Unlocking True Free Cash Flow: Wesco as a Case Study

How Adjusted and Normalized FCF Reveal Operational Strength

I will publish a general write-up on Wesco International ($WCC) soon. Today, however, we’ll discuss Wesco specifically in the context of its free cash flow (FCF).

This article serves two purposes:

Provides an educational framework for understanding the nuances of free cash flow (FCF) and why adjustments are critical for accurately assessing a company’s cash-generating ability.

Applies these principles through a case study of Wesco International ($WCC), demonstrating how a real-world company’s cash flow dynamics can be clarified and better understood using these techniques.

Free cash flow (FCF) is the lifeblood of any business, but interpreting it correctly requires a deeper understanding of the adjustments needed to account for growth-related volatility. Wesco International ($WCC) offers a fascinating case study for exploring these nuances.

Free cash flow is an interesting metric for WCC, as the company navigates the aftermath of its transformative 2020 acquisition of Anixter. However, traditional reported FCF metrics can sometimes obscure the underlying operational performance due to the impact of working capital volatility. By adjusting Cash Flow from Operations (CFO) through “Change in Net Operating Assets” (CNOA), we will uncover a clearer picture of Wesco’s cash-generating ability.

Why Adjust CFO for "Change in Net Operating Assets"?

CNOA encompasses fluctuations in working capital—such as changes in accounts receivable, inventory, and accounts payable—which can heavily influence reported CFO. These fluctuations often reflect temporary or strategic adjustments rather than sustainable operational performance.

Below is the operating section of Wesco’s FY 2021 cash flow statement to help visualize what we’re discussing. I denoted within the red box the CNOA section to be adjusted.

For Wesco, the years 2020 through 2022 were marked by three important events:

Anixter Integration: A significant acquisition that expanded Wesco’s scale and market reach but introduced complexity in evaluating working capital management and investment.

Supply Chain Challenges: The pandemic-driven disruptions and inflationary pressures led to deliberate inventory buildup to ensure continuity of operations.

Data Center Growth: Wesco provides to the data center industry and demand has been growing at arguably unsustainable rates.

These factors caused larger than usual swings in working capital, inflating or deflating CFO without necessarily reflecting core business performance. Adjusting for CNOA removes this noise, offering a cleaner view of operational cash flow.

To illustrate, below is a chart of Wesco’s FCF yield as a percentage of market cap. The reported FCF yield (magenta bars) doesn’t tell the real story about what happened with normalized cash flow, but the adjusted FCF (blue bars) gets pretty close by crudely reversing the entire CNOA. Yields below represent FCF as a % of market cap.

The Adjusted CFO Approach: A Sharper Lens

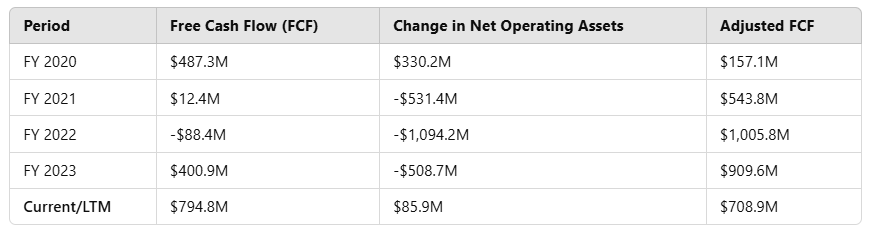

Using a custom financial template in Koyfin, we adjusted Wesco’s CFO to exclude CNOA and exported to Excel. Here’s what we found:

Disclosure: I am now an affiliate partner of Koyfin. I receive fees if you sign up to Koyfin for a paid subscription using the link above. No obligation to use that link, however, using that link gives you a 20% discount on your subscription.

Context for Changes in Adjusted FCF (table above):

2020: Lots of noise due to Covid and the closing of the Anixter acquisition. Inventory was reduced by $203.8M (increasing reported FCF) likely due to Covid disruptions as sales continued. Reversing CNOA makes FCF look a bit light but arguably more realistic.

