.

Why? Reputation matters. Investors favor transparency—until it makes them uncomfortable. But real investing isn’t just about wins. It’s about learning from mistakes.

I won’t pretend to be free of bias, but I will always aim to share my full investing journey—the good and the bad.

Background

Teleflex experienced an elevated multiple in the late 2010s as it accelerated revenue growth - approaching 20% YoY. Then, beginning in 2021 the share price began a significant decline from a PE ratio near 40x (~$449 per share at its all-time high) dropping nearly 50% through 2022 from its peak.

The correction was attributed to a few factors:

Multiple compression in 2021 due to pauses in elective surgeries and supply chain disruptions associated with the pandemic, which also affected other medtech companies.

Cost inflation and customer staffing shortages in 2022.

Lower guidance in summer 2022 due to UroLift weakness.

Some of the operational challenges noted above were industry wide. Teleflex also experienced some product recalls. Recalls are not uncommon in this industry, but the company had a bit more than usual during the 2022-2023 timeframe.

Historically, TFX has traded between 10-40x as a forward PE multiple since transitioning to a pure-play medical device company in 2007. It’s quite a range below, and you can see now it trades at an all-time low multiple.

My Entry

Teleflex showed on my active radar in November 2024 after the company reported earnings on 10/31/2024. TFX shares dropped 16% the next day and continued to decline further throughout Q4 2024. In December 2024, TFX traded around $180 when I opened my position in the company.

Management reduced its revenue forecast to 3.1% from 3.9% citing disruptions of supplies from the hurricane in North Carolina, doctor shortages in South Korea, and softness in OEM markets.

At this point, the company was trading at a forward PE of 12.1x, which was more than one standard deviation below its entire historical PE going back to the 1990s. It only traded lower during the GFC. The company’s margins remained stable and exhibited sufficient FCF to continue acquisitions and share repurchases.

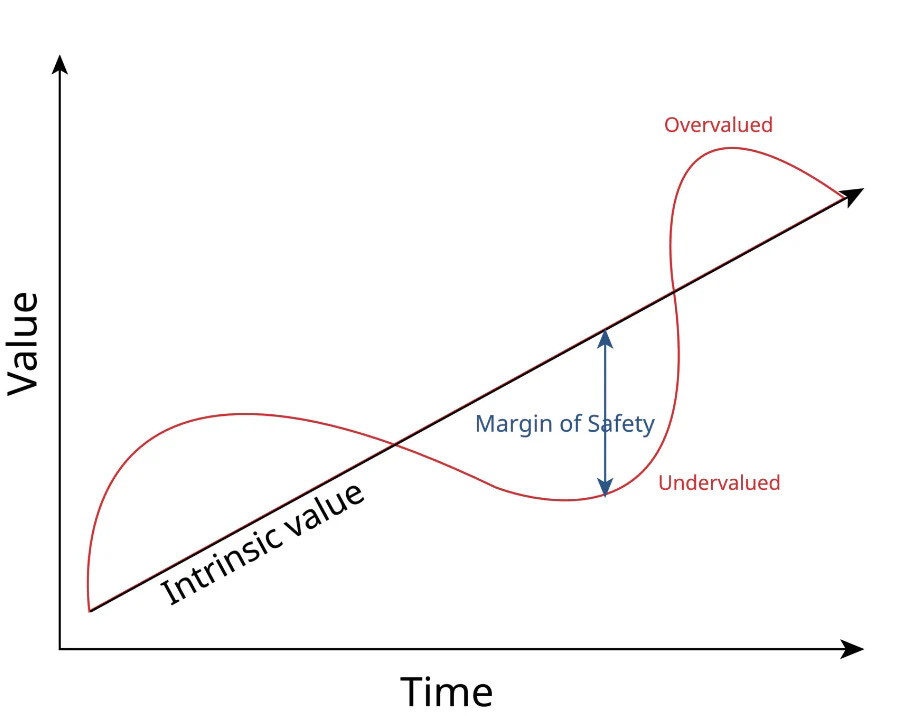

Margin of Safety

I’ve mentioned the term Margin of Safety across various articles in this newsletter. With Teleflex, I entered my position around $180 because I felt there was a healthy margin of safety based on its current valuation (12x), margin profile (60% GM, 27% operating margin) and nature of its products.

