Unpacking Wesco International: A Leader in Industrial Distribution

Analyzing Wesco’s growth strategy, cash flow strength, and return potential in industrial distribution.

Wesco International (WCC) has quietly established itself as a pivotal player in the industrial distribution sector. With a rich history, robust financial metrics, and a strategic focus on high-growth markets, Wesco offers a compelling case study for long-term investors seeking cash flow resilience and secular growth exposure. In this article, we explore Wesco’s evolution, competitive landscape, and financial strengths while diving into the drivers behind its potential for sustained growth.

A Brief History: From Westinghouse to Global Leadership

Founded in 1922 as Westinghouse Electric’s distribution arm, Wesco began as a regional supplier before evolving into a global powerhouse. Its transformative acquisition of Anixter International in 2020 expanded its communications and security solutions capabilities, solidifying its market reach. More recently, the 2022 acquisition of Rahi Systems strengthened its presence in data center and IT infrastructure solutions, aligning Wesco with the growing demand for digital transformation across industries.

This strategic evolution has enabled Wesco to transition from a traditional distributor to a multi-segment provider of supply chain, logistics, and technical solutions.

Key Acquisitions Powering Growth

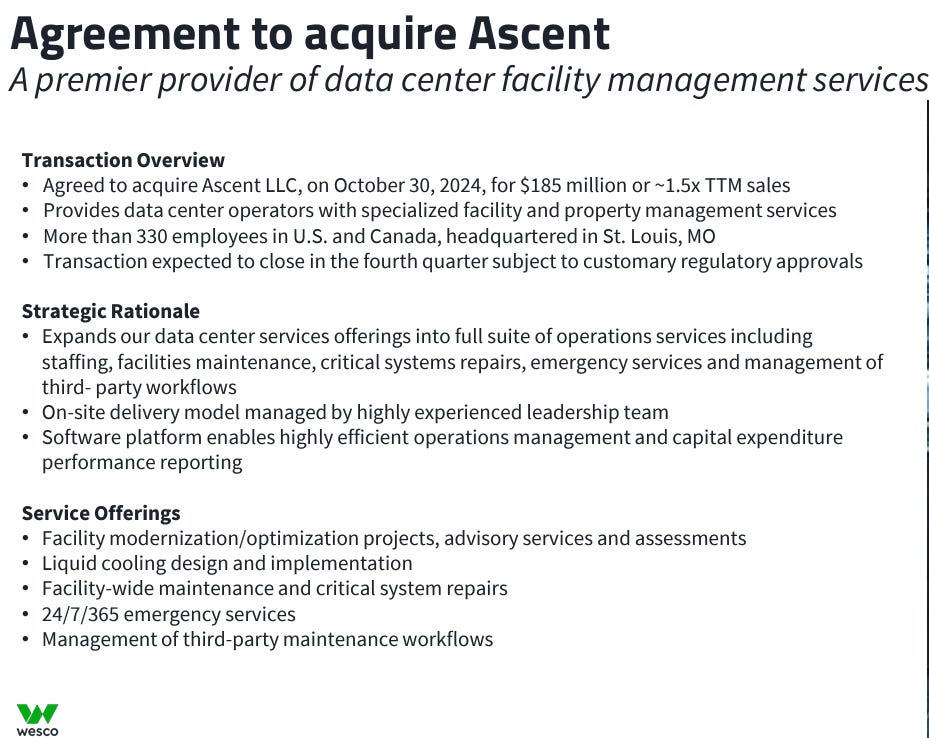

Anixter International (2020):

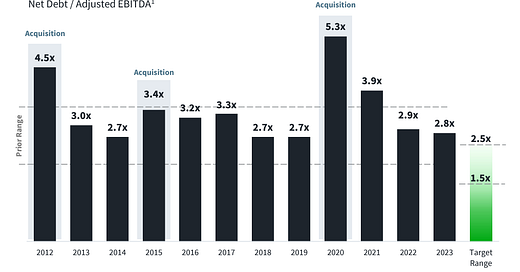

This $4.5 billion acquisition marked a major milestone for Wesco, doubling its revenue base and significantly enhancing its capabilities in communications and security solutions. Post-acquisition, Wesco successfully deleveraged its balance sheet, achieving its target net leverage by integrating Anixter's operations and capturing synergies.