2021: Higher sales drove significant growth in accounts receivable and inventories (+$531.8M and +$530.7M, respectively), and accounts payable higher (-$449.6M). This depressed reported FCF. Adjusted FCF surged to $543.8M after removing CNOA, showcasing operational cash flow strength not evident in reported numbers.

2022: Reported FCF was negative $88.4M. Adjusted FCF actually rose to $1.0B, driven by record sales after adjusting for one-time investments in working capital to support growth. Wesco also accumulated additional inventory during this period reacting to supply chain issues.

2023: Adjusted FCF began to normalize at $909.6M, with inventories declining (-$68.4M) and accounts payable decreasing (-$319.7M), from timing of large accounts payable paid down. Sales growth moderated and required less incremental NWC investment.

Current/LTM (9/30/2024): Adjusted FCF declined to $708.9M, reflecting reduced working capital demands as growth moderates and operations stabilize. Organic sales growth is flat, and management is making progress in optimizing net working capital.

That’s a lot to digest but simply focus on the bigger picture here - the potential for misinterpreting reported figures. It appears WCC had major cash flow issues based on the magenta bars, but it simply had to adjust its investment in NWC in those years in response to a large acquisition, surging data center demand and some supply chain issues.

Adjusting FCF for CNOA highlights Wesco’s operational cash flow strength despite recent working capital volatility. In the next section, normalizing FCF takes this a step further by accounting for the steady-state requirements of Net Working Capital (NWC) over time.

Using NWC Intensity to Estimate Normalized FCF

Net Working Capital (NWC) intensity—expressed as a percentage of revenue—offers a practical way to assess normalized FCF by estimating the cash tied up in working capital over time. This approach captures the steady-state requirements for supporting revenue, cutting through the noise of one-time or growth-driven cash flow fluctuations.