A good lesson here is to remember that Margin of Safety does not equal No Losses. In fact, Seth Klarman often explained how a contrarian must often hold a position for a period of time at a loss before seeing a profit.

I was aware of this risk, but it is worth reiterating for you. The purpose of a margin of safety is to mitigate downside risk, not eliminate it. Seth Klarman’s book of the same title is a great read on this.

Catching a Falling Knife

I was aware of the risks with this company like any other. Let’s take a moment to discuss them now.

First, management has had some history of being slow to update its guidance. Back in 2022, analysts called out the CEO for remaining too optimistic on UroLift sales growth recovering post-pandemic. A quarter later, management reduced its guidance due to UroLift sales.

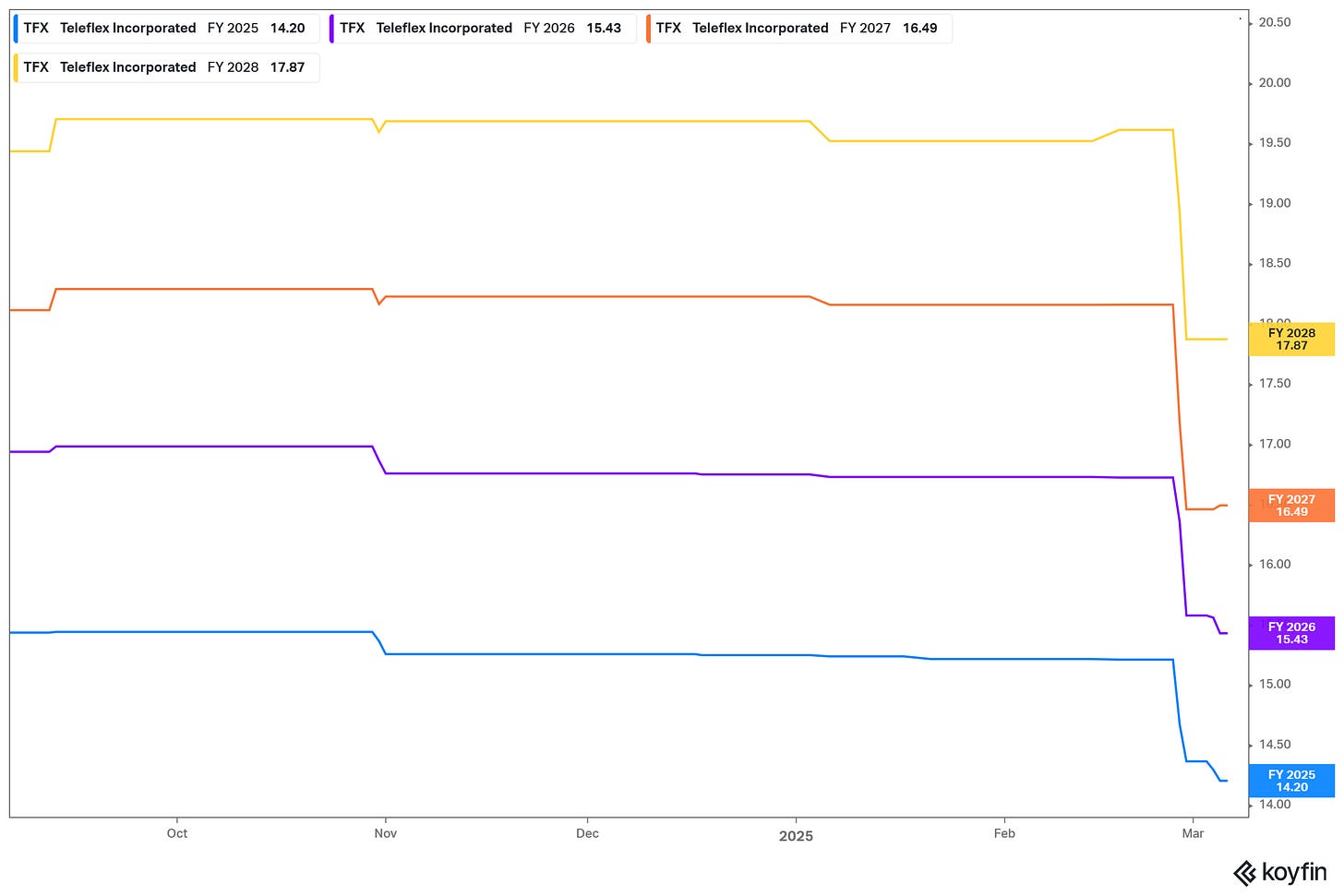

Second, analysts have also been slow to update their own estimates as a consensus. Despite the company lowering revenue guidance for 2024, analyst EPS estimates remained steady as you can see below - until about one week ago after it issued lower 2025 guidance for EPS.