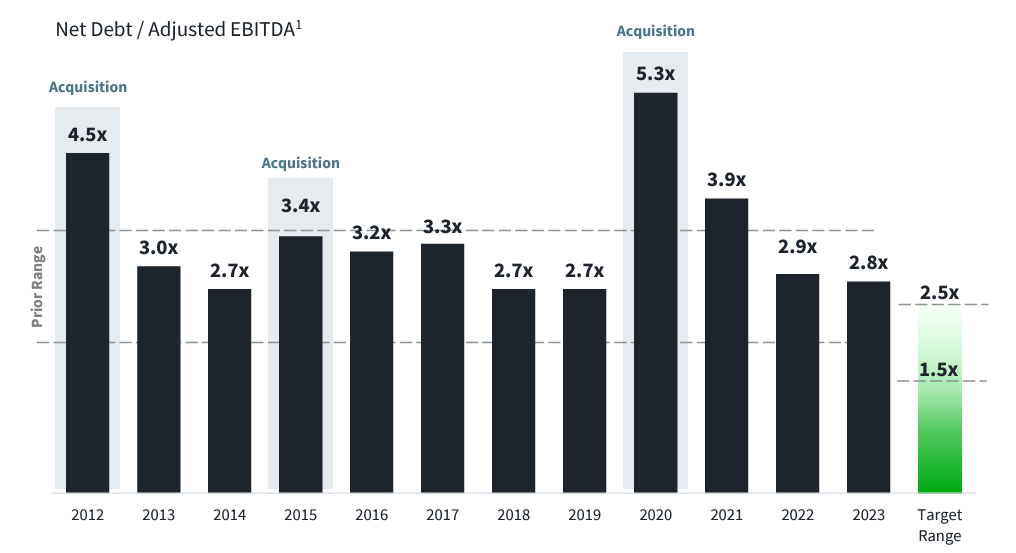

Rahi Systems (2022):

The strategic acquisition of Rahi Systems expanded Wesco’s footprint in the rapidly growing data center market. Rahi’s expertise in IT infrastructure solutions complements Wesco’s portfolio and aligns with trends in digital transformation and AI-driven data center demand.