Breaking Down the Drivers of NWC Intensity

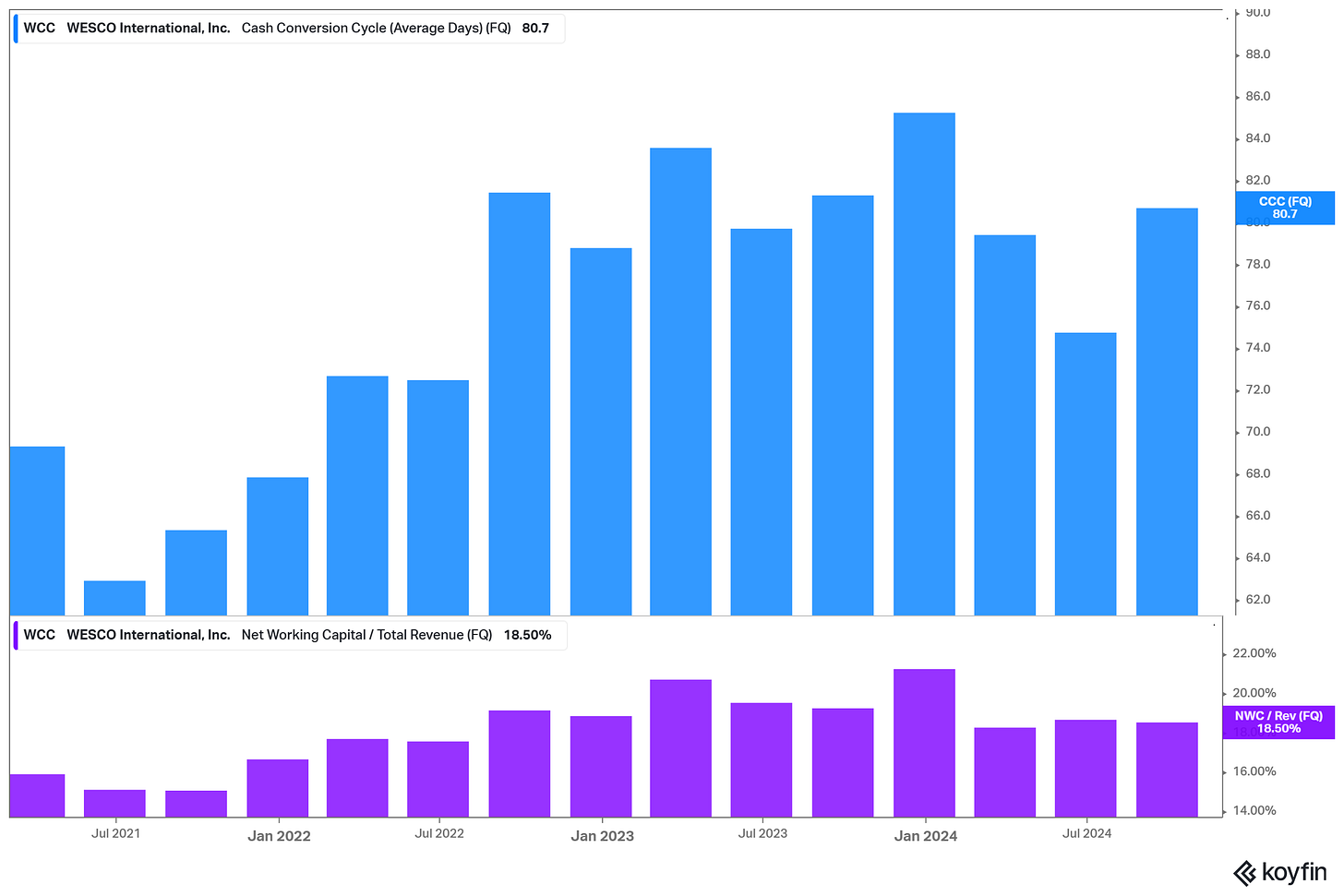

Cash Conversion Cycle (CCC):

Measures how efficiently a company converts receivables and inventory into cash while managing payables. A longer CCC ties up more cash in working capital, increasing NWC intensity.Gross Profit Margin:

Determines the cost of sales percentage (1 - gross margin) and directly impacts how much working capital is required to generate revenue. Lower gross margins mean higher NWC requirements.

Which NWC Intensity to Use?