Third, the company has arguably overpaid for some of its acquisitions although it has shown success in executing those integrations.

Fourth, the company tends to announce restructuring plans every year or two. This frequency may prompt us to consider these charges as regular expenses, some of which perhaps should not be adjusted for in EPS.

My Response to the Latest Earnings

Teleflex reported FY 2024 earnings on 2/27/2025 which included initial guidance for FY 2025. Guidance on EPS came in at a midpoint of $14.15, about 7.5% lower than the analyst consensus driven by modest sales growth and EPS growth.

The company also announced a plan to spin-off its lower growth segments including interventional urology. The spin-off will not close until mid-2026. This could be a positive for shares by unlocking value however it would take time to realize.

From my perspective, there was nothing that warranted an additional 26% drop in the stock post-earnings down into the $130s. After earnings, the market appeared to have really over-reacted to the downside despite:

Forward PE (on new guidance) now around 9.5x, which is an all-time low going back to the 1980s.

Tailwinds of accretive and growing acquisitions which it has yet to lap in 2025/2026.

Organic sales likely to be troughing.

Given the above, I decided to average down on my TFX shares in the 130s and 140s. Management has a 100% track record of beating analyst estimates for at least 40 consecutive quarters.

Moreover, I built up a 7% position in TFX pre-earnings and gave myself room to add more in a situation like this. Teleflex is now a 12% position, and I own it at a cost basis of $155 per share. My cost basis remains below the historical all-time low for the last 25+ years.

The company has also issued an accelerated share repurchase plan to buy back approximately 4.5% of outstanding shares at today’s valuation. The shares now trade at a FCF yield of ~8%.

Looking Forward: Lessons Learned

It remains to be seen whether TFX shares will bounce back soon (or at all). In the end, as investors we work with incomplete information and imperfect markets. I believe this company simply got cheaper rather than weaker, although the price could languish here still.

I will share my thoughts now on my experience.

More Patience

I could have exhibited more patience in accumulating shares pre-earnings. After reviewing my accumulation, I believe I partly let the already large drawdown influence my eagerness to accumulate TFX sooner rather than later.

As I’ve written before, I try to evaluate my investments on the fundamentals first as best I can but it’s difficult to fully remove historical price. There is something to be said here relating to FOMO. When a stock sells off hard, there is a temptation to get in before it rebounds. Recent years abound with this type of price action exhibiting quick and strong reversals.

Options First

Part of my strategy is to employ cash secured put options to build exposure in stocks with more volatility. I can earn premium income while waiting for an even better entry point. I would have preferred to employ this strategy with TFX but its options didn’t provide enough necessary liquidity.

I went ahead and purchased the shares outright instead. Read more below on my put option strategy.

Time and Concentration

It takes time to invest in a portfolio of individual stocks. It requires much more time than allocating to a few stock ETFs. I currently hold a portfolio of 27 companies, and I am working to prune this down to under 20. I did hold 36 companies at the beginning of 2025.

At a certain number of holdings, for example over 50, simply allocating to an ETF begins to make more sense as you are approaching a Beta of 1 with a more diversified portfolio. In my case, I am concentrating my portfolio, and it requires more focus, research and time.

I failed here in the sense that I had the opportunity to trim my position in TFX going into earnings but didn’t. I was waiting first to see how the stock performed as it approached the earnings release. The stock had closed near my original cost basis of $180 and I honestly lost track of it for a couple of reasons:

Earnings season is compressed into a few short weeks predominantly. I was also reviewing several other releases.

My wife was out of town, and I was watching our kids and dog during this time.

Again, these are not excuses but aspects of my investing in which I can rethink and address differently going forward. I could have thought ahead and proactively reviewed my TFX position before my wife’s trip and the bulk of earnings season.