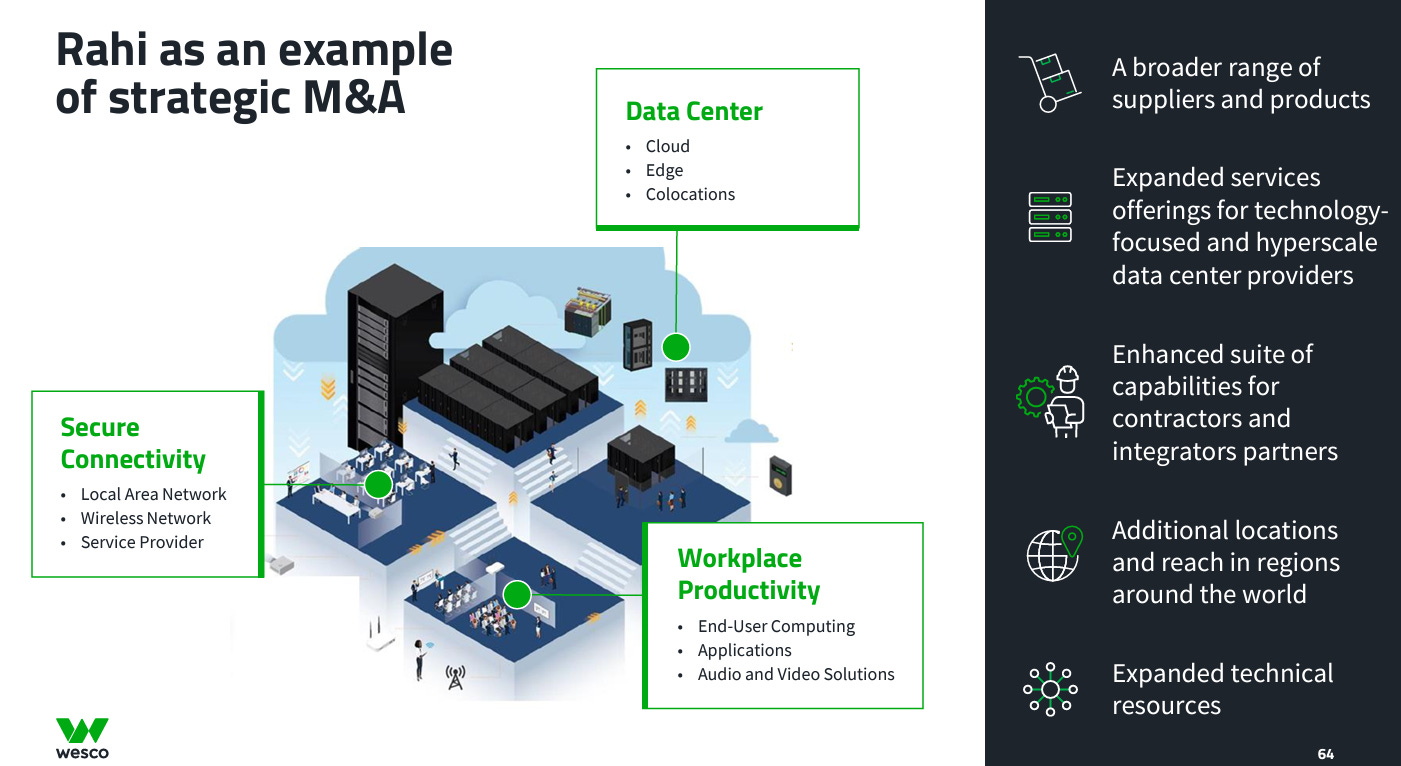

Ascent (2024):

Wesco’s recent acquisition of Ascent, finalized in December 2024, adds a fast-growing business to its portfolio. Ascent specializes in providing recurring management services to data centers and is growing at an impressive 30% annually. This acquisition strengthens Wesco’s position as a premier partner in data center solutions, leveraging Ascent’s recurring revenue model to drive long-term stability.

Secular Growth Drivers Fueling Wesco’s Momentum

Wesco’s positioning aligns with several macroeconomic and technological tailwinds, including:

Electrification and Green Energy:

The global push for electric vehicles (EVs), renewable energy, and grid modernization creates consistent demand for Wesco’s utility and electrical solutions.

Data Center Expansion:

Accelerated adoption of AI and cloud computing has made data center infrastructure a priority, a market Wesco bolstered through its Rahi Systems acquisition.

Reshoring Trends:

North America’s efforts to localize supply chains provide opportunities for Wesco to support industrial and broadband projects.

Broadband Infrastructure Growth:

Government initiatives and consumer demand for high-speed internet have propelled investments in Wesco’s Utility and Broadband Solutions (UBS) segment.

These secular drivers are expected to sustain Wesco’s growth trajectory for the foreseeable future.

Navigating a Competitive Landscape

Operating across three segments—Electrical & Electronic Solutions (EES), Communications & Security Solutions (CSS), and Utility & Broadband Solutions (UBS)—Wesco faces competition from established players such as Grainger, Rexel, Graybar, and Sonepar. Additionally, strategic supplier relationships with companies like Hubbell, which also compete in certain niches, require careful management.

Supplier Relationships: A Double-Edged Sword

Wesco collaborates with over 50,000 suppliers globally, with approximately 65% of its purchases concentrated among 360+ preferred suppliers. These partnerships allow Wesco to maintain a diverse and competitive inventory while benefiting from volume-based cost efficiencies. However, some suppliers, like Hubbell, operate as both partners and competitors, creating a dynamic where Wesco must balance collaboration with competition. This duality necessitates strong relationship management to ensure uninterrupted supply while differentiating itself through service and value-added solutions.