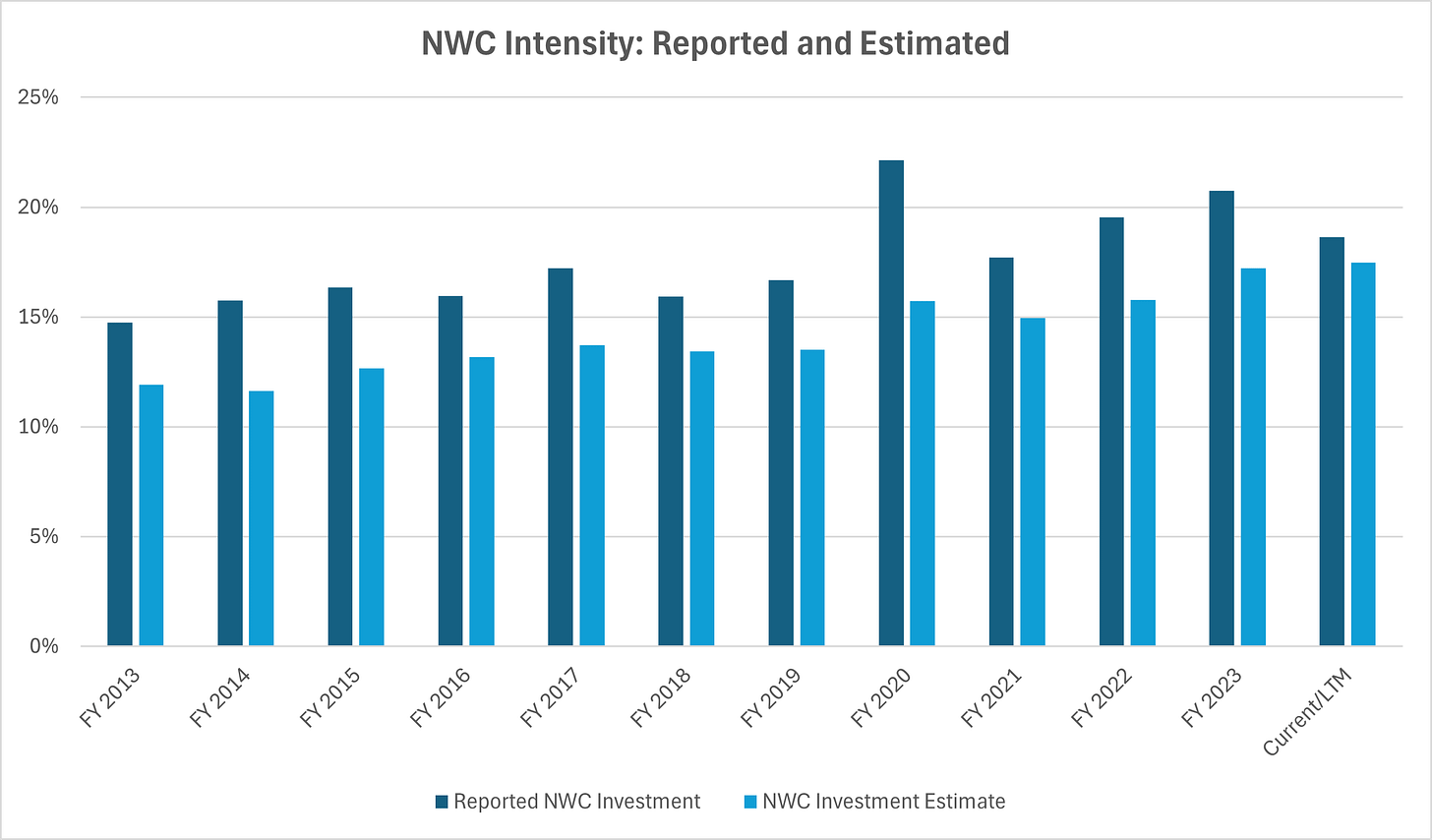

Like the FCF metric as a whole, there is the reported NWC intensity and our estimated version. The chart below shows the history - comparing the reported metric with my own estimate.

The reported ratio is simply the NWC / Revenue as of the end of the period. A great benefit to the estimated metric below is that it reflects the implied average over the entire period instead of a single point in time at the end.

For anybody eager to know how I estimate the NWC Intensity, I pasted the formula below. I will write a future article diving deeper into this. There is a more technical underpinning to NWC intensity and the aforementioned drivers.

Estimating NWC Intensity

Using Wesco’s historical CCC and gross margin, we can estimate NWC intensity with the formula above. For example, with a CCC of 81.4 days and a gross margin of 22%, Wesco’s NWC intensity for the latest period is approximately 17.47% (shown in lighter blue bar in chart above).

Calculation: (81.4 ÷ 365) × 78% = 17.47%.

This result indicates that for every dollar of revenue, Wesco requires about 17.47 cents tied up in working capital.

The Value of NWC Intensity for Normalized FCF

By applying the estimated NWC intensity to historical and projected revenue, we can derive the incremental NWC investment needed to support growth. Adjusting reported CFO by removing these one-time NWC outflows reveals normalized FCF.

For Wesco, the historical trend in NWC intensity reflects the impact of the Anixter acquisition, which introduced longer sales cycles and higher working capital demands. However, management’s focus on optimizing working capital suggests potential improvements.

Actionable Insight: Monitoring CCC and gross margin trends provides a roadmap for understanding and forecasting normalized FCF. By reducing CCC or improving gross margins, Wesco could free up cash flow for reinvestment or shareholder returns.

You can see from the last chart above that Wesco’s NWC intensity ratio has increased steadily. This is partly attributable to the 2020 acquisition of Anixter, which added a significant communications and security solutions (CSS) segment to Wesco’s portfolio. These products often require longer sales cycles and involve custom solutions, increasing receivable and inventory turnover times. Utility and broadband customers in the UBS segment also operate on longer billing cycles, delaying cash inflows.

I expect this intensity level to plateau at worst case. Management mentioned in its last earnings call that it is focusing on optimizing working capital management, which will involve reducing the CCC.

Actionable Step: Adjusting FCF using NWC Intensity

Once NWC intensity is estimated, we can apply it to historical and projected revenue to derive the incremental NWC investment required to support growth. This adjustment allows us to remove one-time growth-related outflows from reported CFO, providing a clearer picture of normalized FCF.