I still would have been holding a bag with TFX shares post-earnings. I would not have sold all the stock and may not have sold any. Nonetheless, I didn’t have the opportunity to review the position going into earnings.

Consequently, I also neglected to give stronger consideration to the accuracy (or lack thereof) regarding forward 2025 analyst estimates. I discussed cases of poor forward analyst coverage with Marex and Amentum, and the same happened here - just on the flip side.

All the above are good reasons why I am working to concentrate my holdings to about 12-15 companies. Earnings season is otherwise unwieldy.

Emotional or Contrarian

The last, but not least, point I want to make carries us back to that fine line of investing. Am I being an Emotional or Contrarian Investor with Teleflex?

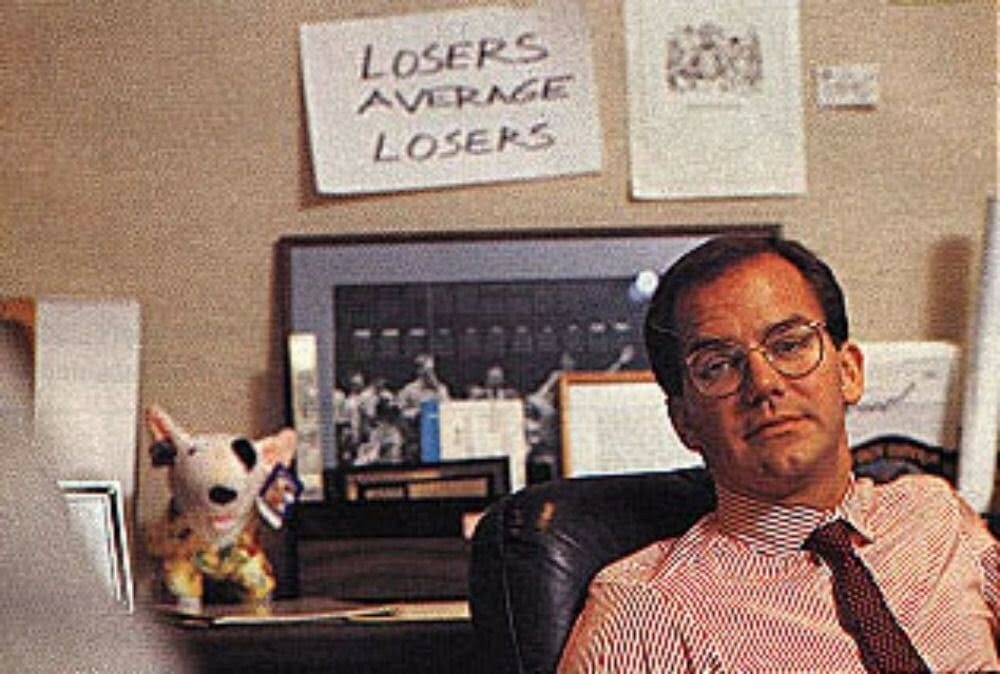

I shared the photo above of Paul Tudor Jones because long-term investors can easily fit the mantra: “Losers average losers". PTJ was a shorter-term momentum trader in the 1980s but the meaning holds for long-term investors too.

Honestly, I don’t believe we can ever truly know whether we’re acting as the contrarian or the emotional investor at any given time, or with any given stock. In fact, often we are likely acting a bit of both simultaneously.

The more important takeaway is that we must remain aware and cognizant of this dynamic day by day. Emotional discipline is crucial for investors. And, as I like to say, this discipline is a journey without a destination - meaning we must practice this each and every day. It’s Groundhog Day for investors.

I don’t know if TFX will rebound in the next few months, but I do know this—its valuation is at historic lows, management is aggressively buying back shares, and the company is still generating strong free cash flow. That’s enough for me to stay patient and see this through. Time will tell whether I’m the contrarian or the fool.

That’s all for now. Stay tuned for updates on my Teleflex position when I publish my weekly or monthly recaps.

Thanks for being part of the Safe Harbor community! Follow me for more insights: LinkedIn | X (formerly Twitter) | Instagram | YouTube

Disclosure: This information is provided for informational purposes only and should not be considered a solicitation or recommendation to buy or sell any securities. The author or entity providing this information may hold positions in the securities discussed. This is not investment advice.

Thanks for posting! Not many investors have the guts to share their losses

It's better to be the "non-emotional" investor :P