How to Apply NWC Intensity

Calculate Incremental NWC Investment:

Find the difference between the NWC intensity (in dollars; Revenue * NWC Intensity %) between the current and prior period.

Adjust Reported CFO:

Subtract the incremental NWC investment from reported CFO to reflect normalized FCF.

Example Calculation

For Wesco:

Calculate Incremental NWC Investment:

($22.385B * 17.22%) - ($21.793B * 17.47%) = $47 million Incremental NWC

Adjust Reported CFO: $894 million - ($47 million) = $847 million Adjusted CFO

This incremental NWC investment represents a slight one-time cash inflow in this case due to the revenue decline. Removing this from reported CFO highlights Wesco’s normalized FCF, offering a clearer view of steady-state cash generation. Revenue declined due to a divestiture.

You can reference the table below to follow along with the example listed above, which uses the Current / LTM column.

Analyzing the Adjusted FCF

Above, the years 2020-2022 experienced unusual and unsustainable growth from the factors we mentioned. This required large one-time investments in NWC to support it going forward. Adjusting this out of CFO we can see very healthy FCF, contrary to what reported figures show on its face.

One caveat I would note is the 33.8% FCF yield for 2020. I would throw this out of consideration altogether. That year involved onset of Covid and a mid-year closing of the Anixter acquisition. Despite this, Wesco has actually generated quite impressive FCF. We can apply the same approach in forecasting future FCF.

CCC is a Concern

A concern worth noting is Wesco’s CCC stabilizing at a longer cycle (~ 80 days) causing higher NWC intensity. Management notes it is working to improve this but only time will tell how effective they are. The increasing quarterly trend is graphed below.

When To Include Incremental NWC Investment

When analyzing a company’s cash flows, it’s critical to distinguish between one-time growth-related cash needs and ongoing, steady-state operating cash flow. A common question arises when incremental Net Working Capital (NWC) investment is required to support recent sales growth: Should this be included in normalized Free Cash Flow (FCF)?

The short answer: No, incremental NWC investment tied to recent growth is typically a one-time cash flow impact and should not be included in normalized FCF. However, it plays an important role in understanding a company’s overall capital efficiency and returns including use in DCF and ROIC.

I will address this in a future article as well, so stay tuned for it.

Conclusion: The Broader Takeaway from Wesco’s Cash Flow Dynamics

Wesco International’s journey through the Anixter acquisition and pandemic-driven disruptions highlights the importance of looking beyond headline cash flow numbers. Adjusting and normalizing FCF reveals the true cash-generating potential of the business, cutting through the noise of temporary working capital swings and one-time events.

By focusing on metrics like the Cash Conversion Cycle (CCC) and Net Working Capital Intensity (NWC/Revenue), investors can better understand the operational efficiency and cash flow demands of a business. For Wesco, this analysis underscores the following key insights:

Operational Strength: Despite challenges, Wesco’s adjusted and normalized FCF figures showcase its resilience and ability to generate substantial cash flows.

Growth Dynamics: The NWC intensity trends reveal how acquisitions and customer mix influence working capital demands, providing a foundation for forecasting future performance.

Actionable Guidance: Investors should monitor Wesco’s progress in reducing CCC and optimizing gross margins, which could unlock additional free cash flow and drive long-term value creation.

Understanding normalized FCF isn’t just about analyzing a single company—it’s a framework for evaluating cash flow-heavy businesses across industries. By distinguishing between steady-state and growth-related cash needs, you gain a clearer picture of both operational health and future potential.

As Wesco works to stabilize its CCC and align NWC intensity with historical norms, it positions itself to continue creating shareholder value. For investors, this underscores the power of looking beyond reported figures to uncover the real drivers of cash flow performance.

Thanks for being part of the Safe Harbor community! Follow me for more insights: LinkedIn | X (formerly Twitter) | Instagram

Disclosure: This information is provided for informational purposes only and should not be considered a solicitation or recommendation to buy or sell any securities. The author or entity providing this information may hold positions in the securities discussed. This is not investment advice.